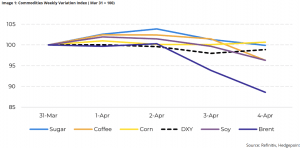

• Market expectations of the announcement of US tariffs disrupted the support that sugar had found in India’s poor March crushing figures, leading to increased volatility and a fall in sugar prices.

• At the end of Friday, sugar closed at 18.84c/lb, with strong support coming from the Chinese import arbitrage.

• The new tariffs had minimal impact on sugar flows as Canada and Mexico are exempt and TRQ quotas are expected to start paying the new tariffs, increasing Mexico’s advantage.

The effect of expectations, followed by the impact of Trump’s so-called “liberation day” – marked by the announcement of new US trade tariffs – limited any gains in sugar prices from fundamentals such as a weaker Indian crush in March.

Although the direct impact of the tariffs on sugar flows was limited, the macroeconomic impact – including the fall in oil prices, the appreciation of emerging market currencies against the dollar and fears of a US recession – contributed to a fall in sugar prices of almost 2.5% on Thursday. The market found some support in the Chinese import arbitrage but remains attentive to the development of the new Brazilian crop and global demand conditions.

Throughout the week, traders remained cautious in the face of international uncertainty. After a brief recovery in sugar prices on Tuesday, driven by weak March crushing figures in India, the market came under pressure again as the announcement of new US tariffs approached.

The move reflected not only the direct impact of the tariffs, but also the sharp fall in crude oil – down over 7% – and the global depreciation of the dollar. Despite the pressure, sugar found support in the arbitrage of Chinese imports, with prices approaching 18.7 c/lb and closing the week at 18.84 c/lb, avoiding even greater losses.

According to Livea Coda, Market Intelligence Coordinator at Hedgepoint Global Markets, the market’s anticipation of the US tariff announcement interrupted the support that sugar prices had received. “The tariffs had minimal impact on sugar flows as Canada and Mexico are exempt and TRQ quotas are expected to start paying the new tariffs – although the latter remains rather uncertain as the programmed was not explicitly mentioned. Concerns about a possible recession in the US and rising inflation are putting pressure on the dollar, increasing the purchasing power of other currencies,” she says.

How have the new tariffs affected sugar?

Despite the noise surrounding the new tariffs announced by the US, the direct impact on the sugar market so far appears to be limited.

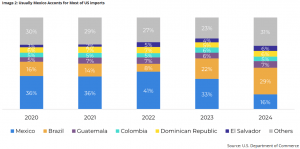

This is because countries such as Canada and Mexico – members of the USMCA agreement – have been exempted from the new measures, allowing Mexican sugar to continue to enter the US market without new taxes. This scenario reinforces Mexico’s position as the main supplier of sugar to the United States.

Imports under tariff-rate quotas (TRQ), which were previously exempt, were not explicitly included in the exemptions and may now pay the new tariffs – tending to make Mexican sugar even more competitive.

On the other hand, out-of-quota imports, which were already subject to tariffs, should retain their previous terms, although the issue will require close monitoring. Even with the possibility of new, broader tariff proposals, the current flow of imports is unlikely to change significantly.

From a macroeconomic perspective, the strengthening of emerging currencies against the dollar, driven by fears of a US recession and the prospect of new trade retaliation from China and the European Union, has created an environment of uncertainty.

With the arrival of the new Brazilian crop, the market now has an important short-term balancing factor. Anticipation of crushing at several mills reinforces expectations of increased supply, limiting the scope for significant price rises, even in the face of international uncertainty.

Indicators such as the Crop Health Index deserve attention, but whether the crop is excellent or merely good, Brazil is once again playing its role as a price moderator, signaling that the short-term pressure on supply may indeed be temporary.

Lívea Coda is the Market Intelligence Coordinator at Hedgepoint Global Markets. She has been working in the agricultural commodities sector for over 5 years, especially with quantitative and fundamentalist research on the sugar and ethanol markets.