Insight Focus

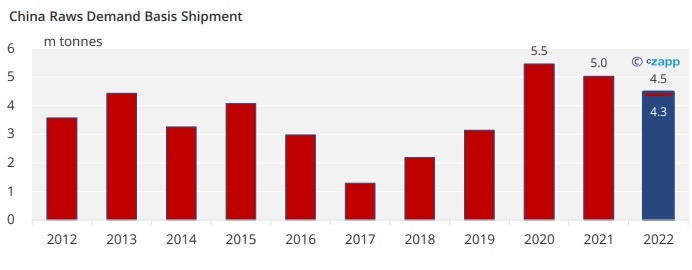

Chinese refineries have been buying raw sugar even with negative margins. Offtake has reached 4.3m tonnes for the year. Will they continue to import with today’s margin of -160 USD/mt?

Strong Imports Despite Negative Margin

Chinese refiners increased their coverage of 2022 demand almost every time the No.11 raw sugar futures fell below 18c/lb. Therefore, this year’s raws demand has reached 4.3m tonnes, just 200k tonnes away from the target.

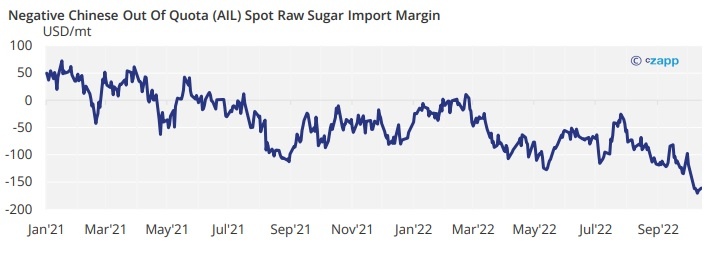

This is even though AIL import margin was negative during most of the year. So why would they import at a loss?

The first reason is that Chinese sugar refineries usually need to make use of all their Automatic import licenses (AIL) each year to ensure next year’s volume is not reduced.

Actual Margin Higher Than Paper Margin

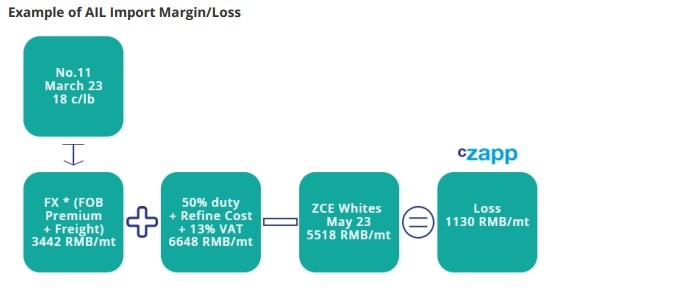

The actual margin is higher than paper margin once spot premiums are included. We usually calculate paper margin, which is the price difference between AIL import cost and ZCE white sugar futures.

But there are 3 more factors to be considered.

1. Quality Premium

2. Regional Premium

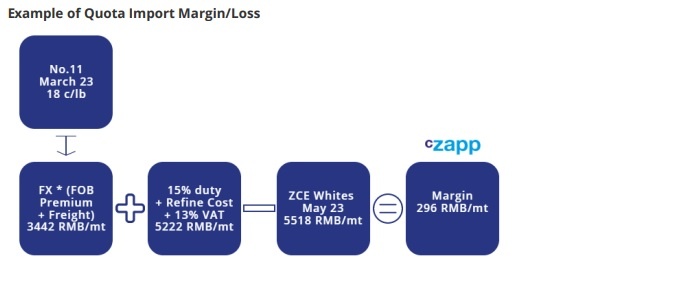

3. Quota Imports

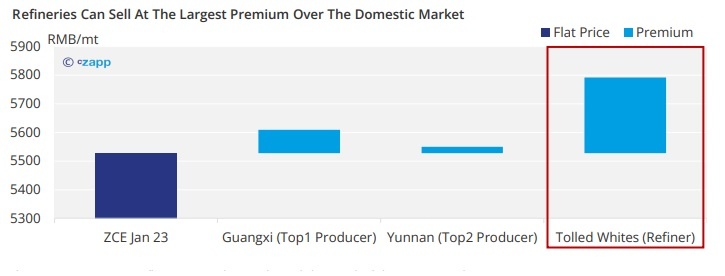

The national standard of Chinese white sugar is 150 icumsa, most of which are produced directly from sugar cane. Whereas the quality of refined sugar is usually better (60 icumsa) as it’s produced from raw sugar. Therefore, refiners can usually sell sugar at a higher price against the domestic whites.

These spot premiums fluctuate with supply and demand of domestic market.

Refineries also benefit from being in coastal China, closest to the major sales areas for sugar. This means sugar refiners have a regional advantage because they are closer to consumers and can save on logistics costs.

It’s Not Just Out Of Quota Imports

China allocates 1.945m tonnes of import quota annually, which is subject to only 15% import duty (compared to (50% for OOQ imports).

Around 1.5m tonnes will be allocated to raw sugar imports, among state-own trading sector (mainly COFCO) and private sector (mainly sugar mills). Some refiners also own domestic sugarcane mills, which means they also get some low tariff import quotas. This means they can use the quota import to compensate the loss of AIL import.

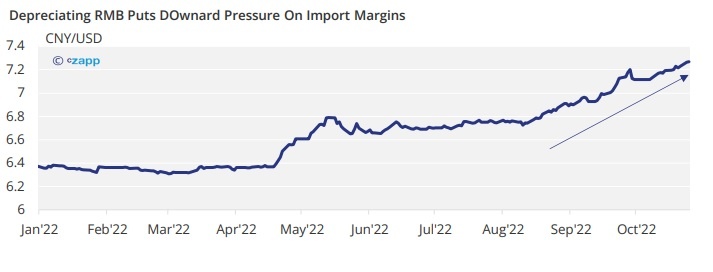

However, the RMB depreciated 15% in last 6 months. This means the import cost has surged significantly. With losses on AIL imports now exceeding 1000 RMB/mt, the spot premium and quota compensation are not large enough to incentivise refiners to import. The spot premium can only make the operation profitable when paper margin is at a small loss.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.