Opinion Focus

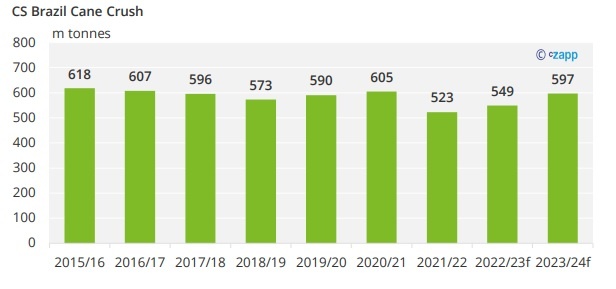

We think Centre South (CS) Brazil will crush 597m tonnes of cane this year. Sugar output will be the second highest on record at 37.6m tonnes. This follows excellent rainfall in Q1, boosting cane yields.

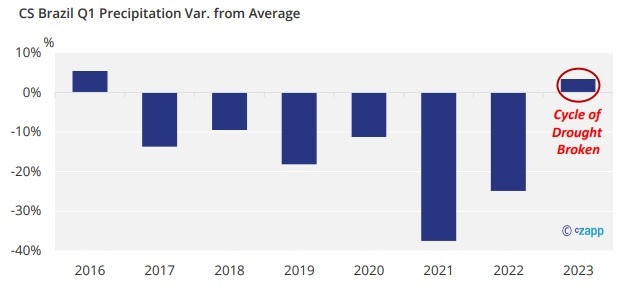

Centre South Brazil is the world’s largest cane region, and cane harvesting is about to begin. Rainfall has been excellent this quarter, above the historical average for the first time since 2016. This is positive for cane development, meaning we expect high agricultural yields and high cane availability.

Cane Crush Could Surpass 600m Tonnes

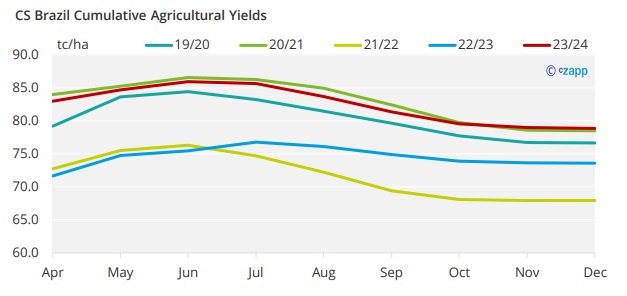

Rains in the first quarter of the year are essential for a healthy cane field. We think agricultural yields could increase 7% this season, reaching almost 79 tonnes of cane per hectare (TCH).

This would be the highest TCH since 2020/21, when CS Brazil crushed 605m tonnes of cane. For this upcoming season, the cane crush should reach around 600m tonnes. This figure has an upside bias but will largely depend on rains throughout the rest of the year.

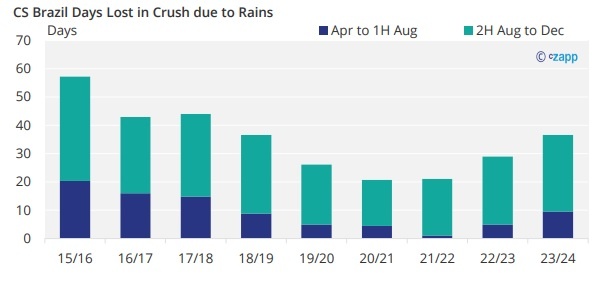

The past 4 cane harvests were marked by weather drier than normal. Harvesting stops if more than 10mm is recorded in a day and so in the last 4 years the dry weather has in some cases (2020/21) permitted a higher crush due to a higher time efficiency, while in others (2021/22) affected agricultural yields leading to lower cane crush.

More Cane, More Sugar

We think CS Brazil will produce 37.6m tonnes of sugar in the 2023/24 season. This would be the second highest output on record.

Again, there is an upside risk to this figure, depending on weather conditions. If rains more than we expect sucrose content will be affected. Wetter weather results in less sugar concentration, affecting the total output.

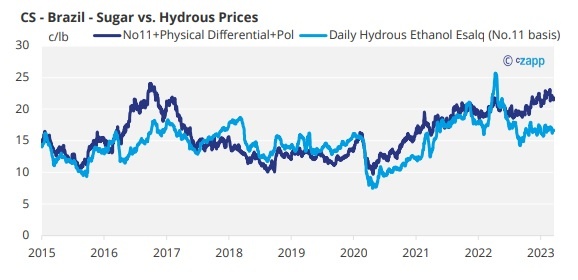

We think mills will maximize sugar production over ethanol for the 4th season in a row. This is because sugar pays more than ethanol. Considering the volume of cane and ATR (sucrose content), sucrose allocation to sugar is expected to reach 47.5% this season – the highest since 2011.

You can follow the parity between Sugar and Ethanol with daily updates on our Interactive Data Page

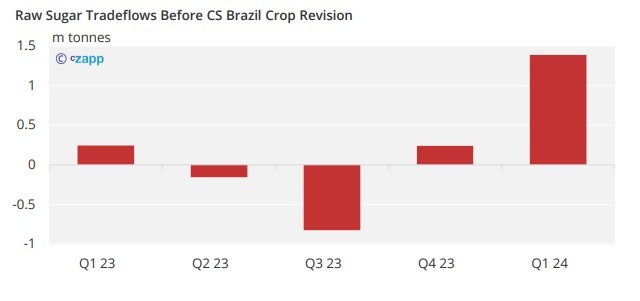

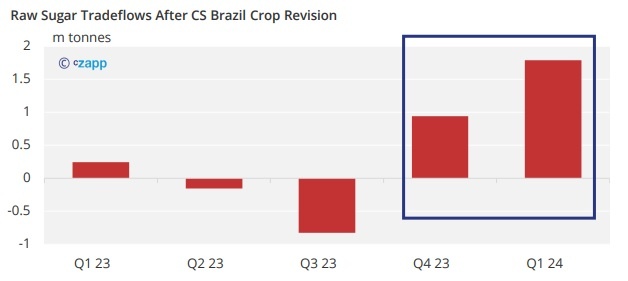

Still Hard to Reach the World

Although we have increased our sugar production estimates from our January forecast, it does not mean the world will see this sugar available before Q4. CS Brazilian logistics will be an issue this season, due to grains record crops. Over 80% of sugar is exported through Santos port, while corn share is 40% and soybeans 25%.

Since the sugar terminals also operate grains, the capacity allocated to sugar is already occupied. We estimate that monthly sugar exports will be limited at 2.6mmt.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.