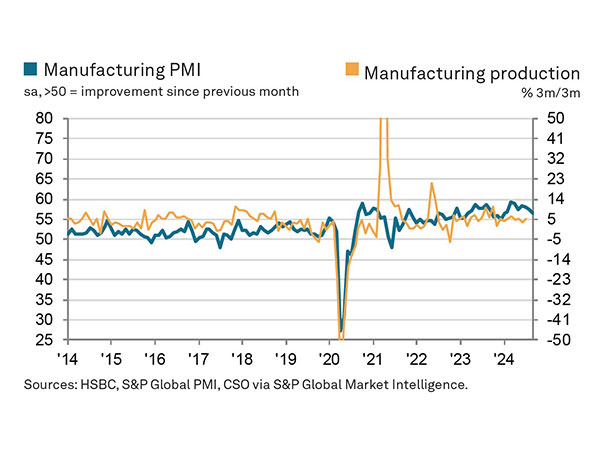

The PMI dipped to 56.5 from 57.5 in August, according to the latest data from the HSBC India Manufacturing Purchasing Managers’ Index, which showed a slight softening in India’s manufacturing sector in September 2024.

Although the index remains firmly in expansion territory, this marks the weakest performance since January 2024. The moderation in growth reflects a broader trend in the second fiscal quarter, with the average PMI reading hitting its lowest level since the three months ending December 2023.

The slowdown was attributed to several factors, including fierce competition and a softer increase in new export orders. While demand trends remained positive, the pace of expansion was constrained, leading to a more modest upturn in sales.

Export orders, in particular, saw a marked deceleration, with the rate of growth hitting its lowest level in 18 months. Domestically, factories continued to operate at a robust pace, outpacing the long-run series average.

However, production growth slowed in both the consumer and capital goods segments, while intermediate goods production remained steady. This contributed to the overall rate of expansion falling to an eight-month low.

Cost pressures mounted in September, with manufacturers reporting higher prices for chemicals, packaging, plastics, and metals.

Despite this, the rate of inflation was considered mild by historical standards. Pranjul Bhandari, Chief India Economist at HSBC, said, “Momentum in India’s manufacturing sector softened in September from the very strong growth in the summer months. Output and new orders grew at a slower pace, and the deceleration in export demand growth was especially evident as the new export orders PMI was the lowest since March 2023.”

Bhandari added, ” Input prices rose at a faster rate in September while factory gate price inflation eased, intensifying the compression on manufacturers’ margin. Weaker profit growth might have an impact on companies’ hiring demand, as the pace of employment growth slowed for a third month.”

Despite rising purchasing costs and labour expenses, manufacturers managed to raise their selling prices in September, though the rate of inflation eased to a five-month low. The uptick in charges mirrored the softer pace of input cost inflation.

Indian manufacturers continued to ramp up their purchasing activity, driven by new business growth and greater production requirements. However, the rate of expansion in input buying was the slowest in the year-to-date.

On the employment front, growth also slowed, with some firms reducing their use of part-time and temporary workers. However, companies with projects in the pipeline continued to hire, which helped maintain net employment growth.

Another key development in September was the stabilisation of outstanding business volumes, which had been accumulating for 11 straight months. This was attributed to the combination of slower new business growth and job creation, enabling companies to keep up with their workloads.

Inventory trends were mixed in September. Stocks of finished goods continued to decline, extending a seven-year trend, while holdings of raw materials increased sharply, supported by improved lead times.

Business confidence, however, took a hit. Only 23 per cent of manufacturers forecast output growth in the year ahead, while the remainder expected no change. As a result, the overall level of business optimism fell to its lowest point since April 2023. (ANI)