Czapp Insight Focus

Since 2016, Chile’s government has imposed taxes and labelling on products high in sugar and calories. As a result, producers are reformulating their products and by substituting sugars with artificial sweeteners and discontinuing products. This has resulted in changes in consumer preferences and decreases in overall sugar consumption.

Chile’s Sugar Consumption Has Been Decreasing Since 2016

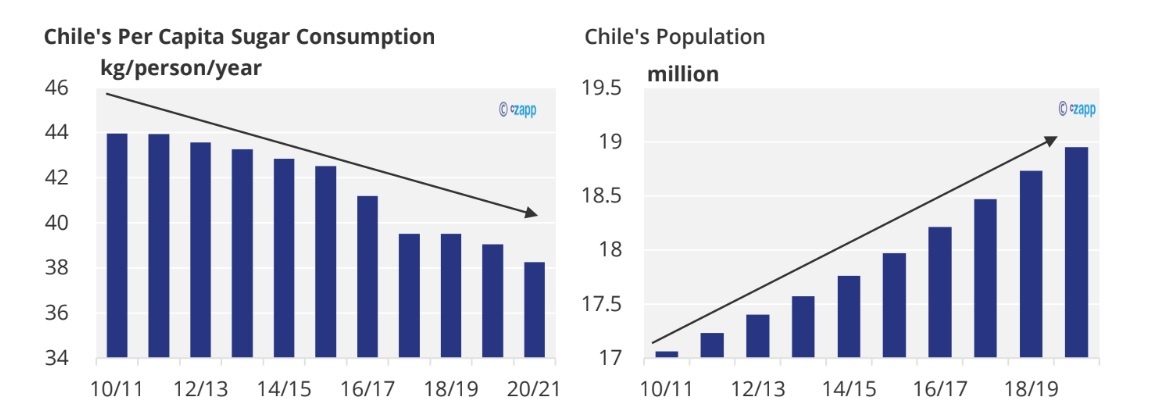

In 2010, a study evaluating Chile’s processed food consumption showed that these foods accounted for 29% of the country’s total energy consumption. These findings prompted the Chilean Government to ensure citizens were eating healthily and avoiding excessive consumption of specific ingredients, including sugar. Today, Chile is seen as a leader in sugar regulation; its per capita sugar consumption has declined in the last decade, in line with new government measures.

What Measures Has Chile Introduced?

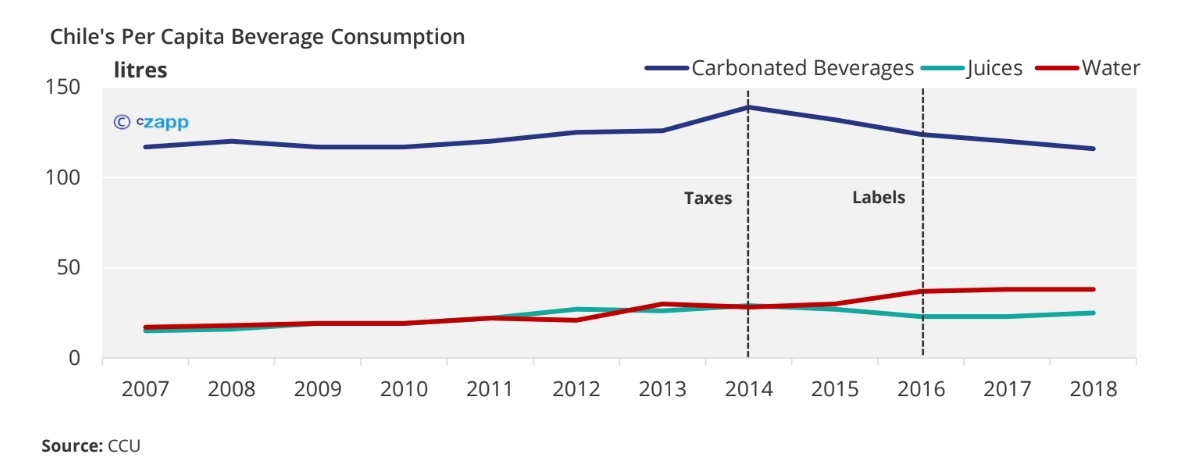

Chile has a long history of taxing sugary soft drinks. This process began in the 1960s, but the soda tax took its current form in 2014. This sees drinks containing more than 6.25g of sugar per 100ml taxed at 18%, whilst those below this level are taxed at 10%. Later, in 2016, the advertisement of foods deemed unhealthy for children was also heavily regulated, with mascots and promotional toys now banned.

Warning labels were also introduced in 2016 to highlight which foods are high in fat, sugar, and calories.

How Have These Measures Impacted Sugar Consumption?

One study found that the amount of sugar bought in soft drinks fell by 21% between 2014 and 2015. Another revealed that high-sugar drinks purchases fell by 3.4%. The studies both used different methodologies, hence the different outcomes, but they both agree that sales of high-sugar drinks fell following the implementation of taxes and other measures.

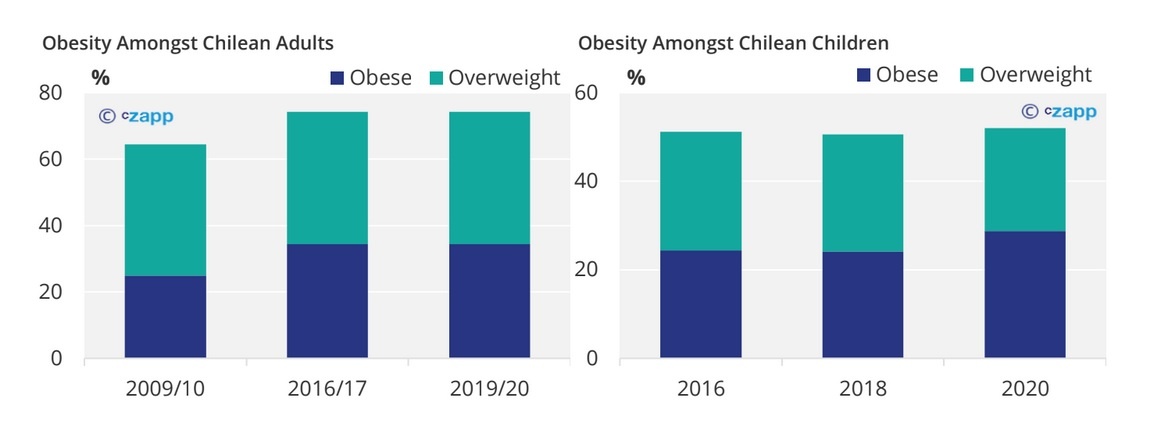

This is positive as the measures were introduced to combat the fact that Chile has one of the highest levels of obesity in the world, with 74.2% of its adult population and 52.1% of its children deemed overweight in 2019/20.

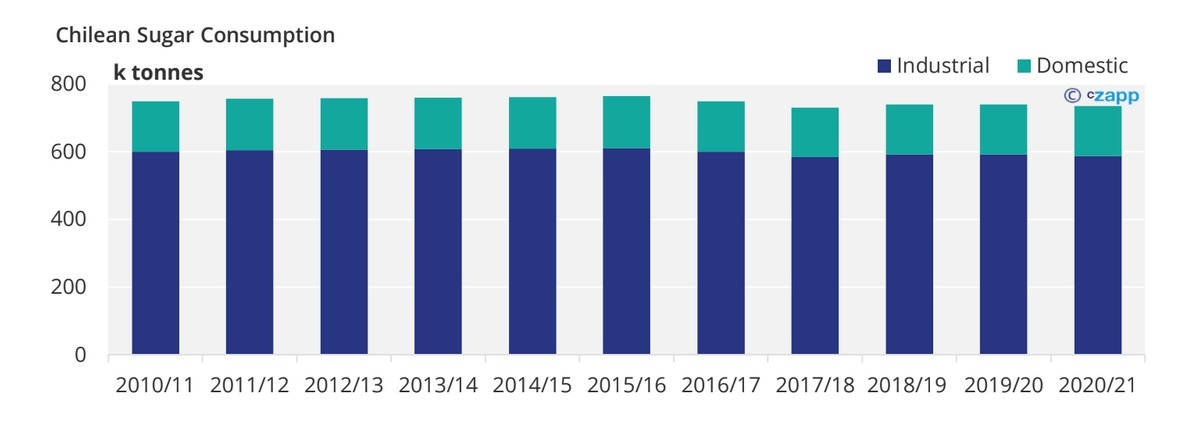

However, there’s a downside in that the country’s diminishing sugar demand means Chile’s industrial sugar users, which account for up to 80% of Chile’s annual sugar consumption, have taken a hit.

Some food and beverage manufacturers have reformulated their products, replacing sugar with artificial sweeteners. This is because products without nutritional labels were selling more easily, as consumers started to favour healthier products. One study even noticed that sales of products that were formerly deemed to be healthy by consumers dropped by 16% when labels were implemented. To put this shift into context, before the soda tax was introduced, 54% of the drinks sold in Chile had a high sugar content, with this figure dropping to 18% following the tax implementation.

What Other Factors Could Be Reducing Sugar Consumption?

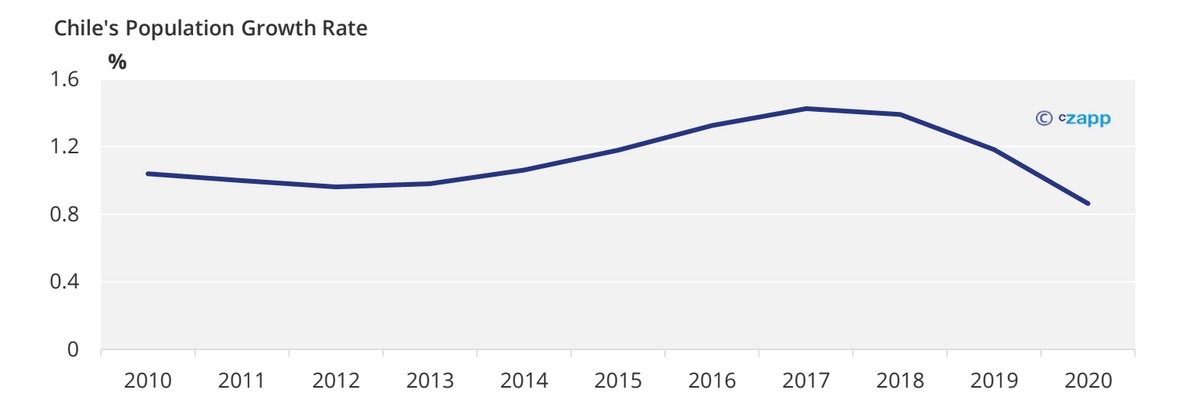

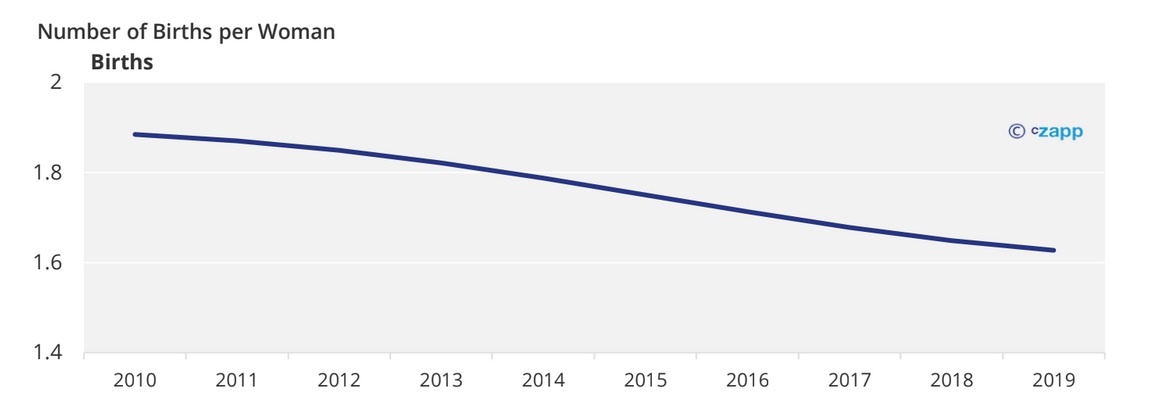

We think Chile’s slowing birth rate has also impacted sugar consumption.

Chile’s birth rate has decreased in the past decade, likely as access to education for women has improved. Those that attend high school and universities are less likely to have children at a young age.

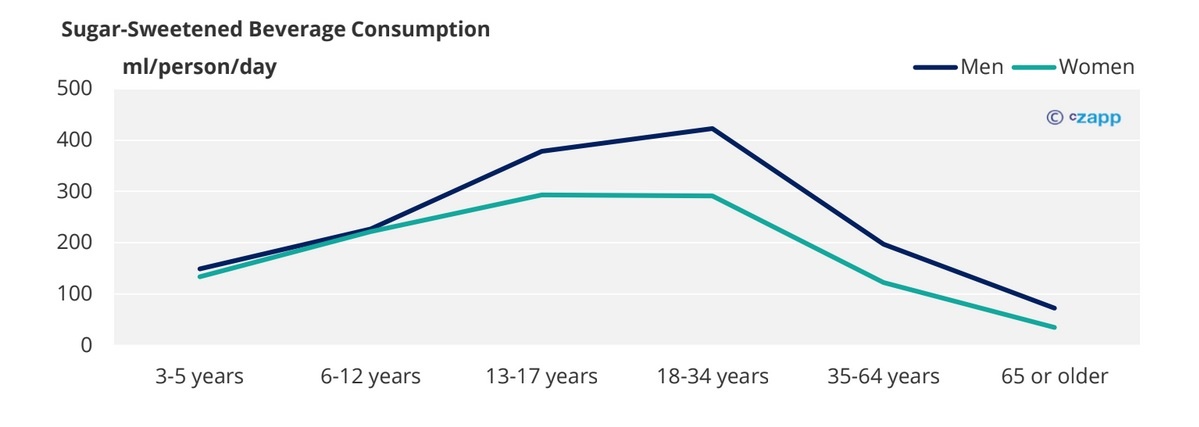

With this, Chile’s ageing population has grown, which is bad news for sugar consumption as it tends to dip with

age.

What Does the Future Hold for Chilean Sugar Consumption?

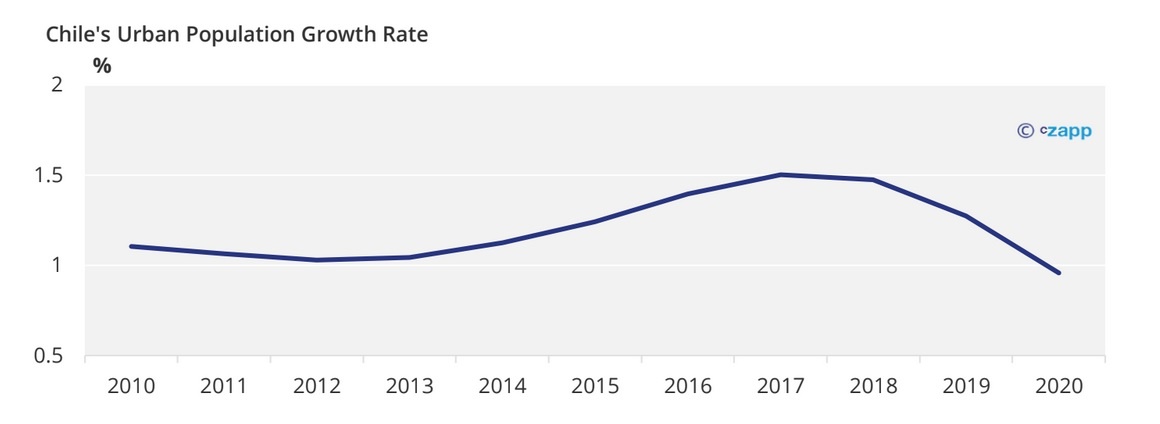

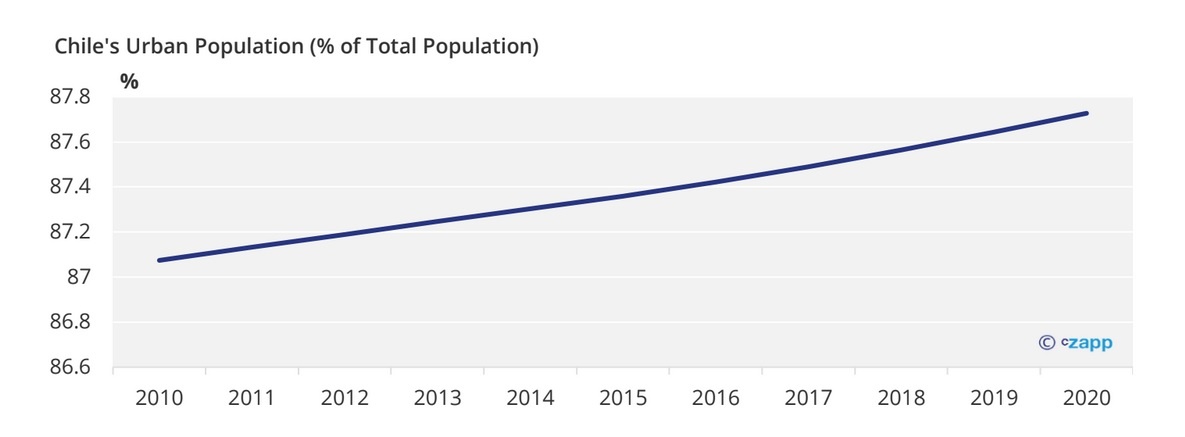

We think Chilean sugar consumption will continue to decline across the next decade. This season, 2021/22, we think its consumption will drop to its lowest point in five years (735k tonnes). The country has been urbanising, but even the growth rate here has decreased in recent years as the population ages.

Also, urbanisation often leads to increased sugar consumption as those living in urban areas tend to have more disposable income and enjoy improved access to areas where sugar consumption is more common (bars, restaurants, and theatres, etc).

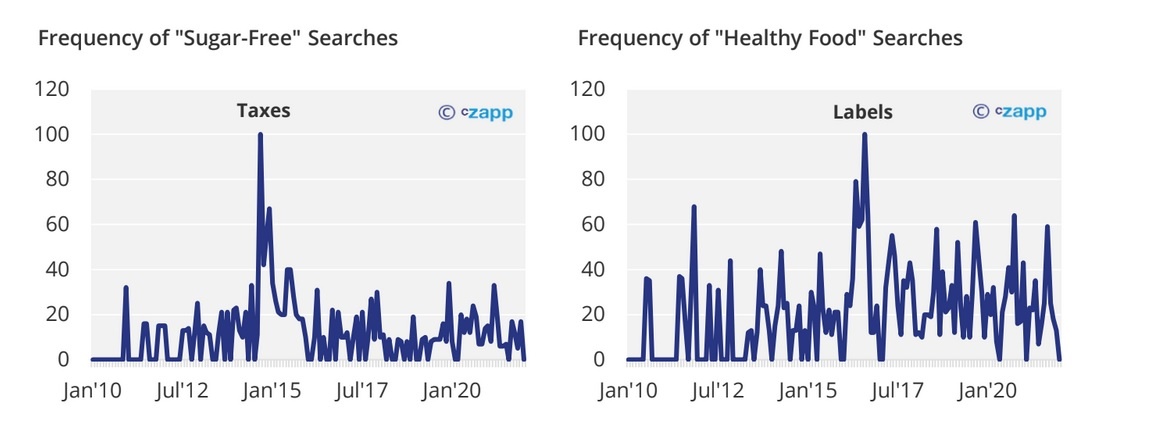

However, in Chile, the government’s regulations mean the urban population has drifted away from consuming products that contain a lot of sugar as they strive for healthier lifestyles. This move is reflected by Chile’s spike in “sugar-free” Google searches from the point when the taxes were introduced in 2014. The “healthy food” Google search also hit its peak shortly after the labels were implemented.

Concluding Thoughts

Chile is a pioneer when it comes to sugar regulation. Their tax and labelling efforts seem to correlate well with increased consumer interest in a sugar-free lifestyle.

Today, there are around 50 countries with sugar taxes in place. These, along with others contemplating such measures, could perhaps see their sugar consumption go the same way as Chile’s in years to come.