Insight Focus

- Bulk refined sugar prices were unchanged during the week ended December 1.

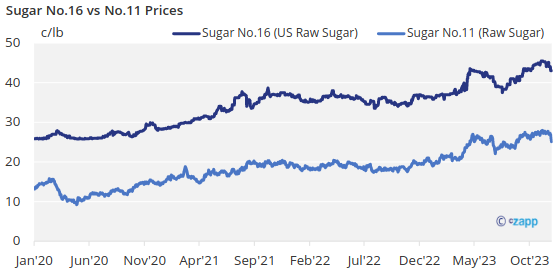

- But raw sugar futures tumbled after the Office of the US Trade Representative announced a reallocation of the raw cane sugar tariff-rate quota (TRQ) on November 29.

- Meanwhile, corn sweetener contracting for 2024 moved closer to completion.

US TRQ Re-Allocation Pressures Market

The USTR’s reallocation of 223,740 tonnes, raw value, of unused raw cane sugar TRQ allocations for 2023-24 was one of the earliest reallocations on record and should help ease tight raw cane sugar supplies. US raw cane supply is tight because of drought- reduced output in Louisiana and Mexico and a sizeable TRQ shortfall mostly due to the Philippines designating all of its production for domestic use this year.

The action had an immediate depressing impact on nearby New York No. 16 (domestic) raw sugar futures but did not move cash sugar prices. World raw sugar futures (No. 11) also tumbled for the week with pressure from Brazil’s record-large crop and fund long liquidation.

Spot refined cane sugar was offered at USD 0.68/lb nationwide through December 31. It was offered for calendar 2024 at USD 0.63/lb FOB Northeast and West Coast and in the range of USD 0.59/lb to USD 0.61/lb FOB Gulf and Southeast.

The cash sugar market was mostly quiet. The sugar beet harvest was complete, and the sugar cane harvest in Louisiana was 50% complete as of November 26. This was behind the year-ago and five-year average paces amid ongoing exceptional drought conditions. The cane harvest advanced in Florida.

Beet Buying Active for 2024

Bulk refined beet sugar offers for spot delivery were in the range of USD 0.59/lb to USD 0.62/lb FOB. For 2024, they were in the USD 0.57/lb to USD 0.59/lb FOB Midwest range. Traders indicated beet sugar could be purchased for 2024 below list in the mid-50s depending on volume and other factors.

All beet processors were in the market with sugar to sell although some were nearly sold out of new-crop sugar with additional sales mostly from contract underperformance. Traders noted active buying interest for 2024 despite the rush to contract in March 2023.

Inquiries for 2024-25 continued with beet sugar pricing said to be in the low- to mid-USD 0.50/lb range FOB Midwest, flat to modestly below 2024 price levels and unchanged from a week ago. Sales for 2024-25 were ongoing at a slow pace.

Food Manufacturers Seek Sugar Alternative

It should be noted there are indications of some demand destruction for sugar due to ongoing historically high prices. Corn refiners indicated inquiries from food manufacturers seeking to replace sugar with lower-priced corn sweeteners. High sugar prices were supportive to corn sweetener values.

Corn sweetener contracting for 2024 was nearing completion for most refiners except for one who came to the market late. Most bookings were complete by Thanksgiving, and refiners were left with only a handful of late business in wrap up in December. Prices were said to be mostly flat with sharply higher 2023 contracted levels. Some refiners sold at lower levels to protect market share or to gain new business, but others consistently closed deals flat with 2023.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.