Insight Focus

- China doesn’t make enough sugar to meet local consumption.

- Liquid sugar and premix imports will continue to bridge some of the gap.

- They remain the cheapest source of imported sugar for China.

China Still Needs Sugar Imports

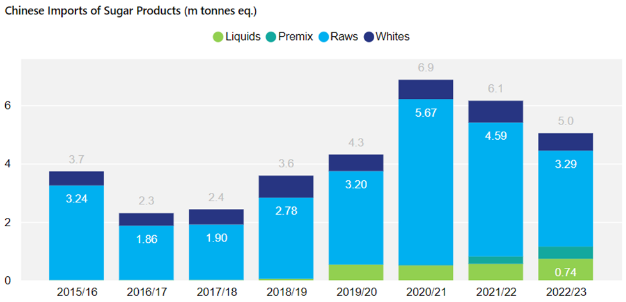

China makes less sugar than it consumes. In the past three seasons to average shortfall has been 5.6m tonnes. As a result, China is one of the world’s largest importers of sugar, and its buying patterns are important for the sugar market.

Source: China customs, Czapp. All figures are in dry weight, sugar content equivalent.

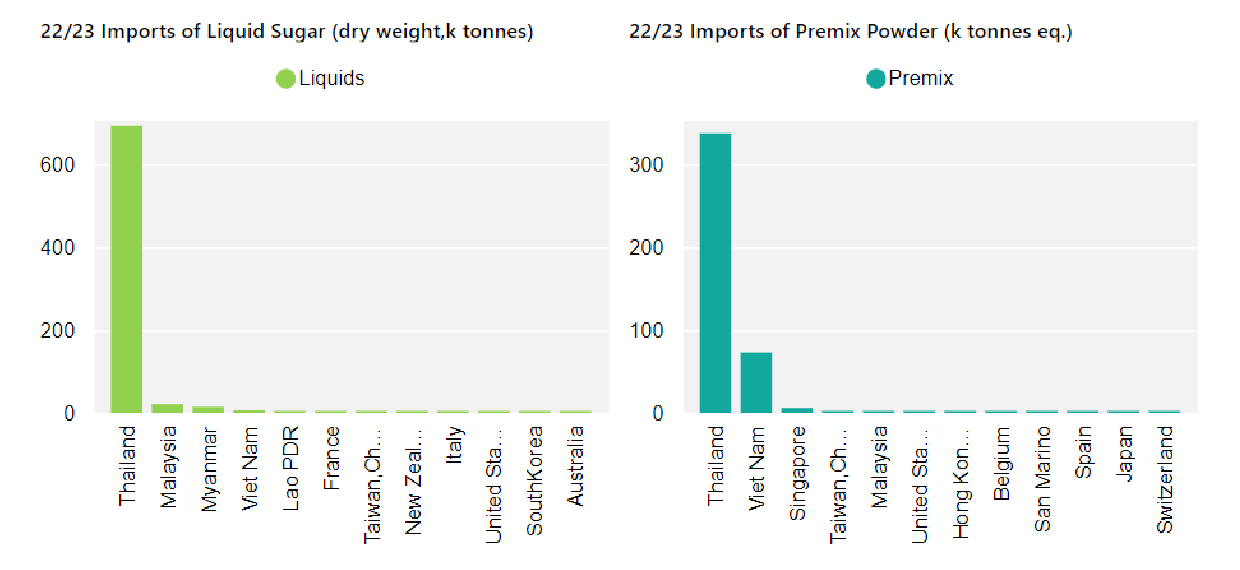

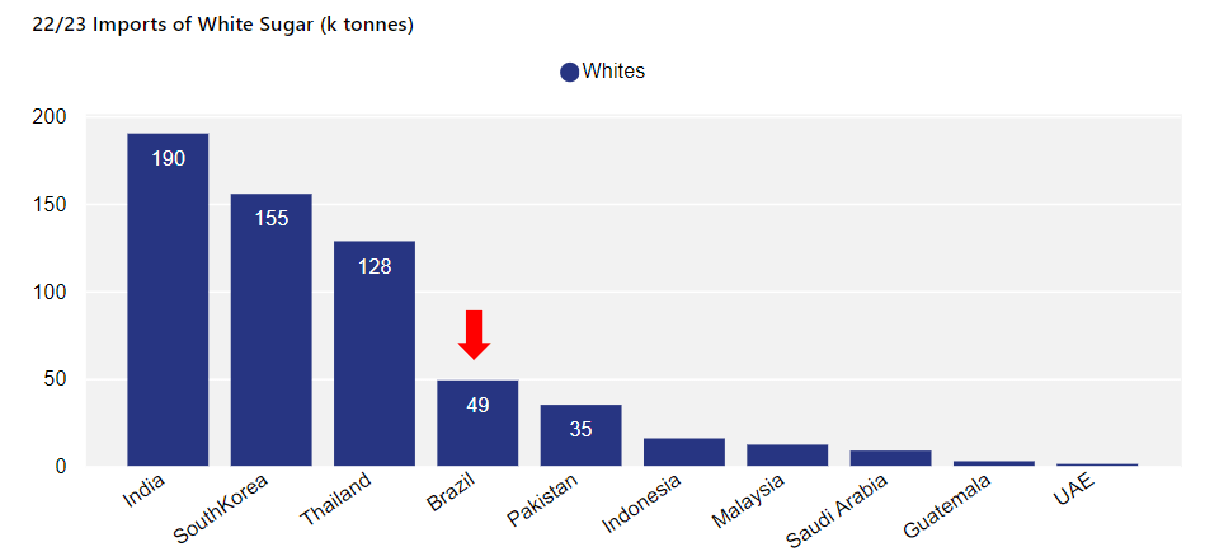

China imported 5m tonnes of sugar in the 2022/23 season, 1.1m tonnes less than the year before. The shortfall was mainly in raw and white sugar imports; liquid sugar and premix powder imports reached record levels.

We think this strong demand for liquids and premixes should continue in 2023/24. China will still have a sugar production shortfall of more than 5m tonnes, commercial sugar stocks are low and strong world market sugar prices make conventional imports difficult.

Three Consecutive Months of Decline

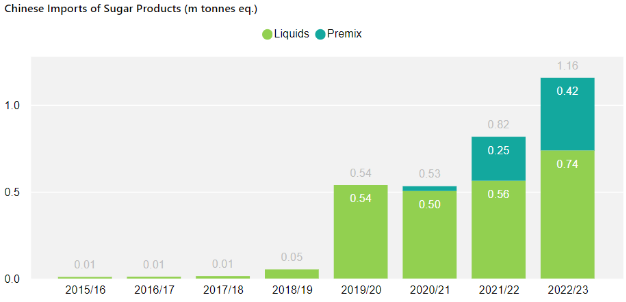

Despite repeated rumors this year that the government would restrict liquid sugar and premix powder, imports in the 2022/23 season reached 1.16 million tonnes (dry weight, sugar content), an increase of 340k tonnes over the previous season.

Source: China customs, Czapp. All figures are in dry weight, sugar content equivalent.

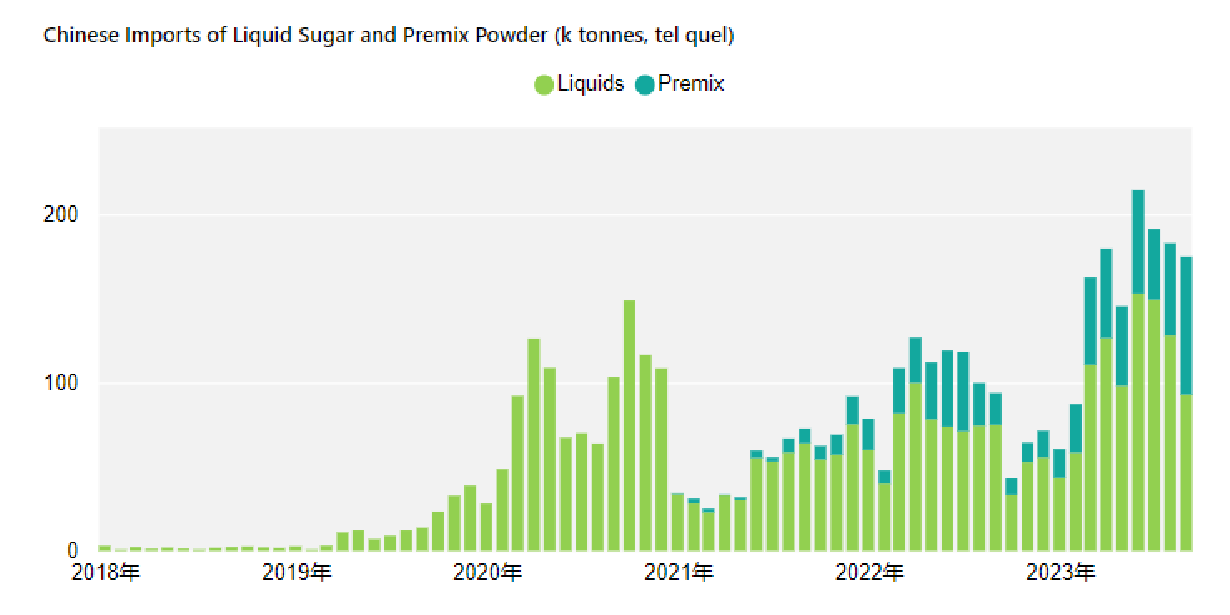

However, in September, liquid sugar imports fell for the third consecutive month, to less than 100k tonnes. Meanwhile imports of premix powder reached a new high of 82k tonnes, up 49% from the previous month. We believe this may be because premix powder has a longer shelf-life and importers are concerned about competition from government destocking and new-crop sugar.

Source: China customs, Czapp.

Liquid and Premixes Benefit from Lower Import Costs

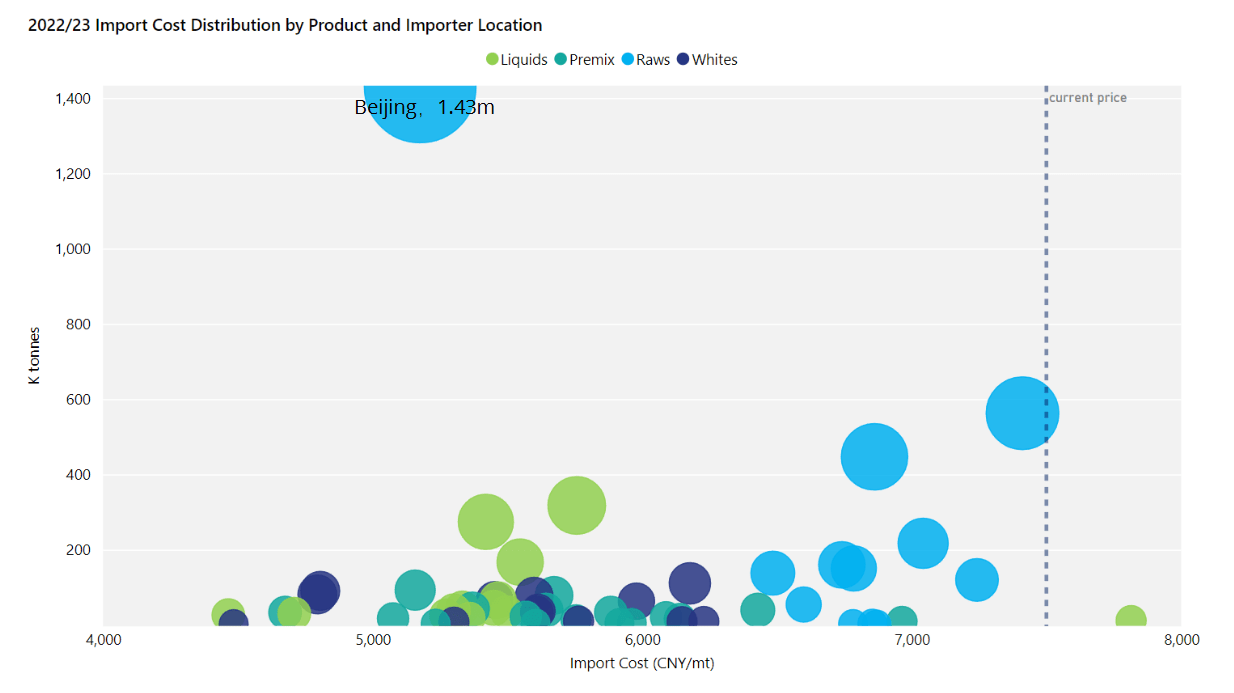

When it comes to Chinese sugar imports, margins are the main driver. With high global sugar prices this year, the cost of sugar imports ranges from RMB 4,000 – 8,000 per tonne, depending on the method of arrival.

In-quota raw sugar imports (paying 15% import duty) were among the cheapest source of sugar in 2022/23, and accounted for 1.43m tonnes. But liquid sugar and premix powders were also extremely competitive, especially when compared to out of quota AIL raw sugar imports paying 50% import duty.

Source: China customs, Czapp.

Sugar Availability Remains an Issue

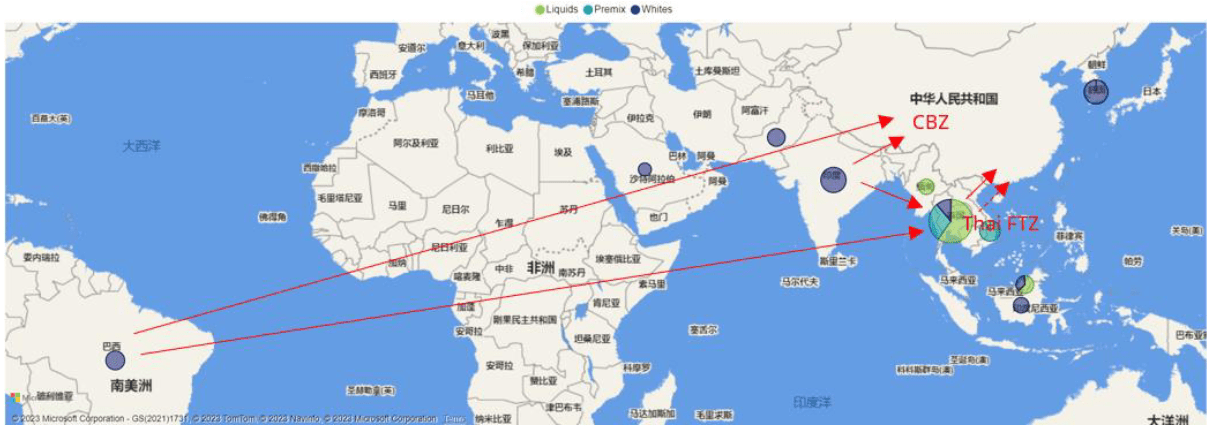

Thailand accounted for 93% of China’s liquid sugar imports and 81% of its premix powder imports in 2022/23. Meanwhile, 53% of China’s white sugar imports came from Thailand and India. But both countries will have poor cane harvests in 2023/24. India is unlikely to export sugar at all while Thailand will have its lowest sugar production in more than a decade.

Chinese Comprehensive Bonded Zone sugar producers and Thai Free Trade Zone producers have been gradually switching to Brazilian sugar, but long transportation times mean operational difficulties and policy risks.

Nevertheless, we believe that Chinese demand for liquid sugar and premix powder in the 2023/24 season will remain at similar levels, at around 1.2 million tonnes. Some of the whites demand could shift to Brazil.

White Sugar Flows to China

For more articles, insight and price information on all things related related to food and beverages visit Czapp.