The Central Board of Indirect Taxes and Customs (CBIC) has extended the due date of Goods and Services Tax ( GST ) Return GSTR-1 ( GST Returns) filing to January 13, 2025 for regular filers and to 15th of January for quarterly filers due to ongoing issues with the GST portal.

The GST tech team, GSTN (under Infosys), had previously mentioned that the CBIC was reviewing the incident report. In a tweet, they stated, “GST portal is currently experiencing technical issues and is under maintenance. We expect the portal to be operational by 12:00 noon. CBIC is being sent an incident report to consider extension in filing date. Thank you for your understanding and patience!”

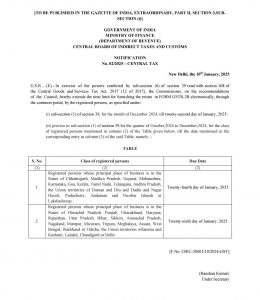

According to the notification, this extension applies to returns for business activities undertaken in December 2024. The deadline for furnishing GSTR-1 details has been extended to 13 January 2025 for monthly filers. Quarterly filers under the QRMP scheme now have until 15 January to submit their returns.

For GSTR-3B, the filing deadline has been pushed by two days as well. Monthly taxpayers must now file by 22 January 2025, while QRMP taxpayers can file between 24 and 26 January, depending on their location.

Netizens had earlier reacted to the technical issues and demanded that the deadline be extended.