Indian Sugar & Bio-energy Manufacturers Association (ISMA) has released the second advance estimates production for 2023-24 sugar season.

As is the practice, ISMA procured satellite images of cane area in the 2nd week of Jan’ 2024. The satellite pictures have given a good idea of the area already harvested and remaining unharvested area in the fields across the country.

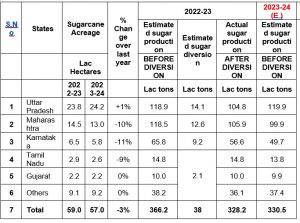

Based on the images of harvested and balance area, field visits, current trend of yields and sugar recoveries achieved till now, as also expected yield/sugar recovery in the balance period of the sugar season, ISMA released its 2nd advance estimates of sugar production for 2023-24 SS as per table below, which is self-explanatory:

Above statement indicates gross estimated sugar production of around 330.5 lac tons for 2023-24 SS against 366 lac tons produced in last season.

Government has so far allowed sugar diversion of only 17 lac tons for production of ethanol via sugarcane juice / B heavy molasses for 2023-24 ESY. This would mean net sugar production could be around 313.5 lac tons.

Considering an opening stock of about 56 lac tons on 1st October 2023, domestic consumption of 285 lac tons and the estimated production of 313.5 lac tons, a comfortable closing stocks of around 84.5 lac tons can be expected as on 30th September, 2024.

We believe that Government may now easily allow around 18 lac tons of additional sugar diversion for production of ethanol in the current ESY. Even then closing stock will be sufficient enough to cater around 3 months into next season.

Meanwhile, 187.2 lac tons of sugar has been produced till 31st January’ 2024 against around 195 lac tons produced last year on the corresponding date. However, this year around 520 factories are operating against 517 factories which operated last year.

Brazil also reported a 148% increase in their sugar production and crush over last season with favorable weather conditions for the may 2024 crop creating a healthy supply which should create selling pressure to capture artificially higher prices created by governments regulation. Lower prices to be expected as ethanol demand flows with lower prices as strong US Dollar policy continues to deflate commodity prices across the board.