Insight Focus

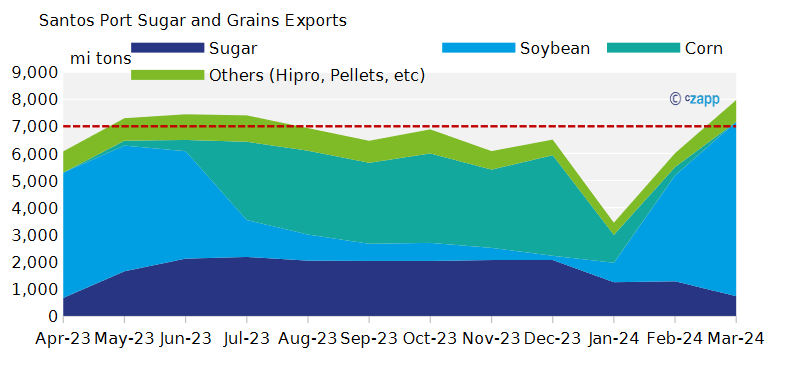

Soybean exports were slower than expected this season. Sugar exports have started slowly too. Corn exports start this month; is this the calm before the storm?

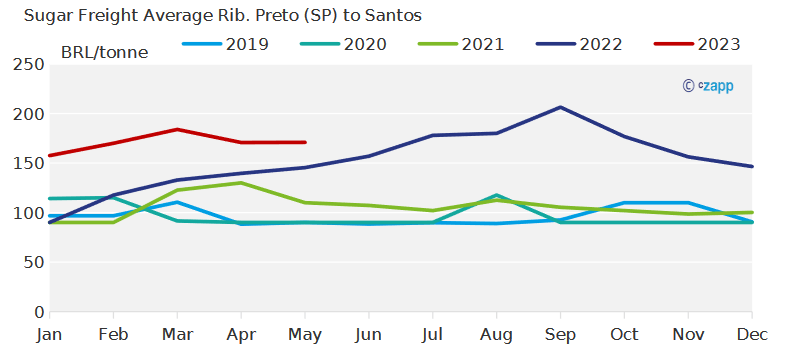

Looking at road sugar freight rates from Sao Paulo state countryside to Santos port, we see that values have come down since reaching a peak in March. This is hardly what one would expect to see in a season of record sugar and grains exports.

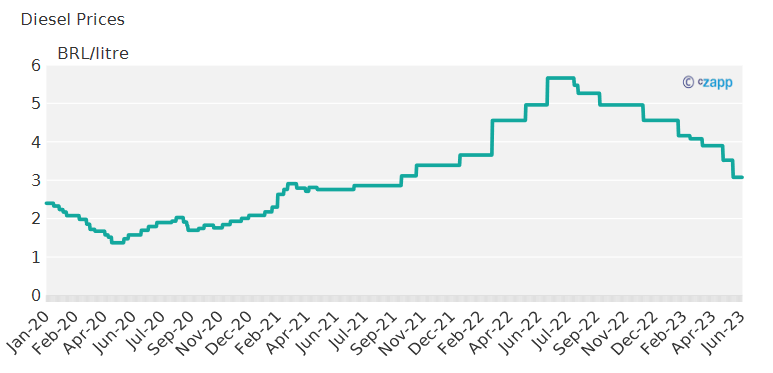

One factor explains this behavior: diesel prices have come down 21% since the start of the season in April. The fuel prices represent around 40% of the freight rates, any price reduction has a significant impact.

Source: Bloomberg

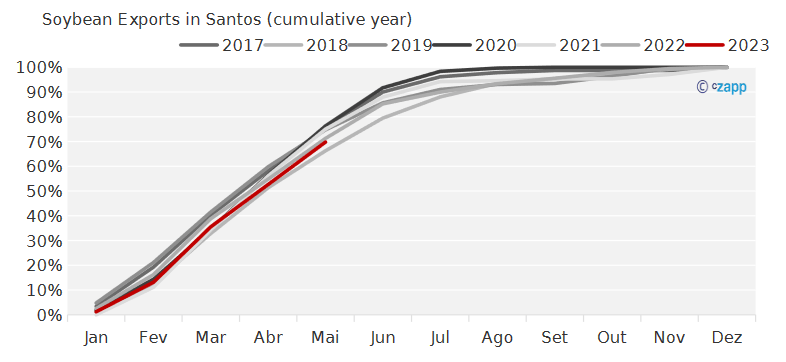

The second reason is soybean export flow, which up until May was 70% out of total expected volume for 2023 and lower than usual. According to IMEA (Instituto Mato-grossense de Economia Agropecuária), the soybean marketing curve in Mato Grosso State (responsible for 30% of Brazilian soybean production) stands at 66%, much lower than the 85% expected for this time of the year. With farmers waiting for higher soybean prices, selling of the grain has been delayed and could be impacting the volume of exports so far.

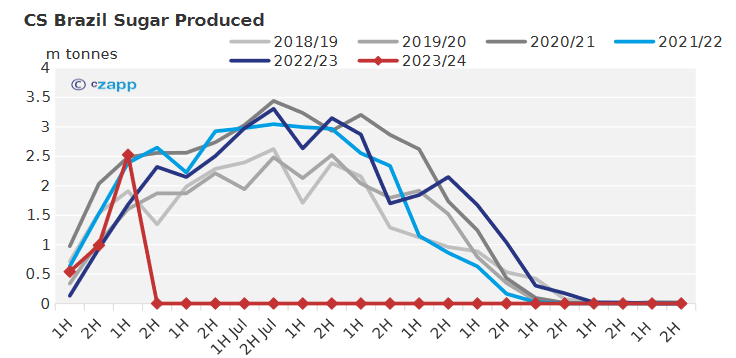

Another factor is the slow pace in sugar operations. With the start of the season delayed by rains in April, sugar production only picked up the pace last month.

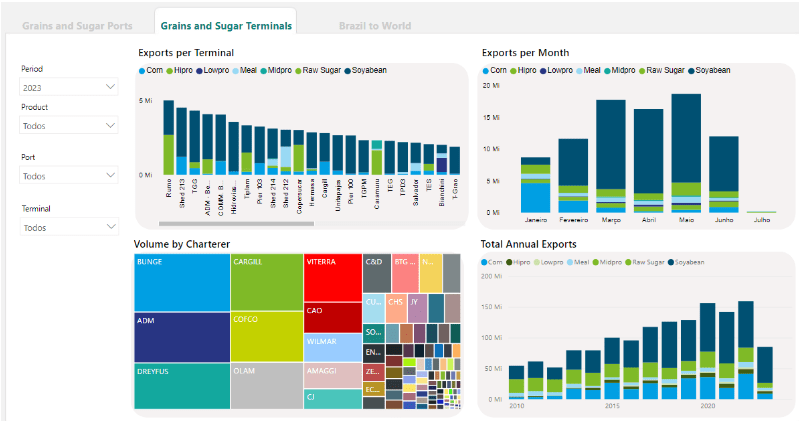

So, the strong flow did not come as expected at the start of the season leaving the terminals operating at a lower efficiency. The pressure has not begun so far…

Waiting for the Storm?

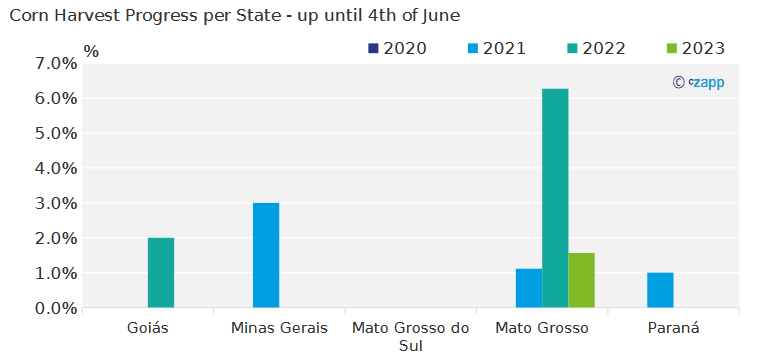

Source: Conab

Now Brazil starts to harvest the 2nd corn crop, which is a slightly misleading name as it is the largest one, with over 76% of total corn production. We expect this season to reach a record 96m mt. The harvest pace is somewhat delayed, so far 0.7% in the main producing states vs 3% same time last year.

With Brazil exporting 40% of its corn production, around 48m mt should be heading to the ports over the next months. And out of this, 43% is exported through Santos.

The pressure is expected to increase in the upcoming weeks, as corn production flow down to the ports (impact on freight rates) and out of the country (impact in terminal operations and sugar logistics). Based on our export pace assumptions, we believe competition between sugar and grains will be tested until September – at least.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.