• The current macroeconomic backdrop is not favorable for the commodities market, including sugar;

• Despite stable fundamentals, Q4 2024 shortages may be less severe than expected;

• Indian exports are expected to be limited, with a significant impact on the market in Q1 2025;

• Brazilian Center-South crop is being monitored. Deteriorating weather conditions in the region could boost prices in the short term, making trade flows bullish.

The current macroeconomic scenario is unfavorable for the commodity market, with a strong dollar, depreciation of emerging market currencies and a weak Chinese economy putting pressure on sugar demand and reducing FOB premiums.

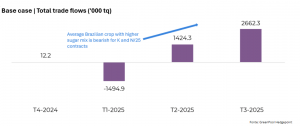

According to Lívea Coda, Sugar and Ethanol Analyst at Hedgepoint Global Markets, “although the fundamentals are stable, the supply shortfall in Q4 2024 may be less than expected, with Mexico showing a positive start to the season and Brazil maintaining strong participation”.

March remains the most bullish contract, with a spread of 140 pts H/K25. “Recent rains in the center-south of the country could further support this trend, as they are positive for the development of the 25/26 crop,” the analyst says.

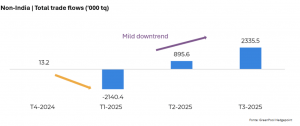

“A significant deficit is expected in the first quarter of 2025, which could exceed 2 million tons if India does not export. Indian production is lagging due to weather and political conditions,” Lívea notes. As of November 15, 144 mills were operating, compared to 264 active mills in the same period.

Crushing and production were down by 44.18% and 44.09% respectively compared to the previous year.

“710Kt was produced compared to 1.27Mt last year. Indian exports are likely to be limited until stocks are replenished, affecting global trade flows,” Lívea points out.

In Brazil, recent rains are helping the development of the 25/26 crop, but adverse weather conditions could push prices higher.

“Sugar prices are currently expected to be between 19.5 and 22.5 c/lb, depending on demand, which remains weak, with a lower share from China and high stocks in refineries,” analyst points out.

“Demand for raw sugar will be decisive for prices, and any problems in the development of the 2025/26 crop in the center-south of Brazil or a greater urgency in global demand could lead to an upward trend,” Lívea concludes.

More balanced trade flows in white sugar, together with a shortage of raw supplies, have put pressure on refining margins.

For detailed information and further insights, please refer to Chinimandi.com, which provides news about the Sugar and Allied Sectors