Insight Focus

- Sentiment about Chinese sugar prices is mixed.

- Sugar production in 2023/24 will be close to 10 million tonnes.

- Import policy will be a key factor in Chinese sugar demand next year.

The National Sugar Conference is probably the most important Chinese sugar industry event of the year. The main topics of discussion are usually around what’s going to happen in the upcoming season. In 2023 it was held on 31st October to 2nd November at Haikou city, Hainan province. At the other end of the island is the famous resort city of Sanya, which is perfect for relaxing from the stressed sugar market.

Divergent Views

Voices at the meeting were divided this time.

The bears believe world sugar prices have stayed high for too long and may have run out of steam. With plenty of raw sugar arriving in China under quota, liquid sugar and premix powder imports, and a larger crop, they think the domestic market is well supplied. Traders with close ties to end-users are pessimistic, because they see consumers switching to cheaper sweeteners.

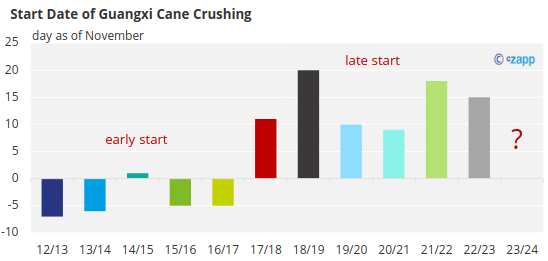

Those who hold the opposite view believe that the current commercial sugar stock level is low in China. Once consumer buying starts, they will push prices up again. And the supply of new-crop sugar may be delayed because sugar mills need to wait for the sucrose to accumulate in cane before harvesting.

Optimistic Production Forecast for 2023/24 Season

Let’s move on to something a little more certain.

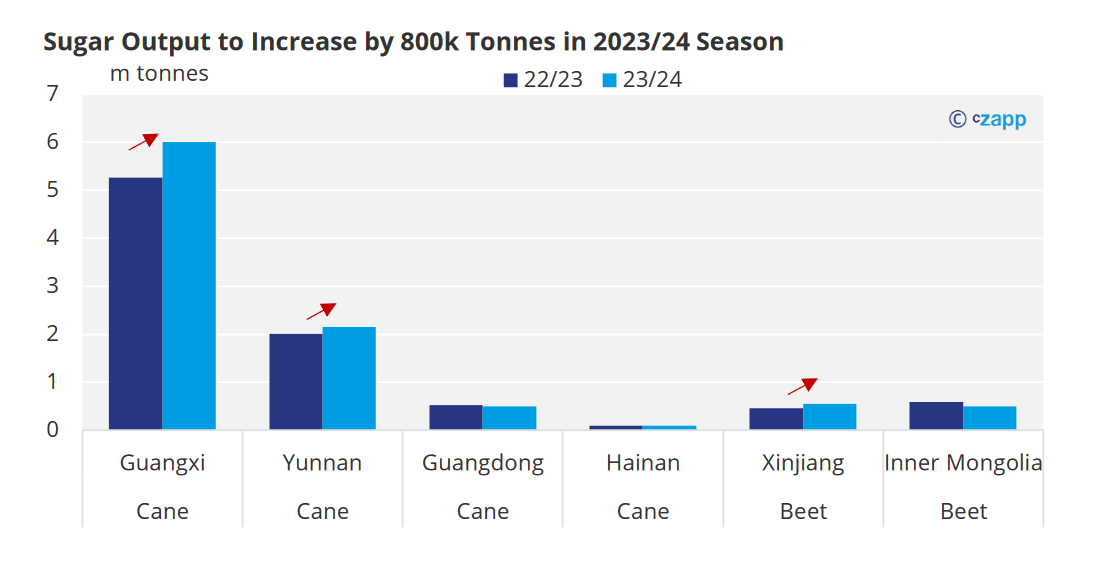

Following good September and October rains, sugar production for the coming season looks more promising at 9.8m tonnes or higher, 800k tonnes higher year-on-year. This is good news for farmers. The same is true of sugar mills, where more cane means more money.

But mills also expressed concern about low sucrose content.

They think sucrose yields for 2023/24 could fall by at least 0.3% year on year, which points to higher sugar production costs (as more cane will be needed to produce a tonne of sugar). Low sucrose yields, however, are no cause for concern for farmers. That’s because farmers’ income from selling sugar cane is only measured by weight, not by sucrose content.

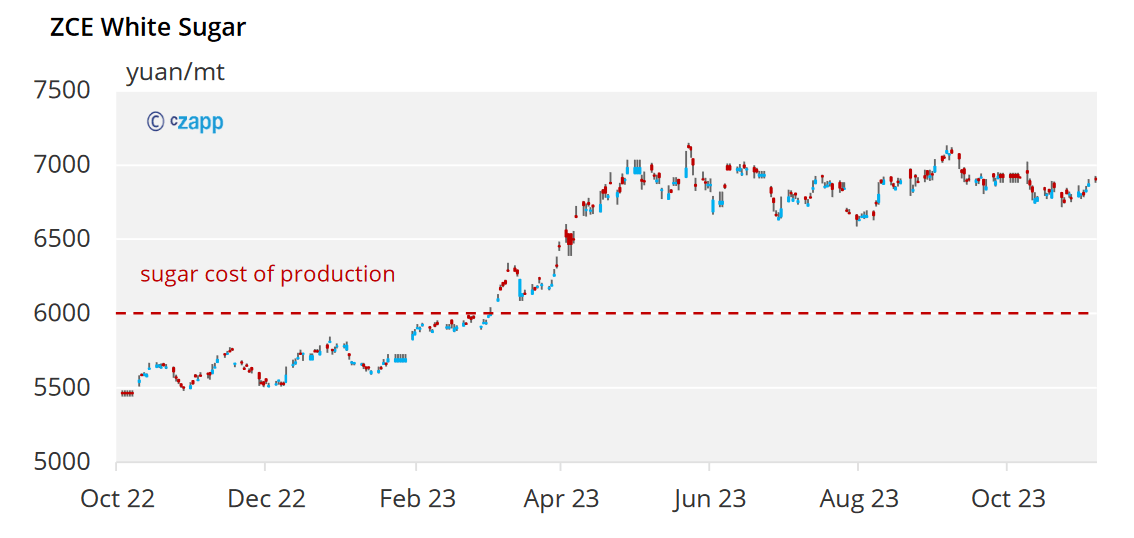

In the 2023/24 season, the cost range of domestic sugar is expected to be 6,000 to 6,500 yuan/tonne ($833~$903) based on the raised cane and beet prices. This means that there is a good chance that 2023/24 will still be a good year for mill profits.

Despite these positive signals, expectations for future cane acreage expansion remain conservative. This is in line with what we expected. It means that China won’t be self-sufficient in sugar for a long time.

Unchanged Gap, Changed Ways?

Then there is the big question mark but the crucial influence – import policy.

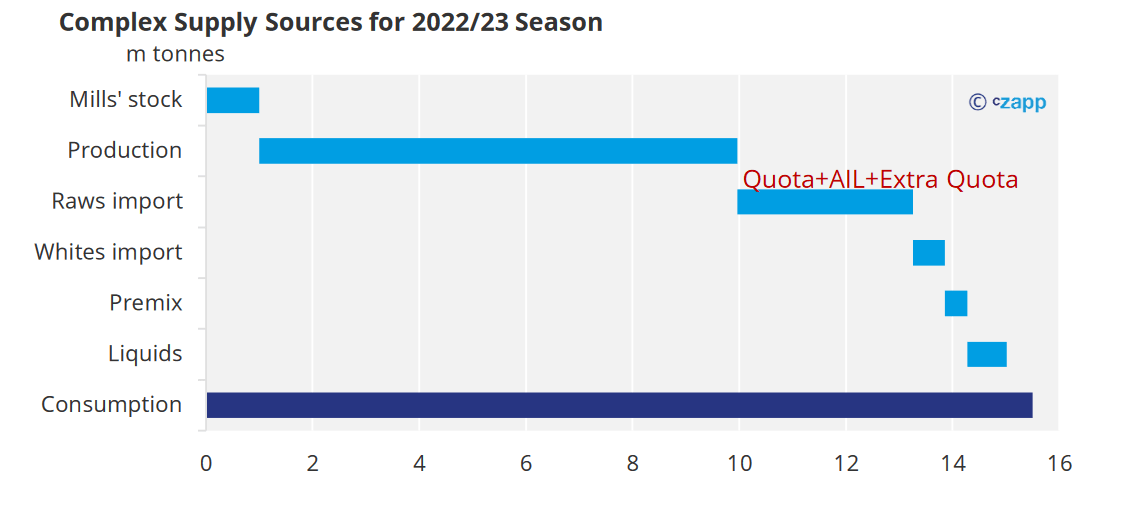

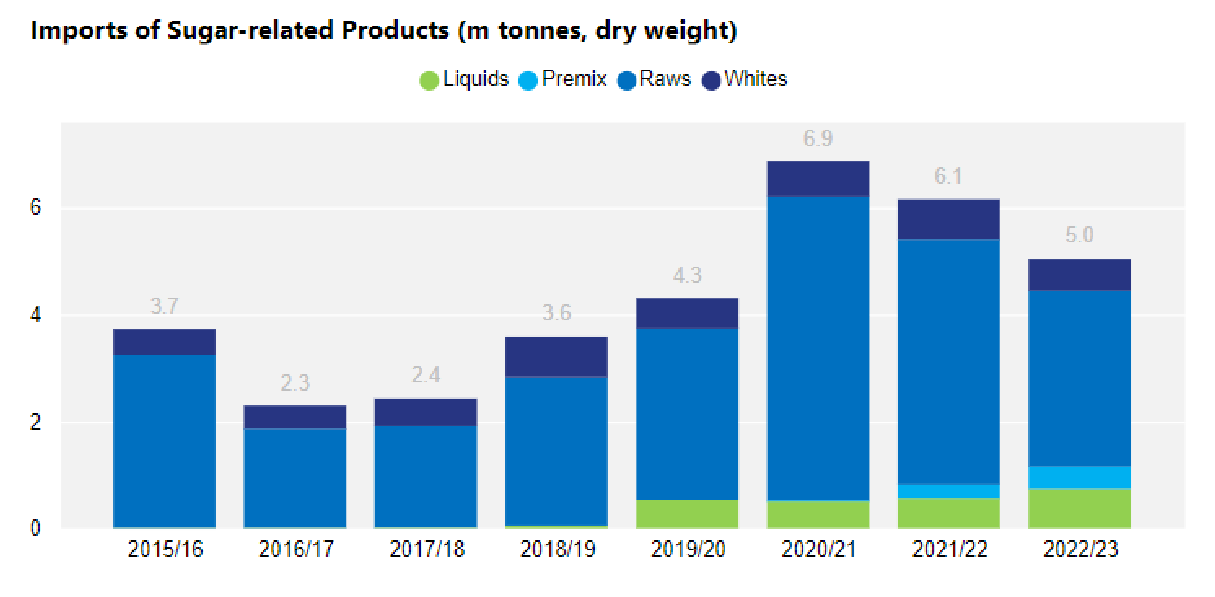

This year has proved that the deficit in the Chinese market can be solved in a variety of ways. Although the AIL (out of quota) raw sugar imports were not feasible the whole year, the shortfall was met by extra quota imports (destocking) and cheap sugar imports (liquid sugar and premix).

Source: Czapp

Source: Czapp

We are still seeing a deficit more than 5 million tonnes in 2023/24 season. If policy still allows the import of liquids and premix powder, and additional quotas are issued for imports when the market is tight, the local market may not need to trade as high as AIL import parity. Policy factors will be key next year, influencing the volume and pace of Chinese sugar demand.

As I said at the roundtable session at the conference, next year will continue to be a very challenging year for refineries. Good luck to them.

Big Complaints on Liquid Sugar and Premix Powder

The conference renewed calls for liquids and premix to be included in sugar regulations. They are considered unfair competition and seriously damaging to the interests of the domestic sugar industry. The meeting also referred to the new customs regulations for the comprehensive bonded zone that we discussed before. Factories are set up there and use imported sugar to produce premix powder, which eventually enters the domestic market. The rules set a deadline of the end of October, but we haven’t heard of any substantive changes or impacts.

Source: China Customs, Czapp

For more articles, insight and price information on all things related related to food and beverages visit Czapp.