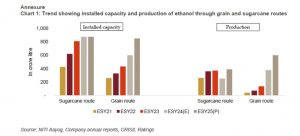

India’s aim to blend 20% ethanol in petrol by ESY1 2025 — or ~990 crore litre annually — will require effective utilisation of both grain and sugarcane feedstock to increase its supply.

According to the press release by CRISIL Ratings, annual ethanol production from grains is expected to see a significant increase to ~600 crore litre by the next season (this season’s production estimate is ~380 crore litre). The balance will have to be produced by processing ethanol from sugarcane, which is viable given the substantial capacity in place.

This can help optimize sugar inventory, especially given the anticipated high carry-over stock at the end of the current season due to government restrictions on diverting sugar for ethanol production and exports.

As per press release, a CRISIL Ratings analysis of 17 integrated sugar mills, accounting for about one-third of sugar-based ethanol supply, indicates as much.

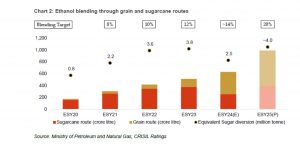

Blending ethanol helps reduce India’s dependence on crude oil imports. The ethanol blending rate has steadily risen 200-300 basis points each season since ESY 2021.

The press release further adds that while grain utilisation for producing ethanol is not controlled, the government determines the quantum of sugarcane utilisation based on its estimation of demand-supply balance of sugar for the year ahead.

Last year’s erratic rainfall is expected to have impacted sugarcane production this year. Consequently, ethanol production from the sugarcane route is expected to be restricted to 2.5 million tonne of sugar diversion this season.

Poonam Upadhyay, Director, CRISIL Ratings said, “Ethanol blending could still improve to 14% in ESY 2024 as extraction from grains has significantly risen due to 40% capacity expansion. That will compensate for the reduced output from sugarcane. However, to reach the 20% blending target by ESY 2025, allocating sugarcane required to produce ~4 million tonne of sugar can be considered for ethanol production, similar to the season 2023.”

In the upcoming season 2025, gross sugar production is expected to be ~33.5 million tonne, with consumption at ~29.5 million tonne. Additionally, sugar inventories are projected to be healthy by the end of this season.

Hence, allowing sugarcane — equivalent to the quantity required to produce 4 million tonne of sugar — for ethanol supply (~390 crore litre) can be considered, while the larger remaining share will be sourced from grain-based route.

Anil More, Associate Director, CRISIL Ratings stated that higher sugarcane usage for ethanol production will also help optimise sugar inventory, which is estimated to rise to about 4 months of consumption (~8 million tonne) by the end of this season. Besides, it can positively impact the cash flows of sugar mills and help them pay cane dues to farmers on time.

In the road ahead, the policy on quantum of sugarcane allowed next season and availability and prices of grain-based feedstock will bear watching.

Continue reading Chinimandi.com for more news about the Ethanol Industry

But haphazard implementation of EBP program is causing so much pain to Ethanol producers. Last year it was for Ethanol from Sugar because of abrupt ban on using B-heavy molasses and this year Ethanol from Grain are suffering because abruptly FCI rice was stopped while there still isn’t enough maize for domestic demand. Maize prices will were lower than Rs 20/kg are hovering around Rs 25-27. How does the Govt expect companies who have invested hundreds of crores to support Governments EBP program to sustain? The high prices of maize is causing issues not just for Distilleries but also starch producers, poultry industry as well. Govt loves taking the credit for increased % of Ethanol blending, but it is oblivious to the sufferings of the producers.

Even though Rice is rotting in FCI Godowns and there is no space to keep Rice from the new harvest, but still the Govt isn’t releasing the obviously excess rice to the Distillers, which could help in easing the price pressure on Maize.

After taking so many steps to hurt the industry, the Ministers complain that the private sector is holding back on capex even after Govt has done the heavy lifting.

It is understandable that Govt is rattled after the elections and want to keep farmers happy, but Govt wont be able to buy enough votes that would justify the harm done to industries with such policies.