Credit profiles to improve for integrated players, stay stable for non-integrated ones

High sugar exports for the second sugar season (SS; October-September) in a row, coupled with increased supplies of ethanol – and at remunerative prices – for blending with petrol, will improve the operating profitability of integrated sugar mills by 75-100 basis points (bps) to 13-14% this fiscal, a CRISIL Ratings analysis shows. Also, the recent announcement by the government to advance the ethanol-petrol blending target of 20% by two years to 2023, could help sustain this momentum over the medium term.

Additionally, sugar closing stocks are expected to decline to their lowest levels in the past four SSs to 9-9.5 million tonne (MT) in SS 2020-21, resulting in lower working capital borrowings. The improvement in profitability and controlled debt levels will, in turn, bolster the credit profiles of CRISIL-rated integrated mills this fiscal. The credit outlook on non-integrated ones, at the other end, will remain largely stable.

Says Anuj Sethi, Senior Director, CRISIL Ratings, “The improvement in profitability of integrated sugar mills will be supported by higher sugar exports, with remunerative prices and increasing proportion of more profitable ethanol, which will offset impact of lower profitability in domestic sugar sales, and subdued returns from co-generation of power.”

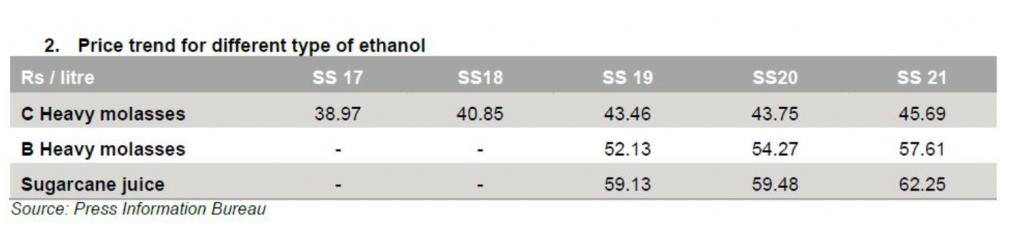

Global white sugar prices, which are currently higher than domestic sugar prices (refer annexure 1), increased by 14.3% over last 6 months to ~Rs 33.6 per kg (excluding export incentives) in June 2021 and are likely to remain firm given continuing supply deficit this season, caused by lower contribution from Brazil and Thailand – the two leading sugar exporters. This will help domestic mills meet, and perhaps exceed their export target of ~6 million tonne by the end of SS 2020-21. Therefore, the recent reduction in export subsidy by Rs2/kg, from Rs. 5.9/kg, announced earlier will not materially impact the profitability of sugar exports as 90-95% of sugar exports were already contracted before the cut.

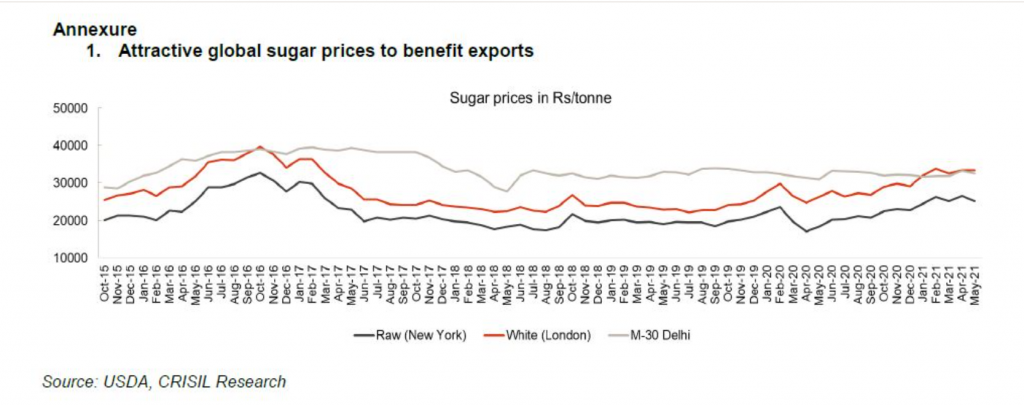

In a bid to enhance the ethanol-petrol blend mix (target advanced to 20% by 2023 from 2025), sugar mills are being incentivised by the government to supply ethanol to oil marketing companies. This is reflected in a consecutive rise in procurement price for ethanol (refer annexure 2) made from B-heavy molasses and sugarcane juice – prices were hiked by 6.2% and 5.3%, respectively, in the current SS. Besides, sugar mills have received interest benefits over the past two fiscals for investing in distillery capacity.

Rising revenue contribution from ethanol through these routes – which are more profitable than the traditional one using C-heavy molasses – will sweeten profitability of the distillery business (75% of operating profits) of integrated players.

That said, operating profitability from domestic sugar sales (65% of sector revenue) will be moderately impacted due to a 4% increase in fair and remunerative price (FRP) for sugarcane, while there has been no upward revision in the minimum support price for sugar (remains at Rs 31/kg). Non-integrated players will be more impacted compared with integrated players as they don’t have more profitable ethanol sales.

Inventory levels for the industry should improve despite similar sugar production of about 30 million tonne in next season. This is assuming healthy exports, and higher supplies of ethanol for blending with petrol resulting in lower working capital borrowings. About 2 million tonne sugar production is expected to be diverted for manufacture of ethanol in the current SS, and ~3-3.5 million tonne in next SS.

Says Sushant Sarode, Associate Director, CRISIL Ratings, “The credit profiles of integrated players will benefit from better profitability, prudent funding of capex and lower working capital borrowings, leading to improvement in interest coverage ratio to 4.5-5 times in current fiscal from ~4 times in the last fiscal. For non-integrated players, however, interest cover is likely to decline to 1-1.3 times from 1.5 times estimated for last fiscal, due to moderate impact on profitability. Nevertheless, lower working capital borrowings, will help keep the credit outlook for these players ‘stable’ as well.”

Also, advancing of blending target by 2 years will necessitate increase in ethanol capacity in the country (from both grain based and sugar diversion) over next two years. Continuation of incentives and soft loans for ethanol, and progress on changes in automobile engine for higher blending will remain monitorable and decide pace of further capacity addition in ethanol.

Further increases in cane procurement cost for mills, support through higher MSP, extent of export subsidies, and remunerative price for ethanol will remain monitorables in the road ahead.

Annexure 1

Annexure 2