International Sugar Organization (ISO) released its first revision of the global 2024-25 sugar balance.

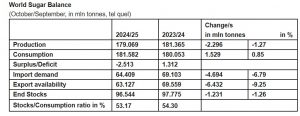

ISO’s fundamental view of the global supply/demand situation sees a reduced global deficit (the difference between world consumption and production) in the current season of 2.513 million (mln) tonnes. In its first assessment of the global supply/demand situation, ISO had forecasted a global deficit of 3.58 mln tonnes. Meanwhile, the finalisation of the 2023-24 cycle has returned a surplus of 1.312 mln tonnes, from a deficit of 0.200 mln tonnes and 2.954 mln tonnes in previous reports. This latest shift to a surplus was driven by lower consumption estimates. World production in 2023-24 was revised fractionally higher to 181.365 mln tonnes, a record level. Changes were relatively small given the cycle ended on September 30th, with delays in the current Australian harvest triggering the biggest change, albeit just 0.223 mln tonnes. The world production outlook for 2024-25 is also little changed at this stage, as much of this season’s operations are yet to give an indication to the accuracy of our estimates. A 0.350 mln tonne increase in China’s production is the biggest change to the November outlook. World consumption is projected to reach 181.582 mln tonnes in 2024/25, 1.285 mln tonnes less than our previous estimate. A similar revision to 2023/24 figures, reduced to 180.053 mln tonnes, has also been incorporated in this revision. Many of these consumption changes are driven by Member feedback to our sugar questionnaire which forms the basis of the ISO Sugar Yearbook.

According to the ISO, changes in trade dynamics are key market considerations. The estimated volume of imports and exports in 2023-24 was raised once more, following record exports out of Brazil. The respective totals now stand at 69.103 mln tonnes and 69.559 mln tonnes. Meanwhile, export prospects for 2024-25 are anticipated to decline sharply to 63.127 mln tonnes, down 6.432 mln tonnes on last season. Import demand has also been hemmed back, partly in a reaction to contracting availability but also in recognition of the lower notional white premium, which makes the re-export of processed imported raw sugar less profitable, assuming sales are based on the white sugar futures market. Import demand is also further reduced by a projected increase in self-sufficiency or domestic production in net-importing countries.

A summary of our world balance projected for 2024/25 and estimated for 2023/24 is provided below.

The ending stocks/consumption ratio for 2023-24 stands at 54.30% at the end of September 2024, down from 54.65% in the previous season, while the projected ratio for September 2025 stands at 53.17%. As has been the norm over the last year, the ISO has also been reporting an adjusted stock total figure, to reflect losses in the refining process. The latest assessment based on Member’s feedback points to a loss of 783,002 tonnes in 2023. Annual losses back to 2001 have been included in this alternative assessment, which returns a stock figure of just over 46% while showing greater correlation between prices and yearly stock totals and changes.

Global fuel ethanol production in 2024 is forecast at 117.7 bln litres, up from 112.8 bln litres in 2023. These forecasts have been revised upward since August, with US production increasing by 750 mln litres to reach 60.48 bln litres, helped by record-breaking exports, while India adds 200 mln litres through expanded grain-based ethanol production to reach 6.7 bln litres. Brazil’s fuel ethanol production is projected at 34.07 bln litres, benefiting from exceptional dynamics around the CS Brazil cane crush. Global fuel ethanol consumption is projected to rise to 115.7 bln litres in 2024, up from 109.1 bln litres in 2023, with Brazil and India leading this growth. Brazil’s 4.57 bln litre consumption increase and India’s 1.61 bln litre growth demonstrate the market’s potential through supportive policies and competitive pricing. In this edition of the Quarterly Market Outlook, preliminary projections for 2025 point to production reaching 119.6 bln litres and consumption rising to 118.0 bln litres, primarily driven by India’s continued expansion of its ethanol-inclusion programme.

As per ISO, Global molasses production in 2023/24 is expected to increase by 5.3 mln tonnes to a record 69.1 mln tonnes from last season’s 63.8 mln tonnes, according to S&P Global. In the ISO’s view global molasses balances should exclude Brazil, as most output is used within the industry. Excluding Brazil and factoring in the new production outlook for the EU, global molasses production in 2023/24 is now estimated to rise by 3% to 50.17 mln tonnes, up from 48.59 mln tonnes in 2022/23. Looking to 2024/25, world output excluding Brazil is forecast to rise to 50.39 mln tonnes. Global molasses demand remains driven by its use as a livestock feed ingredient and as a fermentation substrate for food additives such as lysine and MSG, beverage alcohol and fuel ethanol. Importantly, the ethanol programmes in Brazil, India, Thailand, and the Philippines absorb large volumes of molasses, and fuel ethanol is the most critical market for molasses today.

Global high fructose syrup (HFS) production is unlikely to see any significant growth in 2024, having averaged around 14.1 mln tonnes annually over the past decade. High fructose corn syrup (HFCS) dominates this sweetener category. In the US, by far the globe’s biggest HFCS sector, strong exports to Mexico in 2024 are more than compensating for weaker offtake in the domestic market. US corn wet millers have seen feedstock costs retreat during 2024, albeit there was a short-lived rise between April and June. Byproduct credits (corn oil, corn gluten feed, and gluten meal) weakened between January and June, resulting in an uptick in net corn sweetener costs. However, since then, byproduct credit values have remained firm, which together with easing corn costs, have seen net corn sweetener costs ease to a level not seen since late 2020.

In a release, ISO stated that the WTO’s DG has welcomed the outcome of a dedicated discussion on advancing the WTO talks on agriculture at a meeting of the Trade Negotiations Committee (TNC) on October 10th noting the discussions demonstrated the strong commitment by members to making a breakthrough in the talks. Furthermore, the Chair of the agriculture negotiations has outlined two options for advancing the negotiations. The first option is based on group discussions, where members can form smaller groups to discuss specific issues and then feed their outcomes into broader talks at the Committee on Agriculture. The second option is based on a facilitator-led process, whereby facilitators appointed by the Chair would guide inclusive discussions on various topics, provide updates and ensure members’ inputs shape substantive negotiations.

For detailed information and further insights, please refer to Chinimandi.com, which provides news about the Sugar and Allied Sectors