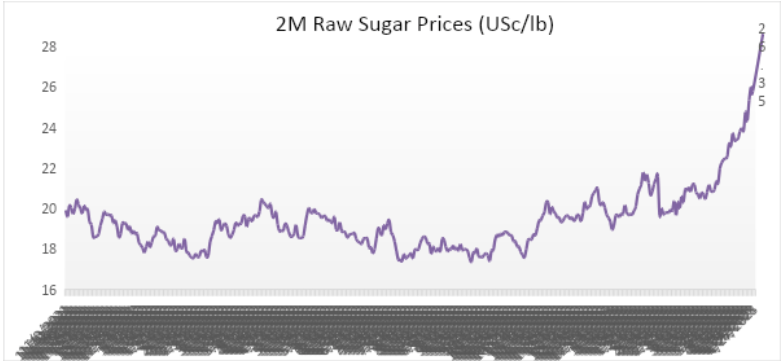

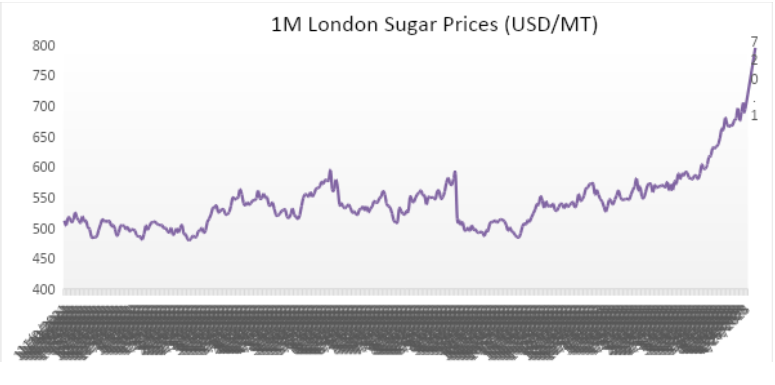

Global sugar prices continued its north ward movement and trading at 11 and half year highs on short supply. Also, the May sugar contract expiry today is driving short covering. Rainfall activity in parts of CS Brazil also fuelled the rally as rains over major cane growing regions of CS Brazil will delay the start of crushing operations which is likely to make balance sheet even worser in already tightened market.

Raw sugar prices have rallied the most during the week, quoting at 26.35 c/lb with increase of 8.3% and whites’ prices have settled higher by 6.5% at USD 720.1 per MT during the same period. Short covering due to lesser availability of sugar to deliver against the May expiry has led to higher rally in raws and lesser possible delivery is expected against the expiry as due to non-availability at the major origins on the back of reduced supply.

Sugar production was trimmed at most of the countries from initial estimates due to reduced yields. Output in India, Thailand, EU, China and Pakistan lowered by close to 3.5-4.0 MMT for the current quarter which has resulted in short supply against the current quarter.

Moreover, expected reduction in acreage in EU, Thailand and China is also supporting the rally in prices in the global futures market. Ban of chemical neonicotinoids is likely to keep beet acreage lower in EU while higher cassava prices are likely to keep acreage lower in Thailand and China.

Currently, most of the weather models are suggesting development of El Nino by July as Sea Surface Temperatures are increasing gradually. Development El Nino by July if any is likely to impact the crop growth in India, Thailand, China and Pakistan due to below normal rainfall. On the contrary above normal rainfall activity over CS Brazil is likely to disrupt the crushing activity and may lead to lower sugar production.

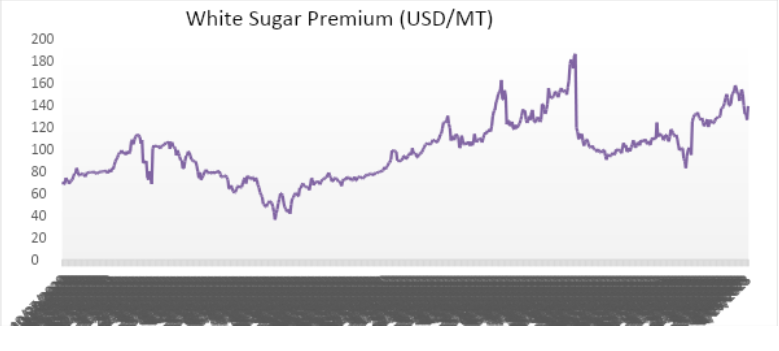

The White premium started to trade weak from the beginning of the week on the back of more surge in Raws sugar futures when compared to Whites dragged white premium below 130 USD per MT. However, higher rally in LIFFE prices yesterday when compared to Raws have improved the white premium significantly and is currently quoting at 139 USD per MT.

The White premium started to trade weak from the beginning of the week on the back of more surge in Raws sugar futures when compared to Whites dragged white premium below 130 USD per MT. However, higher rally in LIFFE prices yesterday when compared to Raws have improved the white premium significantly and is currently quoting at 139 USD per MT.