Insight Focus

New customs rules have triggered concerns about premix powder imports. Liquid sugar and premix imports for 2022/23 will reach new highs. If these sugars are restricted, raw sugar import margins could rise.

New Customs Regulations For Comprehensive Bonded Zones

Comprehensive bonded zones (CBZ) are special commercial zones that enjoy favorable taxation policies and are managed by Customs authorities.

The GAC introduced 23 guidelines, of which article 18 stirred the sensitive nerves of the sugar market.

(18) Adjusting measures for the management of key commodities.

Content: Adjust key commodity management measures involving tariff quota management, implementation of trade remedy measures, suspension of tariff concession obligations and retaliatory tariffs in the comprehensive bonded area. (Completion date: October 2023)

Customs Interpretation: …prevent enterprises from using policy overlapping gaps to avoid tax policies and trade control policies and prevent and resolve major and systemic risks.

Why Does The Chinese Sugar Market Care?

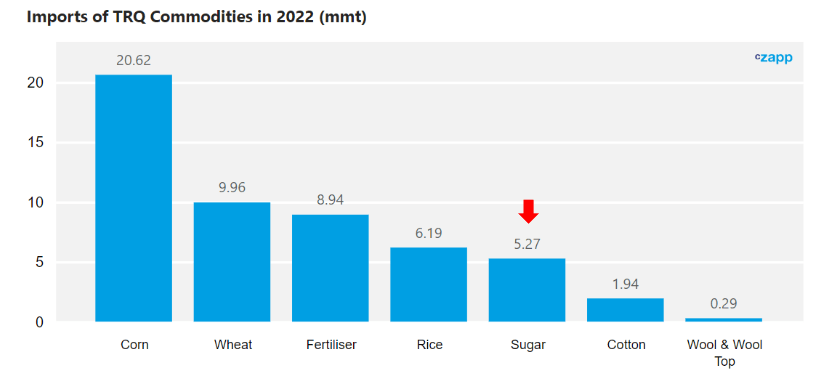

Sugar is one of the 8 commodities subject to tariff quotas.

And the interpretation reminds people of the showstopper concerning sugar this year – premix powder imports into CBZs.

Could it be that the domestic sugar industry’s long-term lobbying against this product is finally working?

- All of this is still speculation, and it may not be until the completion deadline of October this year that we can determine whether the ordinance is aimed at premix powder.

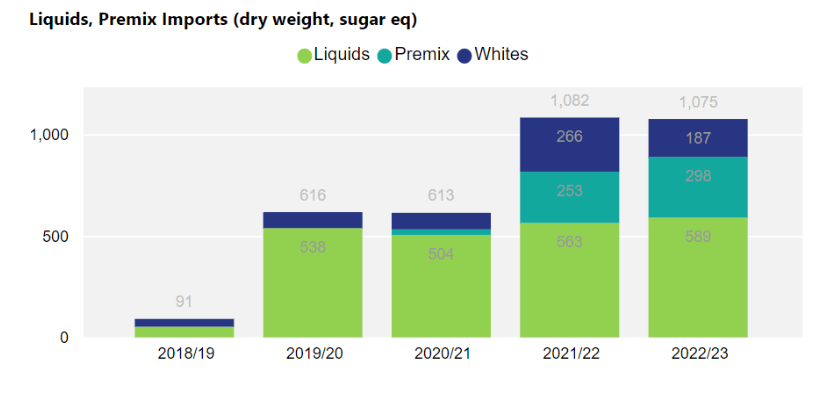

- This involves Chinese demand of about 300k tonnes, mainly white sugar.

- Will direct imports of liquid sugar and premix powder be affected?

Liquid Sugar and Premix Import Rise

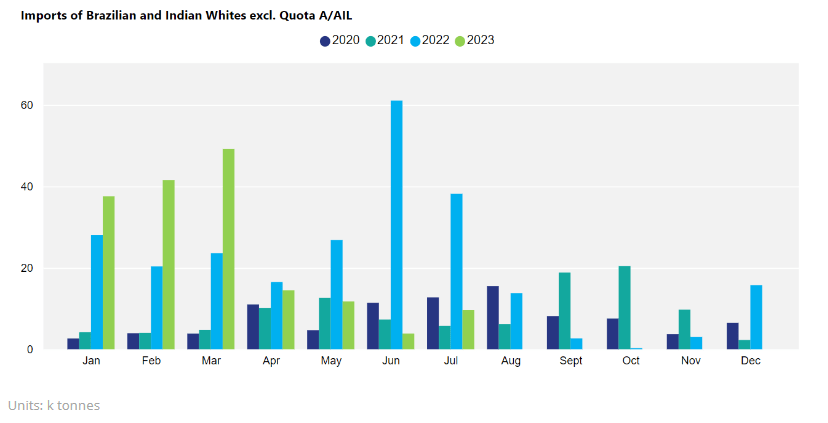

As expected, Indian whites imports dried up in July, but the absence was replaced with Brazilian whites.

We assume this sugar goes into CBZs for premix powder production. If the new regulation is indeed intended to limit the premix in CBZs, China’s demand for white sugar imports may decline.

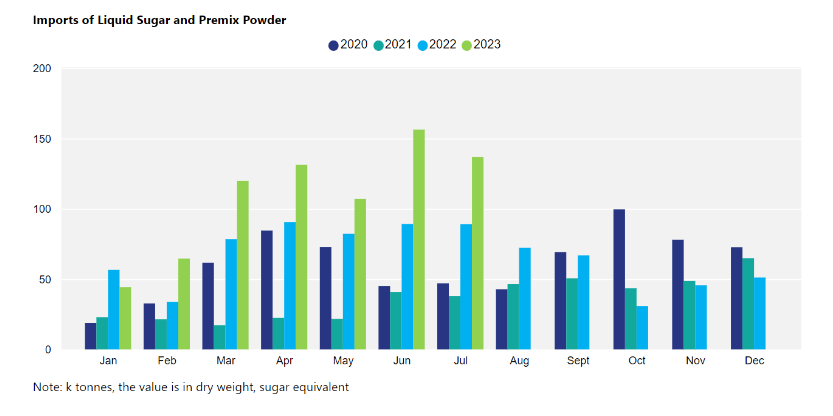

The direct imports continue. July saw another strong month of liquid sugar and premix powder imports, up to 137k tonnes in dry weight, sugar equivalent.

In addition, we also picked up traces of Brazilian white sugar being sent to Thailand, which is likely to be used in the production of liquids and premix for onward export to China.

This season’s imports of liquid sugar and premixes totaled 1.1m tonnes by end of July. With this momentum, it’s likely to break last season’s record.

What If the Cheapest Sugar Got Kicked Out?

I must remind again that we don’t know how the new rules will be implemented. And we know that Chinese officials are not a fan of surging sugar prices. But suppose that imports of these low-priced sugar sources were indeed restricted, that should be good news for sugar refineries.

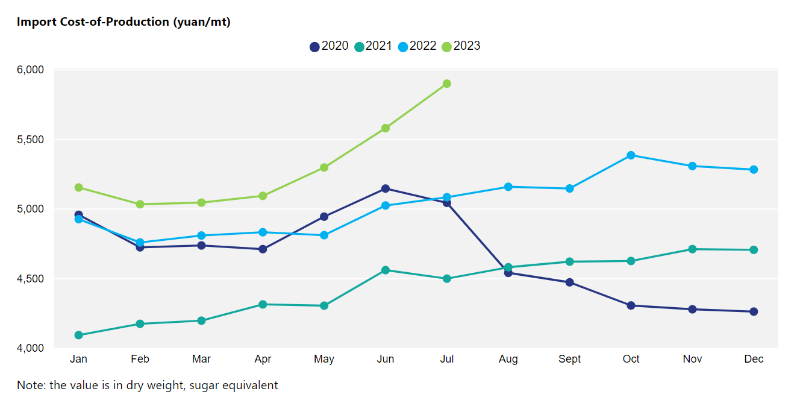

This year, the landed cost (dry weight) of liquid sugar has been rising, from about 5,000 yuan/tonne to 5,900 yuan/tonne in July. Nevertheless, it is still the cheapest sugar on the market.

This has eased the surge in domestic prices but has also put pressure on sugar import profits. The AIL (Out Of Quota) raws import margins have so far remained in negative territory.

If premix powder in CBZs is indeed restricted, we could see the AIL import margin improve.

This helps the refineries to free up their AIL raws demand (50% import duties). So far, we understand that only a few cargoes of raw sugar were bought to cover their AIL demand, while the total allocation is over 3m tonnes. Other refineries are still waiting for a better opportunity.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.