Insight Focus

We think China will make 9.6-10m tonnes sugar this season. Cane and beet processors will struggle to break even. Molasses and biomass sales will be crucia.

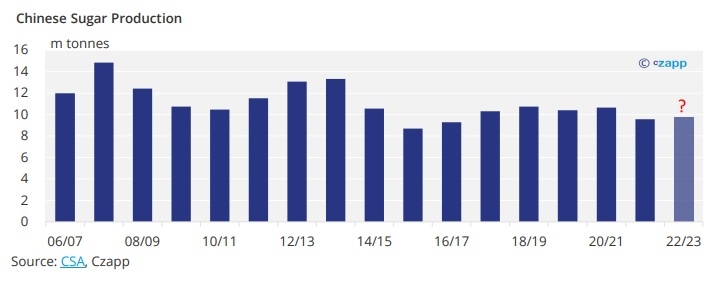

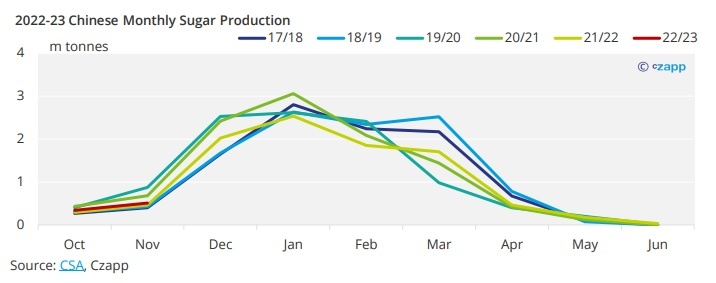

China is the top sugar buyer in the world market, and one of the largest sugar producers too. But sugar production doesn’t cover domestic consumption, currently at 15m tonnes. China produced 9.56m tonnes of sugar in the 2021/22 season, the lowest in five years.

How about this season?

2022-23 Beet Prices Rise to Record High

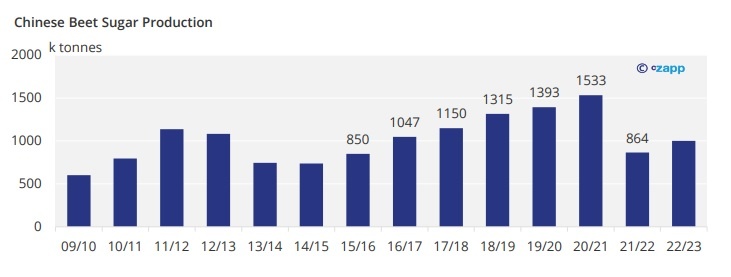

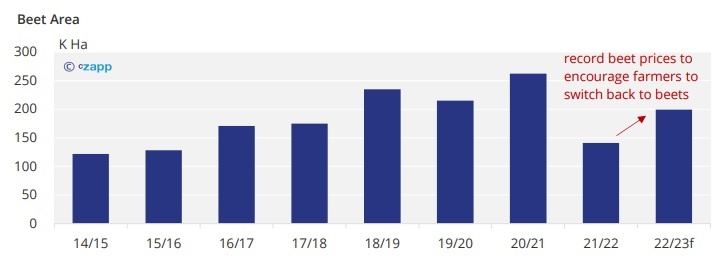

In 2021-22 season, Chinese beet sugar production halved from 1.53m tonnes to 0.86m tonnes, because beet lost the area to corn.

To encourage farmers to grow beets, factories have raised the beet price to record highs. Transportation costs have also increased due to logistics interruption during COVID restrictions. In Xinjiang, the beet prices on arrival to factories were up by RMB 50-100/mt, to RMB 510-560/mt. And in Inner Mongolia, the beet prices were up by RMB 45-90/mt, to RMB 640-690/mt.

This means the beet sugar cost of production could be over RMB 7,000/mt (USD 1,000/mt). A little reminder, current domestic sugar price is around RMB 5,700/mt. So how can the mills afford it?

How Do Mills Afford Record Beet Prices – Beet Pulp Pellets and Molasses

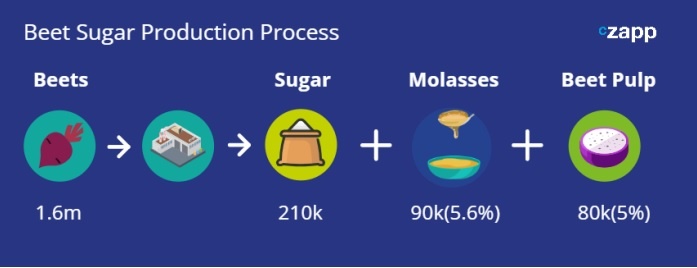

Beet pulp pellets, and molasses could be the heroes for the beet sugar producers.

In 2020/21, the beet molasses price and beet pulp price were around RMB 1,200/mt and RMB 1,800/mt respectively. Now the molasses price is around RMB 2,300/mt and beet pulp price is as high as RMB 3,000/mt. With this, the sugar cost of production is around RMB 5,800 – 6,000/mt, just enough to break even.

Take a Xinjiang beet sugar factory, for example. It’s built to process maximum 1.6m tonnes of beets a year, with an output of 210k tonnes of sugar, 90k tonnes of molasses and 80k tonnes of beet pulp.

Note: the output of sugar and molasses depend on the sucrose content of beets.

Cane Regions: Bagasse Fuel, Molasses Income, Risk of Labour Shortage

The first cane sugar mill started operations on November 3rd, with the arrival of first truck of canes from Laos. Unlike 21/22 season, up to 3m tonnes of sugar cane from Laos and Myanmar should reach the mills this campaign. China produced 850k tonnes of sugar from cane by November, following the track of last season.

With China’s open-up, COVID restrictions are largely removed and logistics can move freely. However, the issue could be labour shortage now, with massive infection of COVID-19. Although the industry continues to push for mechanization, sugarcane still depends heavily on manual harvesting.

Due to cane yield concern, CSADE lowered its estimate of sugar production from 10.35m tonnes to 10.05m tonnes, 0.5m tonnes higher than 21/22 season. We think it’s likely to be in the lower range of 9.6-10m tonnes.

Weather was not in sugarcane’s favour this year with continuous drought lasting from July to November. 40.3% of canes were reported to suffer from drought in Guangxi. We’ve been tracking the risk in our farmer diaries.

December’s crop figures should give us a clearer guide.

The cane should have higher sucrose content due to dry weather. Mills should benefit from this because the cost of sugar production would be lower, besides the higher income of molasses. Sugarcane mills have the added advantage of being able to escape high energy prices by using their own bagasse as fuel.

With this, the average cane sugar cost of production stays around RMB 5,600/mt.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.