Insight Focus

CS Brazil has produced so far over 19m tonnes of sugar. Mills are pushing their crushing pace to the max. The region could set a record sugar production this season.

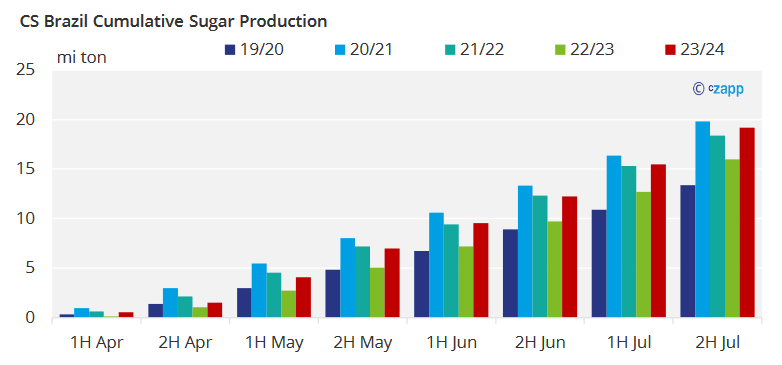

CS Brazil 2023/24 season is 50% done, having produced 19.2m tonnes of sugar. It is the second highest cumulative production on record.

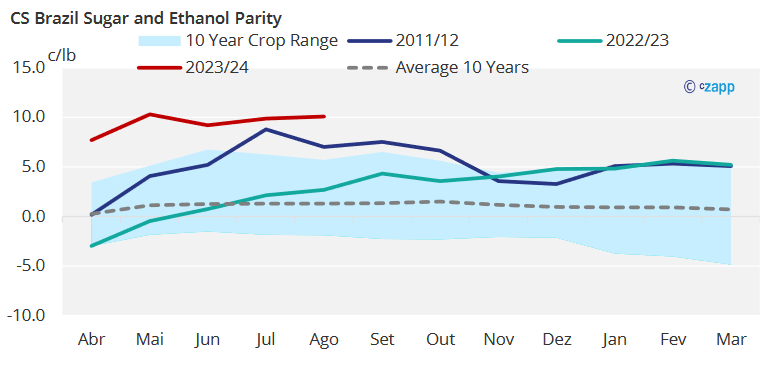

One reason for this that sugar is paying much more than ethanol this season, averaging a 940 premium. Back in early 2011, the gap between sugar and ethanol was even wider at 12.88c/lb (almost1300pts). However, the sugar and ethanol parity has never stayed this wide for this long.

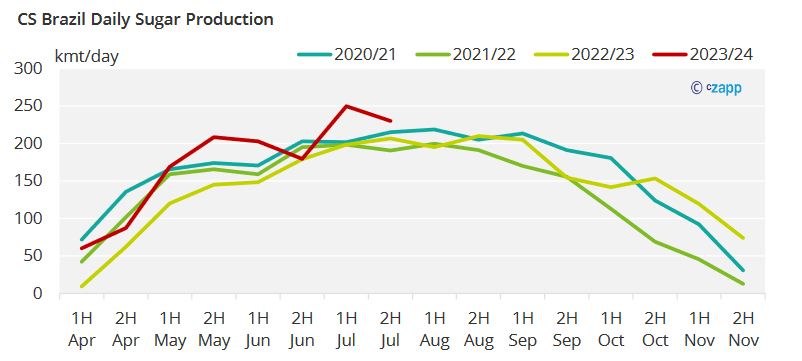

Before this season began, mills looked into ways to tweak their factories to be able to allocate cane as much as possible towards sugar production. The result has been surprising every fortnight, with daily sugar production by far surpassing the last record of 224kmt/day registered over a decade ago.

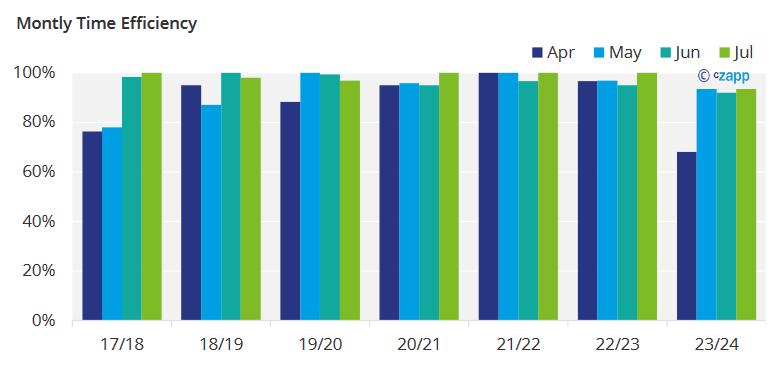

The pace at which mills have been operating seems even more striking when we consider the low time efficiency so far this season – put simply more days have been lost due to rains than in the previous 6 crops.

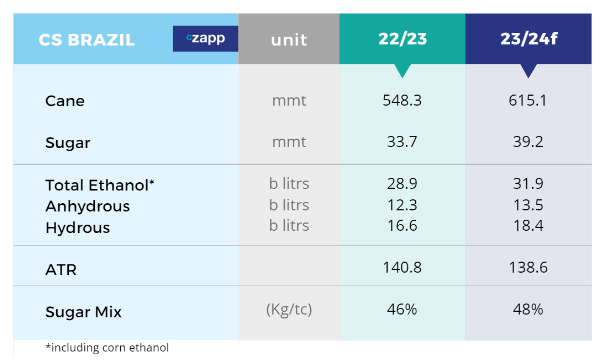

Considering these factors, pace and sugar mix, we have revised our crop model for this season resulting in a sugar production of 39.2m tonnes for 2023/24.

Another upside is not off the table, we might add… if weather is drier than expected at the tail of the season mills will be able to continue crushing as cane availability is not an issue – it will highly depend on how El Niño behaves in CS Brazil, since the region is a transition one and the pattern is less clear than in the South of the country,

A higher sugar production from CS Brazil turns the S&D into a surplus. But could be a momentary one. The Northern Hemisphere will start the season in 2 months, and it seems that there is more downside than upside risks for the region.

Still, more sugar from CS Brazil does not necessarily mean more immediate availability. This year, logistics allocated for sugar are around 2.7m tonnes per month while raw sugar production expected for August is around 4.8m tonnes.

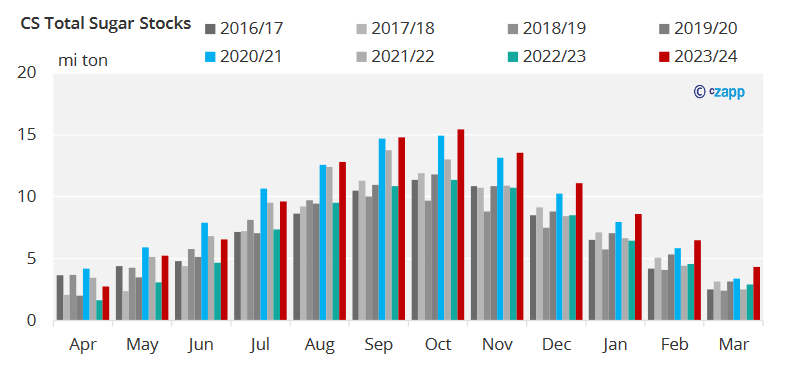

This limited logistics results in the buildup of stocks at the mills. Peak stocks should be registered in October, with mills looking for alternative places to store the sugar. When mills’ warehouses fill to the brim, sugar must be placed elsewhere, or production could be halted.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.