Insight Focus

Drier weather in Centre South Brazil has helped the sugar cane crush last longer into the rainy season. This has helped increase our global sugar production forecast for the 2022/23 season. The sugar cane crush in Thailand has recently started in the North and Northeast regions.

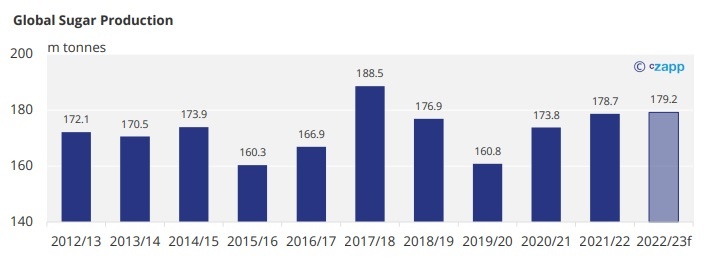

Global Sugar Production

We think global production in 2022/23 will reach 179.2m tonnes, this is 0.5m more than last season and represents the second largest crop year on record.

Our forecast has increased by 0.8m tonnes since the previous update in December, owing to favourable weather conditions in Centre South Brazil allowing for more cane to be crushed than expected before the rainy season sets in properly.

Global Sugar Consumption

Global Sugar Consumption

In 2022/23 we think the world will consume over 176m tonnes of sugar, this will be the highest on record and represents almost 3m tonnes more than the Covid-19 affected 2021/22 season.

With per-capita consumption growth flat or even declining in many developed countries, we think that the main driver of consumption growth globally is from a rising population.

We have not made any changes to this forecast since the last update.

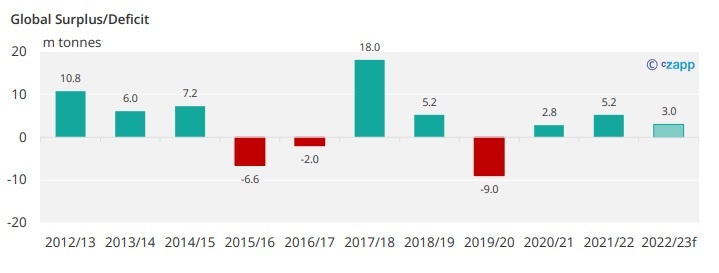

Small Production Surplus

Small Production Surplus

The production surplus in 2022/23 is expected to reach 3.0m. Strong consumption growth from the previous season means this is over 2m tonnes less than the surplus in 2021/22.

Global production has been fairly static over the last decade, yet consumption keeps moving higher. Without significant investment in additional acreage for future crop seasons we think that the world market will continue to get tighter.

Thailand Sugar Production Update

Thailand Sugar Production Update

The 2022/23 Thai sugar cane crush has recently begun, with mills in the North and Northeast able to take advantage of the dry fields. So far almost 300k tonnes of sugar has been produced.

By the end of the season, we think that Thailand will have produced 10.6m tonnes of sugar, 0.5m more than the previous season.

2022/23 is expected to be the second year of recovery after two seasons of poor production in 2019/20 and 2020/21 where bad weather and intense crop competition saw sugar production suffer.

We think it is unlikely that Thailand will be able to replicate the record 2017/18 and 2018/19 crops in the near future since the similarly drought resistant cassava crop is still in strong competition with sugar for planting by many farmers across the country.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.