Opinion Focus

Food prices are rising to their highest in 40 years. A myriad of factors is causing this and adding to food inflation. Due to the complexity of the issue, continued rises should be expected for the rest of the year.

The rising cost of living has been hitting the headlines in recent months. A combination of factors has combined to push up the cost of living, and food a key one because it is essential to everyone in the world.

Food Prices Are Soaring

Food prices have hit their highest in 40 years. While food price rises are not uncommon, the pace of this one has been caused alarm bells to ring among economists and governments alike. It is also likely to hit the poorest in society and push even more into poverty as they spend more of their income on food.

The speed of the rise cannot be attributed to a single factor but is down to several combined.

So, What Does Inflation Have to Do with It?

Inflation is essentially a drop in the value of money. We all know that a burger and fries that cost USD1 in 1960 would now cost USD 9.15 because of inflation. A certain amount of inflation (somewhere between 2% and 3%) is thought to be healthy for the economy.

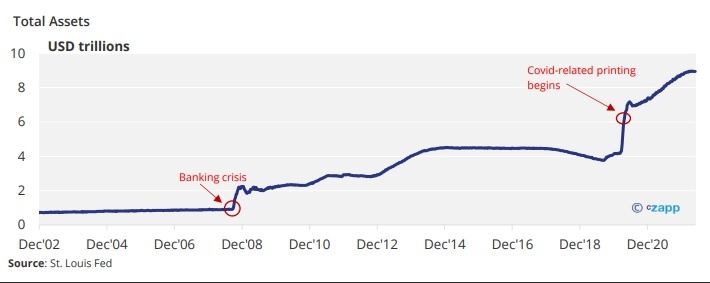

One reason is an increase in money supply. Central banks have printed an enormous amount of money since 2020, creating too many dollars. This started during the banking crisis in 2008 and has slowly progressed. Here’s what’s happened in the USA.

But how can you have too much money? Well, printing extra money creates more demand for products. But without an equivalent increase in goods and services supply, there is more demand but fewer products. This inherently pushes prices up because people are willing to pay more to get their hands on items.

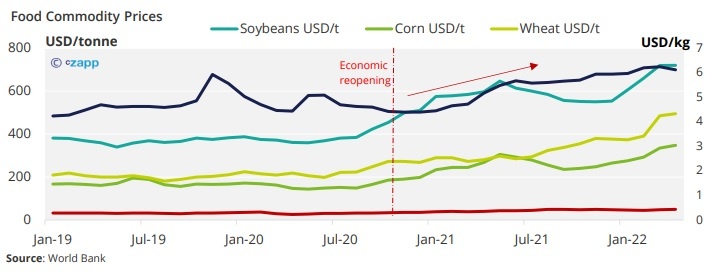

And in 2020, that’s exactly what governments had to do, or entire economies would have collapsed. This money was mainly in the form of furlough payments and stimulus cheques. The problem came in 2021, when vaccines were being rolled out, life was returning to normal and commodity prices were rebounding.

Yet, the Central Banks continued to print more money, leading to the inflationary pressures we see today.

Supply Issues Limit Growth

Now we know all about the demand side, but what of supply? Well, there are several things to consider here. First are global freight and logistics issues.

If it costs you double to ship your product around the world, then that’s inflationary for a consumer. If it also takes twice as long for your product to move around the world that’s inflationary too because there are fewer goods in the supermarket.

Another supply constraint which affects food is adverse weather causing lower yields. Right now, droughts across Europe are threatening harvests of fruit, vegetables and grains.

The war in Ukraine is also tightening the availability of food as exporters struggle to ship grain. The war is even having a knock-on effect on meat prices, since grain feedstocks for cattle are becoming scarce.

This shortage in supply contributes to “demand-pull inflation”, which is upward pressure on prices that follows a shortage in supply. With less food available, prices will automatically increase.

Costs are Climbing

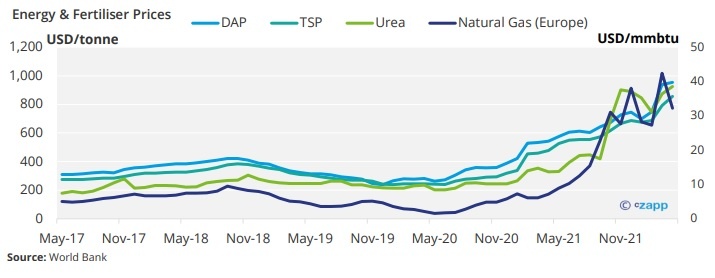

You may have heard a little something about an increase in energy costs. For farmers, this have a further knock-on effect on fertiliser prices, which are manufactured using natural gas.

High fertiliser prices are dealing a double blow to the agricultural industry. The price is high, meaning farmers buy less. This in turn reduces yields and means there is less food on the table.

- On top of all that, the companies that package food are facing challenges because energy prices are higher. Plastic is produced from oil, so as energy costs increase, so do packaging costs.

These factors are all contributing to food price rises through “cost-push inflation”. This occurs when overall prices increase due to increases in the cost of wages and raw materials. Higher input prices mean less can be produced, therefore creating fewer products for sale – and a higher selling price.

Lack of Investment Compounds Supply Issues

Another major factor in current commodity price inflation is the huge lack of investment in the sector in the last decade. Commodities follow a boom-and-bust cycle, so this is not out of the ordinary.

But a dip in commodity prices following on the heels of an investment desert is not a good signal. Getting oil out of the ocean floor or metals out of the ground or crops from the soil requires huge upfront capital expenditure, and then massive ongoing operational expenditure. Often these projects can take 5-10 years to go from planning to operation when they actually generate revenue.

This is certainly not going to encourage people to invest in commodity production. This means production of commodities stagnates while demand for commodities steadily increases as the world gets wealthier – causing demand-pull inflation.

Concluding Thoughts

- There are a few ways the inflation story can play out in terms of food prices.

- It is likely that we will see unrest in the developing world as food becomes more and more unaffordable.

- Already, there is discontent in Egypt as bread availability is called into question.

- Hyperinflation is when inflation occurs at a very high rate — like 30,000% per month as was the case in post-WW1 Germany.

- Stagflation occurs when the economy is stagnating while inflation is occurring.

- There are rising concerns of this happening all around the world as interest rates will be forced to rise to combat inflation.

- Unfortunately, the situation is likely to get worse before it gets better but inflation should peak in the next six months.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.