Triveni Engineering & Industries Ltd., one of the largest integrated sugar manufacturers & engineered-to-order turbo gearbox manufacturers in the country and a leading

player in water and wastewater management business, today announced its financial results for the first quarter ended June 30, 2024 (Q1 FY 25). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

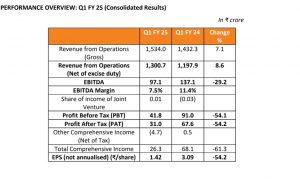

The increase in turnover during Q1 FY 25 is mainly due to higher Sugar turnover by 12% due to a similar increase in sales volumes and 5% increase in the realisation prices. The turnover of Power Transmission business improved marginally by 1% whereas there was a marginal decline of 2% in the turnover (net of excise duty) of the Alcohol business due to lower sales volume (despite higher production). However, the turnover of Water business has declined by 21% due to delays in award of certain project orders.

• Profit Before Tax (PBT) is 54% lower at ₹ 41.8 crore. Segment profitability was lower across businesses with the exception of Water business where cost savings led to higher profitability.

o The profitability of Sugar business, despite higher contribution on sugar sold was lower due to lower production and higher charge of off-season expenses owing to early closure of the season.

o The profitability of the Alcohol business was adversely affected due to restrictions imposed by the Government on the grain feedstocks, as a result of which surplus rice operations were substituted by maize, increasing transfer price of molasses, and due to lower sales volume by 4.3% with lower dispatch of ethanol from higher-margin sugarcane-based feedstocks.

The gross debt on a standalone basis as on June 30, 2024 increased to ₹ 1150.1 crore as compared to ₹ 918.5 crore as on June 30, 2023. Standalone debt at the end of the period under review, comprises term loans of ₹245.6 crore, almost all such loans are with interest subvention. On a consolidated basis, the gross debt is at ₹1280.9 crore as on June 30, 2024 as compared to ₹ 1011.1 crore as on June 30, 2023. Overall average cost of funds (standalone) is at 7.2% during Q1 FY 25 as against 6.7% in the previous corresponding period.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said:

“During the quarter, we commissioned the Rani Nangal distillery which led to highest-ever quarterly alcohol production of 5.46 crore litres, placing us amongst the leading ethanol manufacturers in the country. The Power Transmission business closing order book achieved a new milestone of crossing ₹ 300 crore at the end of quarter under review and we believe the business is on a sustained growth path.

The early closure of SS 2023-24 and lower production in the quarter as well feedstock restrictions imposed for distillery operations have led to lower profitability of sugar and distillery operations.

Our focus is to restore normalcy in our sugar operations and we are vigorously working in this direction – uprooting infected crop, substituting vulnerable varieties with more robust varieties, enhancing yields and step up surveillance to get early warning of any challenges to our crop. We have undertaken curative control measures to contain and control the spread of red-rot disease, that affected our operations in previous season. We continue to focus on premium products such as refined sugar and pharmaceutical-grade sugar (now contributing to 70% of overall sugar production) to further improve the profitability profile of the Company.

In view of comfortable sugar inventory position in the country, we earnestly hope that the Government will do away with feedstocks restrictions and address ethanol pricing feedstock wise based on viability so that a concerted effort is made to achieve the EBP targets. The industry also keenly awaits revision to Minimum Selling Price (MSP) which is vital for the sustainability of the industry. The MSP has remained unchanged since 2019, while input costs, particularly the Sugarcane Price (FRP and SAP), have risen significantly.

In our Engineering businesses, the Power Transmission business continues its strong performance by achieving new milestones including winning breakthrough international orders in line with its export focused growth strategy. The Water business continues to be muted in terms of market activity and finalization of orders. We expect this to improve in the coming quarters and the business is well-placed in terms of bids and credentials.”

If you want to read more about the news about the Sugar Industry, continue reading Chinimandi.com