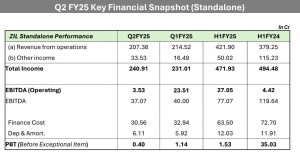

Zuari Industries Limited, the apex company of Adventz, declared its financial results for the quarter ending September 30, 2024. The Standalone Revenue of Q2FY25 stood at INR 240.91 Cr., registering a growth of 4.3% compared to Q1FY25. The Profit After Tax (PAT) Q2FY25 stood at (23.85) Cr. The company registered a 8.9% growth in EBIDTA for the quarter (37.06 Cr Vs 33.96 Cr Q1FY25). According to the company, sugar sales up by 10.5 per cent compared to Q1FY25.

The Company registered notable improvement in operational performance of its SPE division. Sugar sales for H1FY25 stood higher at 8.0 lakh qtls compared to 7.4 lakh qtls for the same period previous year. The Power sales for H1FY25 stood at 99.2 LU and the Ethanol sales registered a growth of 11.1% for H1FY25 (100.2 Cr in H1FY25 Vs 90.1 Cr in H1FY24).

Consolidated Revenue for the quarter ending September 30, 2024, at 277.1 Cr, registered a growth of 14.5% compared to Q1FY25. The Consolidated PAT for the quarter stood at (14.77) Cr against (33.60) Cr in Q1FY25. The Company registered a strong performance in the Investment Services Segment, including Zuari Finserv and Zuari Insurance Broking, which demonstrated significant growth in EBITDA.

The construction of the flagship project of ZEBPL, a bio-ethanol JV of the company, is in full swing. The project has achieved 43% completion and is on-track to be commissioned by mid next year.

During the quarter, the Company focused on reducing its borrowing costs, strengthening systems & procedures, completing R&M of its SPE division on time and nurturing quality talent to implement the strategic objectives.

Commenting on the Results, Mr. Athar Shahab, Managing Director, Zuari Industries Ltd, said: “In Q2 FY25, Zuari Industries Ltd demonstrated resilience and a continued focus on operational excellence across our business divisions. This quarter saw Zuari achieve notable milestones in Sugar, Power, and Ethanol (SPE) Division by recording the highest ever distillery operating days. Our Sugar and Ethanol sales volumes improved by 7.5% and 15.6% respectively, compared to H1 FY24. The quarter also marked a successful 1st Round Table Conference with key stakeholders, including government officials and farmers, reinforcing our commitment to community collaboration and sustainable growth.

On the financial front, we have diligently managed costs and optimized our debt structure. Refinancing efforts have led to a notable reduction in finance costs, contributing to overall savings of ₹9.2 crore in H1 FY25.”

“Despite a challenging macroeconomic environment impacting revenue across certain segments, Zuari has maintained a steady course, balancing operational prudence with growth initiatives. Our bioethanol project is on-track and our subsidiaries have shown promising progress. Looking ahead, we remain committed to driving our deleveraging plans, sustainable growth, strengthening our market position, and delivering value to all our stakeholders,” he further added.