Opinion Focus

Rates to truck sugar from mills to Santos port have sky-rocketed in the last 30 days. We have delved into the reasons; spoiler alert: it’s not only diesel. When are freights coming down?

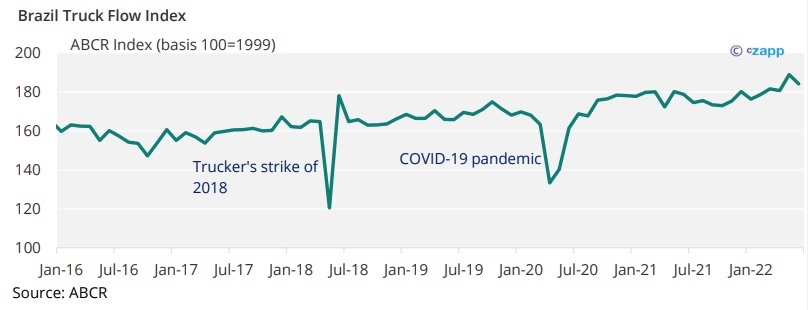

Rates to truck sugar from mills in Centre-South Brazil to the port of Santos have risen 25% in the space of 30 days and have more than doubled year on year to a record high of around BRL 200/tonne (USD 37/tonne) from BRL 102/tonne. This is largely due to the high price of diesel, with competition for logistics, a shortage of new trucks and a rise in other costs also playing a role.

Usually, these freight rates rise at this time of year due to the competition for logistics capacity between sugar and the second corn crop (safrinha), but the extent of the rise marks a break with the norm.

Note: freight rates from CS Brazilian countryside to Santos vary massively between part of the region. However, there is a consensus that rates have risen across the regions but to varying extents.

The increases are detrimental for millers as most are exposed to spot freight rates and even those with freight contracts are somewhat exposed to sharing the burden when the costs rise by this much – it is an exceptional environment.

In this analysis we investigate the reasons behind the increase and what millers might expect in the coming months.

Diesel and Maintenance Costs

Around half the sugar exported from CS Brazil is transported from the countryside to the ports by truck and the rest by rail. Diesel makes up 40% of the truck freight rate; the rest consists of margin and other costs.

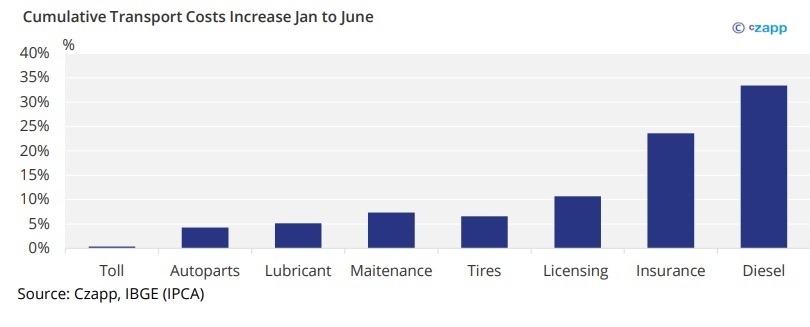

This year, the increase in the diesel price between January and June was over 30%. Other costs such insurance, tires, maintenance, etc rose as well, on average 7%.

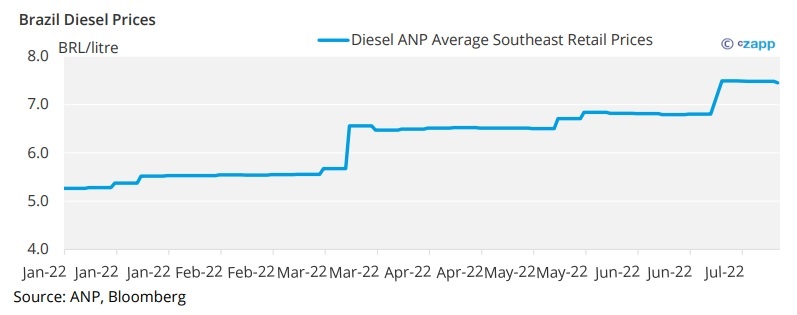

Inflation forecasts indicate that costs are likely to continue growing, although not as sharply. As for diesel, even with all the changes proposed on fuel taxes last month, retail prices remain almost unchanged.

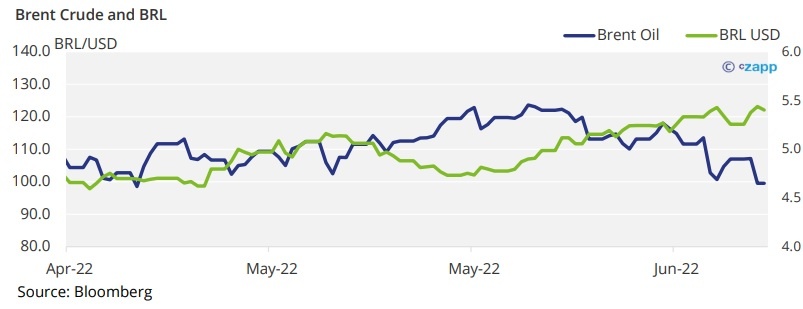

Even though oil prices have fallen 20% this past month, leading to lower international diesel prices, the strength of the US dollar against most currencies, including the Brazilian real could act as a counterweight to any potential reduction in domestic prices.

Unless there is a direct intervention into Petrobras’ fuel-price policy, diesel prices are not expected to fall in the medium term.

Bottleneck in Truck Production

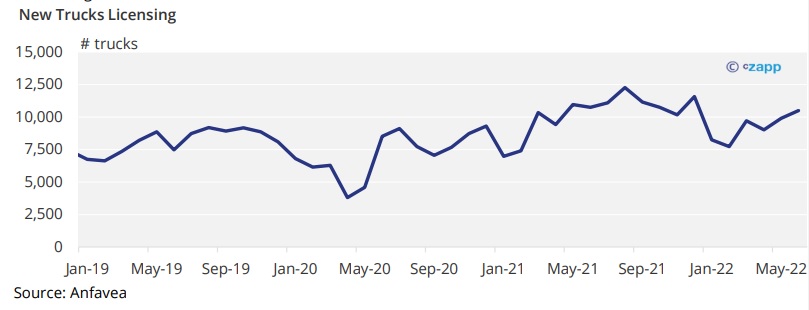

Truck sales surpassed pre-pandemic levels last year. However, production bottlenecks meant the delivery time for new trucks hit six months at the start of the year. This means that the new additions to the fleet are only now hitting the road.

After production stabilised and moved more into line with demand, the waiting time has now fallen to 30 days. A larger truck fleet could help to ease make finding trucks for the sugar routes easier.

Less backhaul?

Market sources say one of the reasons for higher freight rates is the lack of backhaul from ports back up-country. However, we analysed the data, and at first it does not seem to support this narrative…

One of Brazil’s main imports is fertiliser. This means that when a truck unloads sugar at Santos, it can load fertiliser rather than make its trip back up country empty. This helps to keep freight rates more competitive.

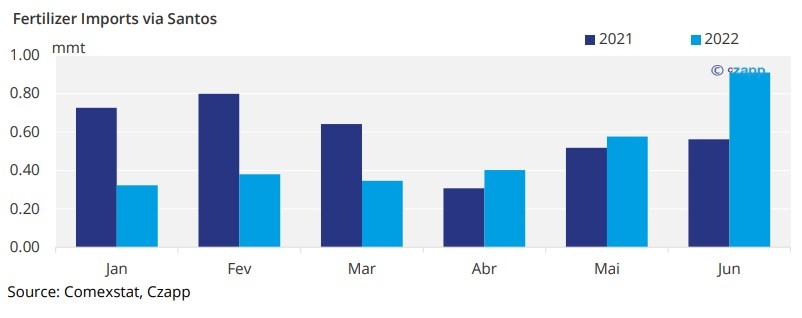

Despite high prices and fears of shortages, fertiliser imports into CS Brazil grew 12% year on year in January-June.

In Santos, despite the weak Q1, volume began to pick up from April onwards with June showing fertilizer imports higher by 62%

Preliminary trade data from the government showed a year-on-year increase of 14% in fertilizer imports in the first week of July.

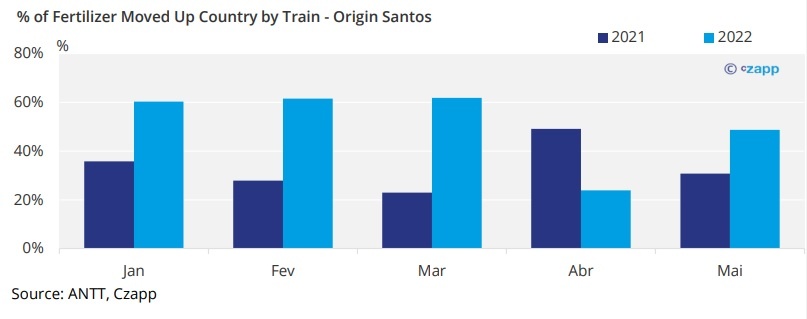

One might argue, as we have heard this week, that although fertilizers imports grew it is being moved up country by trains rather than trucks. So, we chased this data as well.

Unfortunately, we don’t have June data yet for rail freights. However, the movement of fertilizer by truck increased significantly in May. If that pattern is repeated in June, it could be one of the reasons behind higher trucking rates. Fertilizer imports are higher, but they are being moved up country by rail rather than road.

Logistics Competition

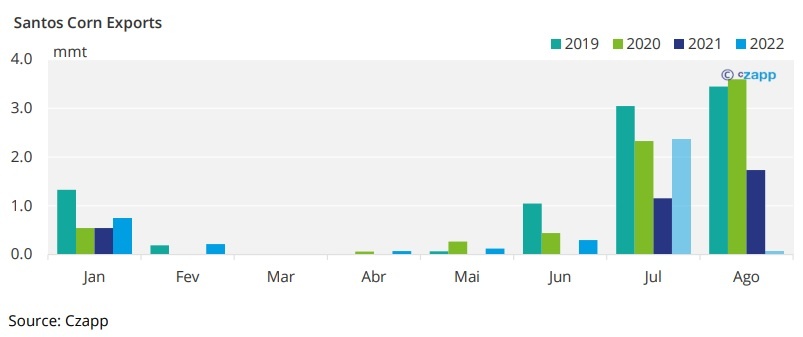

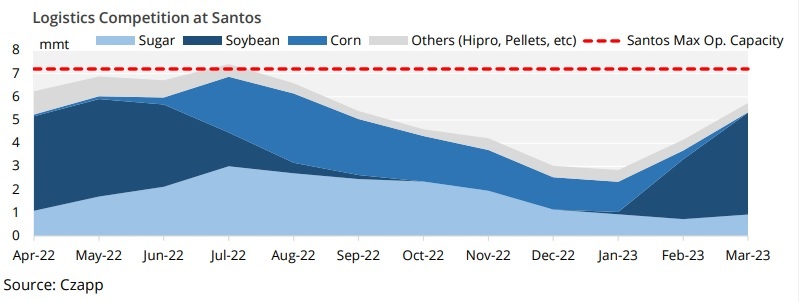

At the start of June, the harvesting of the safrinha corn crop began. This is the largest volume of corn harvested during the season. This year, CONAB (National Company of Supplying) forecasts 88m tonnes of corn should be harvested, 46% more than last year.

Of this, 15m tonnes is likely to be exported via Santos. This is a 70% increase compared with last year. And the flow has already begun…

The July corn line-up is 2.4m tonnes, not an unusual volume. However, what strikes as impressive is the fact that we are in mid-July and the grain line up is almost practically full – nominations for August have already been made too.

Corn will compete with sugar for logistics until September and is expected to keep freight prices up.

The reason is the dynamic of grains flow. While in sugar the mills are responsible for bearing the burden of freight, in corn the trading is responsible for cost. Since corn needs a faster pace to flow to the ports (it does not need processing like sugarcane), the tendency is to pay even high freights such as now without much discussion.

Trucks drivers having the option to load corn or sugar will opt for the higher offering freight.

Demurrage Can Also Push Inland Freights Higher

Demurrage rates have gone up from $20-25k/day to almost $40k/day. This means that if a vessel is nominated and the sugar is not there to load, the trade house will have to pay demurrage. This can become quite expensive quite quickly.

To avoid high demurrage costs, we expect traders to pressure mills to honour the volume they need to deliver, forcing them to accept higher freight rates.

What to Expect?

Since most mills are exposed to the spot markets, they will have to pay high freight rates until at least September – which is the tail of soybean export period and when corn operations start to wind down.

It is too late to obtain freight contracts for this season, so, we would recommend starting to plan for next year. If possible, we would recommend millers try and reduce their exposure to spot freight rates.

We have seen contract modalities similar to booking rail freight, where the truck freight is set plus a diesel price variation.

However, mills must remember that this is like a hedge. It is not intended to make money but to manage risk.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.