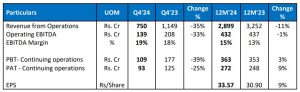

Dalmia Bharat Sugar and Industries Limited (DBSIL) reported resilient financial performance amidst ban on export of sugar and limited diversion of sugar for ethanol production with PAT of Rs. 272 Crore in FY 24 representing increase of 9 per cent compared to FY23. Company reported net profit of Rs 93 crore for Q4FY224, falling 25% compared to the year-ago period.

Salient features of standalone financial results are as under: –

Key Highlights- FY 24

• Industry leading Operating EBIDTA margin of 14.9%.

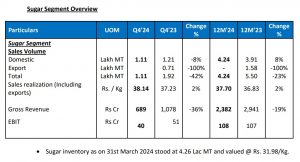

• Cane crushed qty has increased by 11.2% compared to FY23.

• Sugar production has increased by 32.8% reaching to 6.35 LMT.

• Increase in domestic sugar sales volume by 8.4% by reaching to 4.24 LMT.

• Average Sugar sales realization improved by 2.3% on a blended basis (including exports)

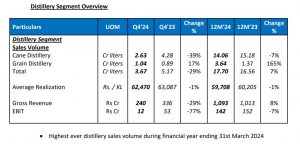

• Highest ever distillery sales volumes of 17.7 Cr liters, 7% increase over last year.

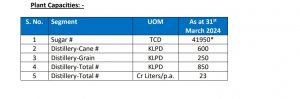

• Commercial production at our wholly owned subsidiary, Baghauli Sugar and Distillery

Limited has commenced in Q4 in record time.

• Grain distillery capacity increased to 250 KLPD from 110 KLPD.

Reflecting on our financial performance, Mr. Bharat Bhushan Mehta, Whole Time Director & CEO of Dalmia Bharat Sugar and Industries Limited, expressed satisfaction on company’s achievements during the financial year ending March 31, 2024. “Despite challenges, we have witnessed a commendable increase of 33% in Sugar Production coupled with significant increase in domestic sugar sales volumes. Notably, our strategic shift towards ethanol production from grain as a feedstock has proven successful in mitigating diversion risks. In terms of significant projects, we are pleased to announce the completion of grain-based distillery expansion project at Jawaharpur, UP, from 110 KLPD to 250 KLPD. Furthermore, following the acquisition of 100% equity shares of Baghauli Sugar and Distillery Limited, commercial production has commenced in Q4 in record time. These milestones underscore our commitment to growth, innovation, and operational excellence as we navigate dynamic market conditions and pursue sustainable value creation for our stakeholders.”

Company reported a near 25 per cent fall in fourth-quarter profit on Tuesday.

These capacities are basis Juice/B Heavy. In view of curtailment of sugar diversion by restricting production of juice and B heavy ethanol, operating capacities have been impacted. This include 3500 TCD capacity of 100% subsidiary company. Nigohi plant is under expansion post which total sugar capacity of DBSIL would be 43200 TCD.

Dividend: –

➢ The board had approved interim dividend of Rs. 3.75/share during the last quarter.

➢ The board has proposed final dividend of Rs. 1.25/- per share (face value 2/-per share)

for FY24 subject to shareholders’ approval.

➢ Thus the total dividend is Rs. 5/share for FY 24