Last week, the Dubai Conference pushed the market into an uptrend, with discussions about Southeast Asia and concerns about Pakistan, India and China leading to the breaking of the 20 c/lb resistance level. The strengthening of the real and the rolling over of positions by funds also contributed to the short-term rise.

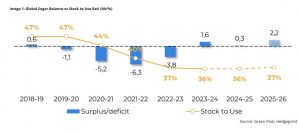

In light of recent discussions, we have revised our estimates: lower production in Pakistan (6.5 Mt) and a reduction in the ethanol detour in India (from 5 Mt to 3.5 Mt). In terms of sugar, we remain optimistic in relation to the market average of 30Mt. However, if the Indian season does indeed prove to be shorter, the total volume of the sweetener could be lower and induce a global deficit of around 3Mt. However, trade flows, which usually define the price trend, suggest a more bearish movement in the long term.

If India bans exports due to lower production, close to 27 Mt, the market could face a deficit in the short and medium term, between the first and second quarter of 2025. This scenario would justify the current concerns and the observed price levels.

The expectation of a late start to the 25/26 harvest in the Center-South of Brazil could sustain prices for a while longer, with FOB premiums rising due to lower availability in the off-season.

However, as the Brazilian 25/26 harvest gets underway, prices should enter a downward trend, making March the most bullish contract of 2025, mainly due to its dependence on the Northern Hemisphere.

June, on the other hand, can be seen as the most bearish contract this year, with the evolution of Brazilian availability. The inflection point between the short-term bullish trend and the long-term bearish trend is uncertain, but we can expect K/N spreads to rise soon after H/K matures, as Brazilian availability of 25/26 should affect the June and October contracts more intensely.

Therefore, the main points to monitor for sugar prices are:

- Short term: Indian export parity. Rising domestic prices have caused the country’s parity to rise from around 19c/lb to 19.8c/lb, sustaining the current price level. Concerns that Indian production may be closer to 27Mt also raise doubts about its ability to export the approved quota of 1Mt.

- Medium term: The weather in Brazil will be decisive for the recovery of the harvest; drier and warmer weather in February could limit production and prevent a sugar mix of 51%, but this should still be monitored.

- Long term: The pace of Brazilian exports and the 25/26 harvest in the Northern Hemisphere will set the trend; if both evolve as expected between now and June, the downward movement in prices could intensify.

Lívea Coda is the Market Intelligence Coordinator at Hedgepoint Global Markets. She has been working in the agricultural commodities sector for over 5 years, especially with quantitative and fundamentalist research on the sugar and ethanol markets.

For more details and in-depth insights, keep reading ChiniMandi, your go-to source for the latest news on the Sugar and Allied Sectors news.