Triveni Engineering & Industries Ltd. (‘Triveni’), one of the largest integrated sugar & ethanol manufacturers & engineered-to-order turbo gearbox manufacturers in the country and a leading player in water and wastewater management business, today announced its financial results for the second quarter & half year ended Sep 30, 2024 (Q2 & H1 FY 25). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

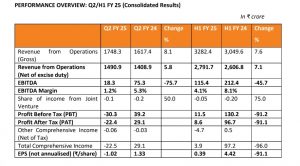

• Net turnover increased by 5.8% in Q2 FY 25 and by 7.1% in H1 FY 25:

• Higher sugar and alcohol sales volume as well as realisation prices in H1 FY 25. The sales volume of sugar was lower by 1.4 % in Q2 FY 25.

o Power Transmission business turnover grew by 30.1% and 18.4% in Q2 and H1 FY 25 respectively, which also contributed to the overall growth. However, the turnover of Water business declined by 35.6% and 28.2% in Q2 FY 25 and H1 FY 25 respectively due to lower order booking in previous quarters along with challenges in certain projects under execution.

• The profitability has been pulled down by Sugar and Alcohol segments whereas Engineering businesses contributed higher profitability:

o The profitability of Sugar business was lower due to lower contribution margins and higher charge of off-season expenses by ₹ 28.90 crore owing to early closure of the Sugar Season 2023-24. Further, includes loss of ₹ 7.7 crore (PBIT) pertaining to the subsidiary SSEL. The profitability of the Alcohol business was adversely affected due to:

a) shortage of molasses-based feedstock resulting from the policy decision of GoI restricting diversion of sugar to B-Heavy Molasses (BHM) and sugarcane juice. It led to closure of distilleries for some period during Q2;

b) Increased transfer price of B-heavy molasses; and

c) high cost of procurement of maize, thereby significantly reducing the margins of maize operations. In the previous periods, substantial part of grain operations comprised high margin Food Corporation of India (FCI) – Rice operations.

Alcohol from molasses-based feedstocks formed 50% and 44% of total sales in H1 and Q2 FY 25 as against 64% and 65% in the corresponding periods of previous year. These primarily consist of relatively high-margin ethanol. On the other hand, the sales volume of low margin ethanol produced from maize operations increased substantially. Additionally, segment profitability includes loss of ₹ 3 crore (PBIT) pertaining to the subsidiary SSEL.

o The profitability of Power Transmission business increased by 20% and 33% respectively in H1 and Q2 FY 25 whereas that of Water business is almost at the same level as previous periods for H1 FY 25.

The gross debt on a standalone basis as on September 30, 2024 increased to ₹ 383.3 crore as compared to ₹ 295.7 crore as on September 30, 2023. However, considering operational surplus funds held as fixed deposit (FD) of ₹ 117 crore, the net debt as on September 30, 2024 is at ₹ 266.3 crore as compared to ₹ 10.2 crore as on September 30, 2023. Standalone debt at the end of the period under review, comprises term loans of ₹ 247.2 crore, almost all such loans are with interest subvention. On a consolidated basis, the net debt after considering surplus funds held is at ₹ 418.8 crore as on September 30, 2024 as compared to ₹ 100.9 crore as on September 30, 2023, including ₹ 70.23 crore pertaining to the subsidiary SSEL. Overall average cost of funds (standalone) is at 6.7% during Q2 FY 25 as against 5.8% in the previous corresponding period.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said:

“Overall profitability of the Company during the half year ended September 30, 2024 was subdued, impacted by lower margins in the Alcohol business and losses of new subsidiary SSEL which was recently acquired. For Sugar Season, the profitability in the first half of financial year remains muted due to expensing of fixed expenses during the off-season period, which was much longer during the current period. However, Engineering businesses performed well both in terms of profitability and order booking, resulting in combined closing order book of ₹ 2070.9 crore, an all-time high for the Company.

We are all set for the new Sugar Season and on an overall basis, the crop seems healthier due to favourable climatic factors as well as due to rigorous sugarcane development activities undertaken by us. We have commenced sugarcane crushing at four sugar units for Sugar Season (SS) 2024-25. We estimate gross sugar production for Sugar Season (SS) 2024-25 for the country at 34 million tonnes as compared to 34.3 million tonnes for the recently concluded SS 2023-24. However, the estimated production is still expected above the domestic consumption and we hope that the Government allows exports at an appropriate time to capitalize on high international sugar prices.

This year our focus in the Sugar business has continued towards varietal substitution, improving crop health and enhancing yield and recovery through active farmer engagement. We believe a healthy plant crop, focused crop management along with continued investments towards debottlenecking, enhancing the crush rate and efficiency improvements will help to improve the overall crush in SS 2024-25. Further close monitoring on sugar quality and refined sugar production of ~70% to ensure superior realisations, is also likely to aid the revenues and the profitability of Sugar business. The industry also keenly awaits revision to Minimum Selling Price (MSP) of Sugar which is vital for the sustainability of the industry. The MSP has remained unchanged since 2019, while input costs, particularly the Sugarcane Price (FRP and SAP), have risen significantly.

In the Alcohol business, we welcome the Government’s move to lift restrictions pertaining to use of B-heavy molasses and sugarcane juice/syrup for the production of ethanol. However, several challenges still persist such as availability of feedstocks, increasing input costs which are impacting overall profitability. We look to the Government to address these through comprehensive measures that will put the industry back on track to meet the ethanol blending (in petrol) targets of the nation. In our Engineering businesses, the Power Transmission business continues to progress well with healthy demand from traditional segments and markets while making strides with new customers especially in global markets along with diversification of its solutions portfolio. In the Water business, we are pleased to receive two new major orders which improves visibility of revenues in the near future. The business is well placed on a few bids of substantial value where we expect more updates in the next couple of quarters.”