Insight Focus

Sugar futures spreads have collapsed. Sugar supply remains extremely strained. Is sugar demand worse than we’d thought?

To watch the video on demand, click here!

Hi everyone, it’s Stephen from CZ with a quick update on the sugar market for June 2023.

I know I only just sent a video on El Nino, but there’s something interesting happening beneath the surface which I wanted to mention.

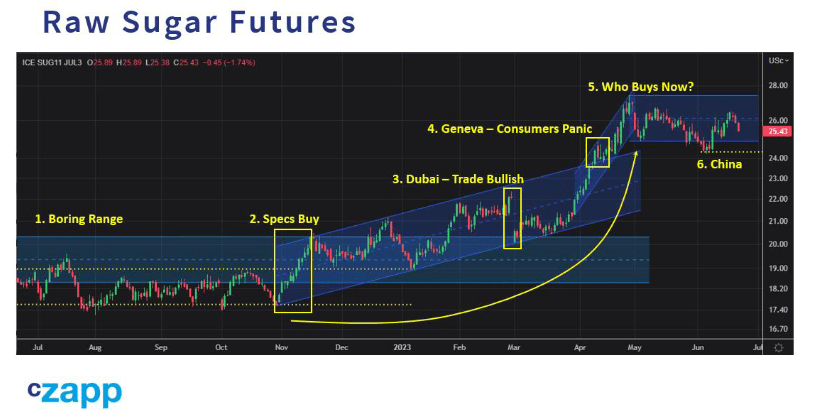

If you look at the raw sugar futures, you’d be forgiven for thinking nothing much was going on. We’re stuck in a boring sideways range.

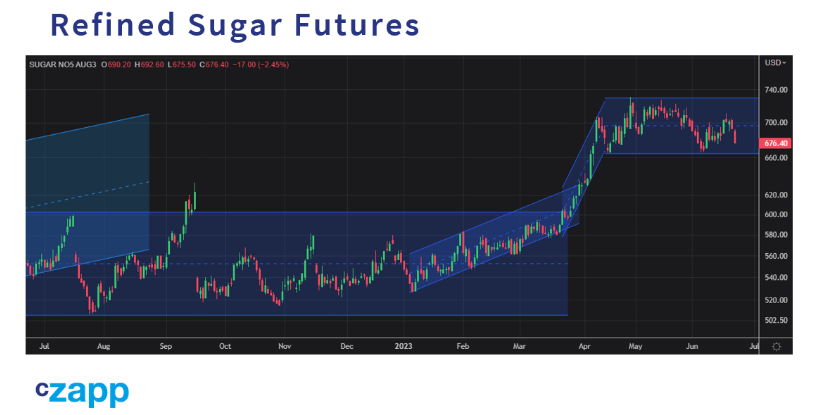

It’s the same for the refined sugar futures.

This in itself is surprising because raw sugar has recently formed a parabolic advance. We had spent more than a year in a sideways range between 17c and 20c. The tedium broke in November 2022 and you can see the point where the speculators came back to buy the market. After months of chopping around we had 12 consecutive up sessions taking us from the very bottom of the range to the top. Specs rebuilt their long at 18-20c and this has been extremely profitable for them…but they only started the move. They weren’t responsible for what happened next.

At the end of February the sugar industry met face to face in Dubai for the sugar conference. This was the first opportunity in a few months for everyone to get together and compare notes. I think it came as a bit of a shock to the sugar trade houses to find out how bullish they each were. Meanwhile, producers around the world were reporting bad news. Brazilian producers were talking about a large cane crop coming but the risk of poor inland logistics limiting supply. Northern hemisphere producers in India, Thailand, Mexico, Pakistan and China were hinting that crops might be below expectations.

By the time everyone met again in Geneva in April this bullishness had extended further. There’s nothing like price to drive sentiment. People were talking about the risk of El Nino. Poor northern hemisphere crop fears had come true. The trade were extremely bullish – some were talking 30c, others 40c. They seemed to want to push consumers into buying. It worked. Consumers hadn’t adapted away from 2010s bear market, where buying late was rewarded. Now they needed to buy early, but they hadn’t and had been left behind in Q1’23. They panicked through April and May, driving a faster and higher rally, leaving a parabola on the charts.

The problem with this is that once the panic-buying has exhausted, who buys next? Speculators, trade houses and consumers have now all bought. Producer hedges seem to be ok – their mark to market is deeply negative, which is painful for finance providers margining hedges, but no-one has been forced to buy back yet. In the short term, the answer was Chinese refiners, who bought around half a million tonnes of in-quota raws when the price retreated below 25c. But they won’t buy their 3.5m tonnes of out of quota sugar at this price, the margins are far too negative.

Usually, when a parabola breaks the only way is down. It’s very rare to see a broken parabola resume its uptrend. So sugar’s performance in June has been amazingly robust; we’re only 8% off the highs.

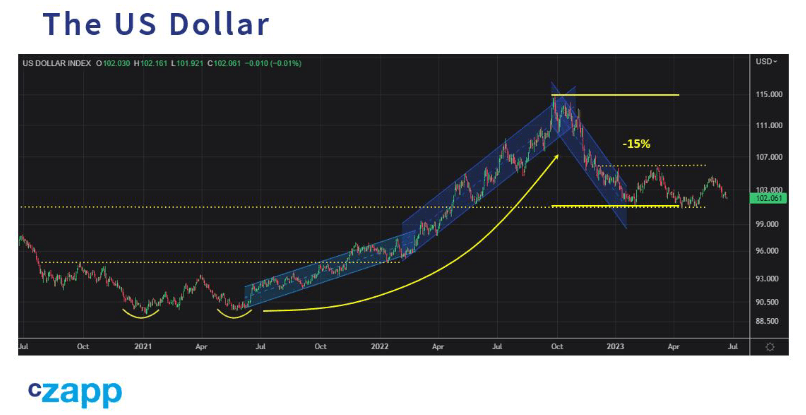

Compare this to the US Dollar’s recent parabola. The US Dollar is the most liquid asset on the planet. If formed a parabolic advance over 15 months in 2021 and 2022, but when this broke it fell 15%.

Sugar’s not done this yet. BUT…..don’t get too complacent. What’s that threat beneath the surface I mentioned at the start?

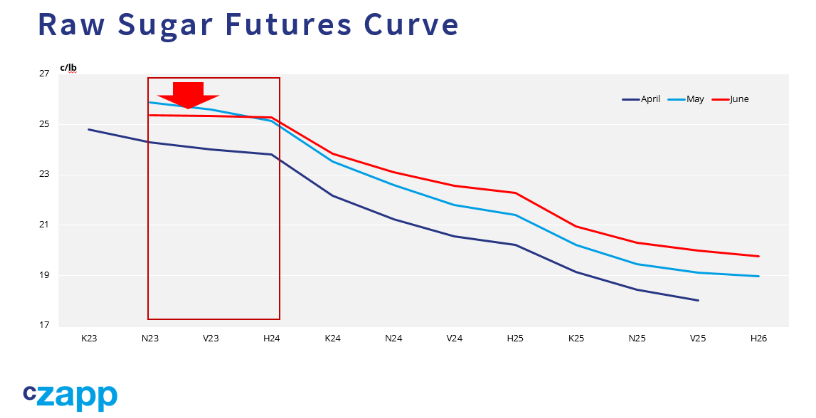

Well, the raw sugar spreads for 2023 are collapsing. The July October spread is about to trade at a discount for the first time since November. The October/March spread is a feast for anyone who likes technical analysis: a double top with a head and shoulders formation too.

The July/March spread has fallen by 100pts in the last 9 weeks. This spread covers the whole of the CS Brazil season.

We’ve gone from the market showing extreme stress through this time to now showing a bit more balance.

It’s a similar story with the white sugar spreads. The August/March spread has collapsed by $50 to trade at flat.

The white premiums in 2023 have also collapsed. How can we believe that the sugar markets have gone from possibly being hugely undersupplied to being ok again?

Well….in the short term we’ve seen some major buyers washout contracts.

They are choosing to defer demand and take their hedges out of the market, earning decent returns by doing so. Of course, you only wash out if you are willing to give up market share or if the demand you were expecting isn’t materializing. We think it’s the latter.

Everyone fixates on supply, which has been bullish – El Nino especially. I tried to explain in my May video that El Nino is unreliable: it doesn’t give you the weather you expect at the time you expect. But people don’t always like to be bothered with the facts. And demand analysis is just as important, but no-one can do this well.

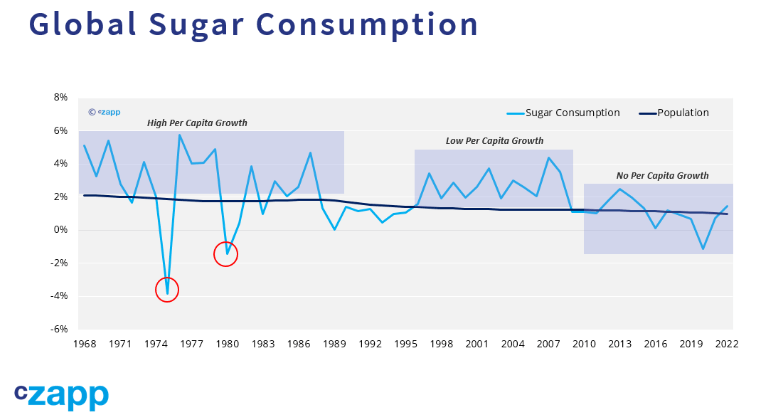

It’s very hard to model or understand demand destruction and deferral in real time. Even when prices rise, consumption of sugar has a complicated relationship with price. You can see from this chart that we’ve been through periods of high and low consumption growth, but apart from when prices went crazy in the 1970s and 1980s there’s been almost no major reaction to high prices.

Sugar is cheap and enjoyable to eat. It’s a useful ingredient. When all food inflation is high, people might actually eat more sugar and cut down on more expensive foods like meat. If you look at some of the stories emerging, it doesn’t paint a pretty picture for sugar consumption in some areas.

Sudan is usually a major buyer of refined sugar but is sadly gripped by conflict.

In Malaysia the government has asked the sugar refiners to provide daily production updates: this doesn’t happen in a well-supplied and normal market.

In Gabon sugar supply seems to be scarce.

In Kenya sugar prices rose by 22% in May alone.

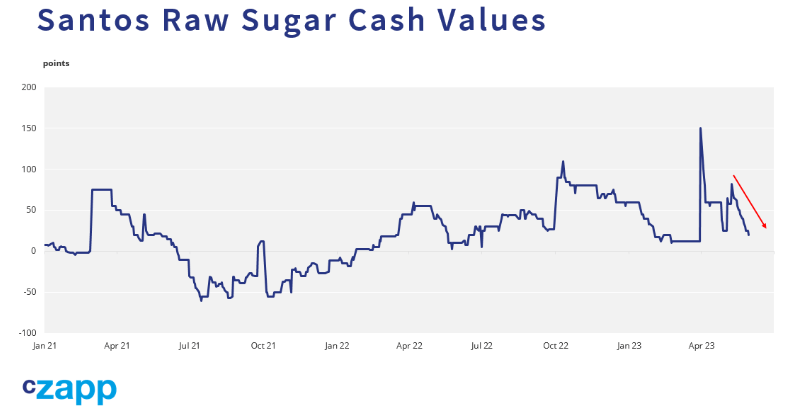

Helping to back all of this up, Brazilian physical values remain quite weak. Traders holding sugar are having to cut prices to find buyers in Brazil. That’s not a positive sign. We also don’t seem to have a receiver for the July futures expiry at the end of June.

It’s entirely possible that everyone in the market is fixating on the very real and serious supply side problems for the sugar market and completely ignoring the equally important but more invisible demand side problems.

I hinted as much on social media recently.

Put this all together and we still have a busted parabola for sugar and structural weakness in raw and refined sugar futures curves. On the flip side, we also know that there is a major sugar buyer who is sidelined.

Chinese refiners still need to use all of their out of quota import permits this year – 3.5m tonnes of them. They will be keen to buy on price weakness. My best guess, then is that sugar trades sideways to lower in the coming weeks. Chinese refiners will be keen to buy close to 20c, perhaps.

In the longer term there’s no denying the major supply -side problems the sugar market has. I’m sure we’ll see new highs in the next 6-12 months, perhaps once end of Brazil crop known and we can see full extent of El Nino on Northern hemisphere Western Pacific crops. But in the short term I’d note the collapsing spreads and tread carefully.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.