There are concerns over the impact of El Nino on sugar production. However, Agrimandi.live, an analysis and forecasting company on Agri-commodities, believes that any effect from El Nino will be lagged by one year and will not impact sugar production in the 2023-24 season, resulting in normal output unless there is a severe drought.

Based on the analysis, ground reports and taking other factors into consideration, Agrimandi.live has released its preliminary estimates of sugar production for the 2023-24 sugar season.

Agrimandi.live emphasises that historical data indicates a one-year lag effect of El Nino on Indian sugar production because good rainfall activity in previous seasons had helped to restore the water table and reservoir levels. Additionally, a positive Indian Ocean Dipole (IOD) is expected to further mitigate El Nino’s effect to some extent.

Agrimandi.live explains that several global weather models are predicting a positive IOD, which suggests that the Indian monsoon will likely remain close to normal or above normal. The Australian Bureau of Meteorology and the United Nations Climate Prediction Centers forecast a positive IOD from July, with a temperature exceeding 1°C in August and September. In previous El Nino years such as 1983, 1994, and 1997, a positive IOD resulted in increased monsoon rainfall. Despite El Nino conditions during those years, Indian rainfall activity was recorded at 109%, 110%, and 99.6% respectively.”

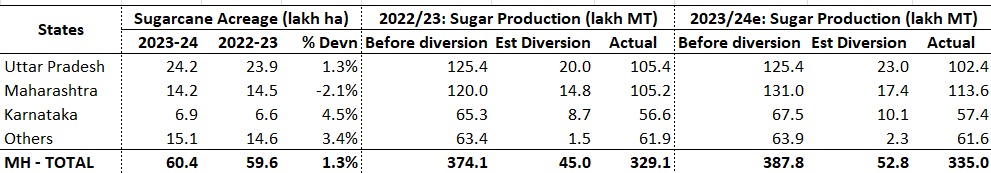

Based on these factors and weather yield models, Agrimandi.live predicts that Indian sugar production for the 2023-24 season will reach 387.8 lakh metric tonnes (LMT), including ethanol diversion. The diversion of sugar to ethanol is expected to range between 50 to 55 LMT, resulting in a net sugar production estimate ranging from 333 to 338 LMT. In the season 2022-23, sugar production is expected to be 329.1 LMT, whereas around 45 LMT of sugar will go for ethanol production.

Following table indicates sugar production estimation:

Maharashtra, one of the major sugar-producing states in India, is known for its volatile nature in terms of sugar production, with 20-25% of the production originating from the drought-prone Marathwada region. Even during the 2014-15 El Nino year, when rainfall in West Maharashtra was 93% of the long-period average (LPA) and only 58% in Marathwada, sugar production in the state increased by 36% year-on-year (y/y). The state is expected to produce 131.0 LMT of sugar, including diversion for ethanol production. With 17.4 LMT diversion for ethanol production, net sugar production in Maharashtra is expected to be 113.6 LMT. Sugarcane acreage in Maharashtra is expected to be 14.2 lakh hectares in 2023-24 season, marginally lower than 14.5 lakh hectares in the current season.

In Uttar Pradesh, sugar production has witnessed a shift from the range of 65-75 LMT to 115-125 LMT over the past seven years. The state’s sugar production is less affected by El Nino due to its extensive irrigation system supplied by perennial rivers. Despite below-normal monsoon rains, with a deficit of 48% in 2014 and 45% in 2015, the sugar production in the state reported higher when compared to normal monsoon years. Over the past four seasons, sugar production has ranged from 105 to 110 LMT, largely due to the diversion of sugarcane towards ethanol. During the 2022-23 season, Uttar Pradesh mills diverted close to 20 LMT of sugar towards ethanol. Sugar production in the state touched at 105.4 LMT.

Agrimandi.live predicts, Uttar Pradesh sugar production is expected to remain in the range of 102-105 LMT in 2023-24 season, with diversion of sugar to ethanol is expected to remain around 22-25 LMT. Sugarcane acreage in Uttar Pradesh is expected to be 24.2 lakh hectares in 2023-24 season, marginally higher than 23.9 lakh hectares in the current season.

Sugar production in Karnataka is expected to remain at 67.5 LMT including diversion for ethanol production. With 10.1 LMT estimated diversion, sugar net sugar production is estimated at 57.4 LMT. Sugarcane acreage in Karnataka is expected to be 6.9 lakh hectares in 2023-24 season, marginally higher than 6.6 lakh hectares in the current season.

The Indian sugar industry is committed towards nation building and striving to achieve the ethanol blending target fixed by the Government and therefore in 2023-24 season, sugar diversion towards production of ethanol is estimated to be higher at 52.8 LMT against 45 LMT estimated in 2022-23 season.

According to the India Meteorological Department, the monsoon, which is now in its advanced stage, is active in the country, and several states are expected to receive heavy rainfall in the coming few days.

As concerns over El Nino persist, the Agrimandi.live will closely monitor weather patterns and the progress of the monsoon to assess the actual impact on sugar production in the coming season.

government export allows for benefits for cane grover &increased sugar prices so mills capable increased sugar production. international markets in mentioned Indian sugar demand Regard Surendra Bhalotia sgrising2020@gmail.com

DUE TO SHORT OF VALIDITY PERIOD OF EXPORT BOTH MILLERS AND EXPORTERS WILL LOOSE PROFIT. AT PRESENT MOST OF THE EXPORTERS EXPORT SUGAR THROUGH CONTAINERS NOT IN BULK SHIPMENT. THEREFORE GOVET WILL GIVE SUFFICENT TIME FOR EXPORT AND ALSO ISSUE SUITABLE INSTRUCTIONS TO BANKERS TO PROVIDE LOAN AT A CONCESSIONAL RATE .