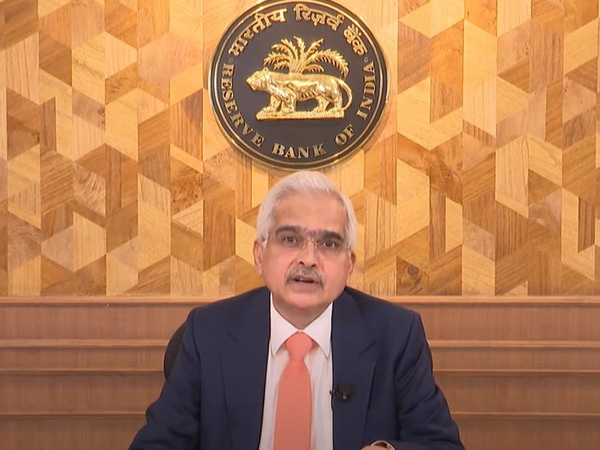

India cannot risk another bout of inflation and the best approach would be to remain flexible and wait for more evidence of inflation aligning durably with the target, Reserve Bank Governor Shaktikanta Das observed in the last meeting of MPC while also noting that the Indian economy presents a picture of stability and strength and that the balance between inflation and growth is well-poised.

According to the minutes of the MPC meeting held from October 7 to 9, Das said that despite the near-term uptick in inflation, the outlook for headline inflation towards the later part of the year and early next year points to further alignment with the 4 per cent target.

“Thus, the conditions are appropriate for a change in monetary policy stance to neutral from withdrawal of accommodation. This would provide greater flexibility and optionality to monetary policy to act in accordance with the evolving outlook,” he said.

“It also provides space to watch out for the uncertainties on the horizon – ranging from heightened geo-political tensions and volatile commodity prices to risks of adverse weather in food inflation. These are significant risks and their impact cannot be underestimated. We need to remain vigilant. At this stage of the economic cycle, having come so far, we cannot risk another bout of inflation. The best approach now would be to remain flexible and wait for more evidence of inflation aligning durably with the target,” he added.

The RBI Governor said that monetary policy can support sustainable growth only by maintaining price stability.

“Taking all these factors into consideration, I vote for changing the stance from withdrawal of accommodation to ‘neutral’ while keeping the policy repo rate unchanged at 6.50 per cent,” he said.

The global economy, despite its uneven growth, remains resilient, with headline inflation softening in many countries.

In India, the economy has shown stability, with agricultural activity boosted by a favourable monsoon and strong services and manufacturing sectors.

Real GDP growth is projected to reach 7.2 per cent for FY2024-25, with expectations of further growth at 7.1 per cent for FY2025-26.

However, inflation remains a key challenge. Headline Consumer Price Index (CPI) inflation moderated during July and August 2024, benefiting from a favorable base effect, but the recent upturn in food prices is likely to push inflation higher in the short term.

“Food prices registered a decline in July-August, but high-frequency indicators available for September indicate an upturn, which is likely to lead to a substantial jump in headline inflation,” Das noted.

The inflation outlook is expected to improve with better prospects for the kharif and rabi crop seasons, but caution remains necessary.

Despite the near-term risks, the long-term inflation forecast is optimistic, with projections of 4.5 per cent for FY2024-25.

(With inputs from ANI)