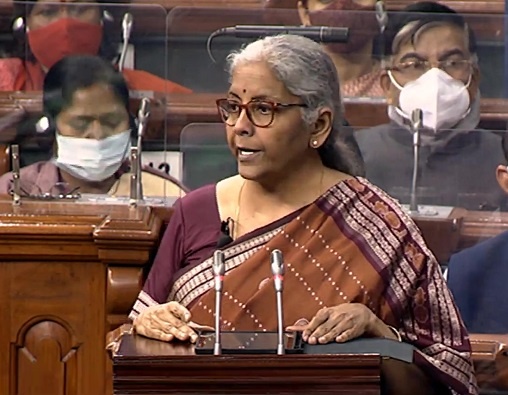

Finance minister Nirmala Sitharaman has presented the Union Budget 2022 in Parliament today.

Here are the Key highlights:

- Customs duty on cut & polished diamonds, gems to be reduced to 5%

- No change in personal income tax slabs

- The gross GST collections for the month of January 2022 are Rs 1,40,986 crores which is the highest since the inception of GST

- To provide an opportunity to correct an error, taxpayers can now file an updated return within 2 years from the relevant assessment year

- Co-operative surcharge to be reduced from 12% to 7%

- I propose to provide that any income from transfer of any virtual digital asset shall be taxed at the rate of 30%. No deduction in respect of any expenditure or allowance shall be allowed while computing such income, except cost of acquisition: FM Nirmala Sitharaman

- Rs 48,000 crores allocated for completion of construction of 80 lakh houses under PM Awas Yojana in rural and urban areas in the year 2022-23

- Both Centre and States govt employees’ tax deduction limit to be increased from 10% to 14% to help the social security benefits of state govt employees and bring them at par with the Central govt employees

- To provide an opportunity to correct an error, taxpayers can now file an updated return within 2 years from the relevant assessment year

- For 2022-23,allocation is Rs 1 lakh cr to assist the states in catalyzing overall investments in economy. These 50-yr interest-free loans are over & above normal borrowings allowed to states. It’ll be used for PM Gati Shakti-related & other productive capital investments of states

- Digital rupee to be issued using blockchain and other technologies; to be issued by RBI starting 2022-23. This will give a big boost to the economy

- To facilitate domestic manufacturing for ambitious goal of 280 GW of installed solar capacity by 2030, addl allocation of Rs 19,500 cr for PLI for manufacturing of high-efficiency modules with priority to fully integrate manufacturing units to solar PV modules will be made

- Effective Capital Expenditure of the Central Govt is estimated at Rs 10.68 lakh crores in 2022-23, about 4.1% of GDP

- Implementation of Ken Betwa Linking project at est. cost of Rs. 44,605 Cr. to be taken up with irrigation benefits to 9.0 lakh hectare farmland, drinking water to 62 lakh people, 103 MW hydropower. 27 MW solar power generation Rs 1400 crores allocated in 2022-23

- 68% of the capital procurement budget for Defence to be earmarked for domestic industry to promote Aatmanirbharta and reduce dependence on imports of defence equipment. This is up from the 58% last fiscal

- To reduce the delay in payment, an online bill system to be launched which will be used by all Central ministries

- SEZ (Special Economic Zones) Act will be replaced with new legislation…for the development of enterprise and hubs… It will cover the existing industrial enclaves and enhance the competitiveness of exports

- Animation, Visual Effects, Gaming and Comics (AVGC) sector offers immense potential to employ youth. An AVGC promotion task force with all stakeholders will be set up to recommend ways to realise this and build domestic capacity for serving our markets and the global demand

- Fund to be facilitated through NABARD to finance startups for agriculture and rural enterprise, relevant for farm produce value chain. Startups will support FPOs and provide tech to farmers: FM Nirmala Sitharaman

- Use of Kisan Drones to be promoted for crop assessment, digitization of land records, spraying of insecticides and nutrients

- To promote a shift to the use of public transport in urban areas…special mobility zones with zero fossil fuel policy to be introduced…Considering space constraints in urban areas, a ‘Battery Swapping Policy’ will be brought in

- 2,000 km of rail network to be brought under the indigenous world-class technology KAWACH, for safety and capacity augmentation

- Issuance of E-passports will be ruled out in 2022-23 to enhance convenience for citizens

- The pandemic has accentuated mental health problems in people of all ages. To better the access to quality mental health counseling and care services, a National Tele Mental Health program will be launched

- PM development initiatives for North East will be implemented for the North Eastern Council… This will enable livelihood activities for youth and women… This scheme is not a substitute for the existing Centre or State schemes

- An open platform for the National Digital Health Ecosystem will be rolled out. It will consist of digital registries of health providers and health facilities, unique health identity and universal access to health facilities

- Our govt has comprehensively revamped schemes of the Ministry of Women and Child Development such as Mission Shakti, Mission Vatsalya, Saksham Anganwadi and Poshan 2.0 to provide benefits

- States will be encouraged to revise syllabi of agricultural universities to meet needs of natural, zero-budget & organic farming, modern-day agriculture

- A fund with blended capital raised under co-investment model facilitated through NABARD to finance startups in agriculture & rural enterprises for farm produce value chain

- PM Gati Shakti Master Plan for Expressways to be formulated in 2022-23, to facilitate faster movement of people and goods. NH network to be expanded by 25,000 km in 2022-23. Rs. 20,000 crores to be mobilized to complement public resources

- ‘One class, one TV channel’ program of PM eVIDYA will be expanded from 12 to 200 TV channels. This will enable all states to provide supplementary education in regional languages for classes 1 to 12

- MSMEs such as Udyam,e-shram, NCS & Aseem portals will be interlinked, their scope will be widened… They will now perform as portals with live organic databases providing G-C, B-C & B-B services such as credit facilitation, enhancing entrepreneurial opportunities

- Chemical-free natural farming will be promoted throughout the country with a focus on farmers’ land in 5 km wide corridors along the river Ganga, in the first stage

-

Procurement of wheat in Rabi season 2021-22 and the estimated procurement of paddy in Kharif season 2021-22 will give cover 1208 lakh metric tonnes of wheat & paddy from 163 lakh farmers& Rs 2.37 lakh crores will be the direct payment of MSP value to their accounts

- Production Linked Incentive (PLI) Scheme for achieving Aatmanirbhar Bharat has received an excellent response, with potential to create 60 lakh new jobs and additional production of 30 lakh crore during next Keycap digit five years

- Moving forward on this parallel track, we lay the following four priorities – PM Gati Shakti, inclusive development, productivity enhancement and investment, sunrise opportunities, energy transition and climate action & financing of investments

- 400 new generation Vande Bharat trains with better efficiency to be brought in during the next 3 years; 100 PM Gati Shakti Cargo terminals to be developed during next 3 years and implementation of innovative ways for building metro systems.

- This Union Budget seeks to lay foundation & give blueprint of economy over ‘Amrit Kal’ of next 25 years – from India at 75 to India at 100

- There was a sharp increase in public investment & capital expenditure in Budget 2021-22…This Budget (2022-23) will benefit, youth, women, farmers, SC, ST… ; shall be guided by PM Gati Shakti master plan, says FM

- India’s growth is estimated to be at 9.27 per cent