Insight Focus

The world’s sugar trade met in-person in London in the first week of October. This was the first time the trade had met in London for 4 years. Here is a copy of the presentation we prepared for Cz customers during the week.

Three Things to Know About Sugar in October 2022

No one likes long presentations, so here are the three major things to remember:

1) Macroeconomic conditions are terrible for commodities right now.

2) Global sucrose production has been unchanged in more than a decade.

3) Sugar consumption has been growing slowly; consumption as ethanol is growing fast.

Putting those three points together mean that the sugar market has a negative feel today, but consumption growth (as sugar or ethanol) should push prices higher in the medium to long term.

That’s it! If you’re pushed for time, you’re up to date. If you’d like a bit more detail, then read on.

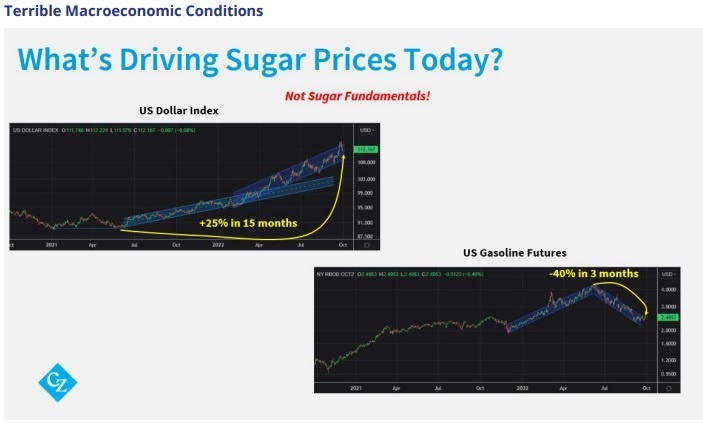

The story of the last 12 months has been the strength in the US Dollar. This, alongside rising interest rates, has restricted credit and also global trade, which is negative for commodities.

A stronger Dollar also makes it cheaper for commodity exporters to supply to the world market, and more expensive for buyers to import. If anything, the Dollar’s strength is accelerating and so these trends are getting worse.

The major impact of this has been seen in energy markets. Crude oil and gasoline futures have lost more than 40% from their highs immediately after Russia’s invasion of Ukraine. Higher energy prices feed through into almost all other commodities as these goods often require processing, sugar included.

Lower gasoline prices also feed through to the market in Centre-South Brazil, where mills are choosing to maximise sugar production, and not ethanol.

The US Federal Reserve has indicated that they will continue to raise interest rates until inflation is closer to their 2% target. The last Consumer Price Index print was 8.3%….

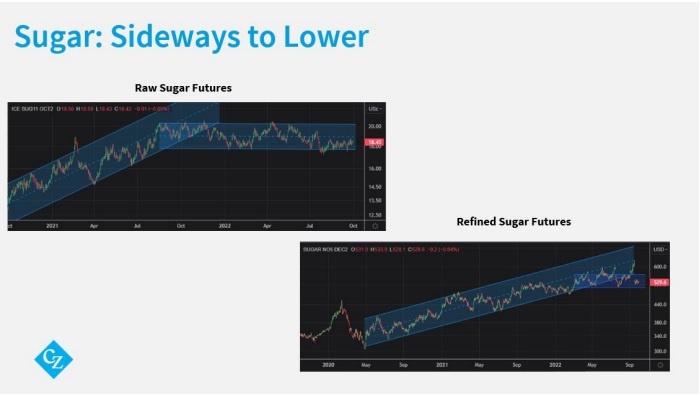

In this context, sugar’s recent performance has been surprisingly robust. Yes, its uptrends have broken, but both raw and refined sugar are now merely chopping sideways rather than retreating.

Indeed, if it wasn’t for the awful macroeconomic conditions, we’d be quite positive on sugar prices because market fundamentals are quite bullish. The sugar market is undersupplied and if anything this is getting worse.

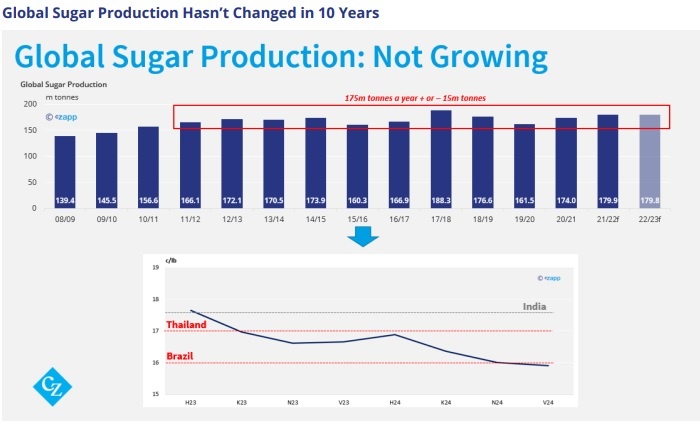

Sugar production around the world has been 175m tonnes each year (+ or – 15m tonnes) since 2011/12.

One reason for this is the collapse in sugar futures prices between 2011 and 2020. But prices have more than doubled from 2020’s 9c/lb low. Might this mean increased investment in sugar production?

Not in some of the major supplying countries it won’t. Prices are still not high enough to give potential investors in the sector a big enough return. Look to Centre-South Brazil, for example. This is the world’s largest cane growing region. Approximate raw sugar cost of production here is around 16c/lb. This implies a 10% return when compared to the March’23 raw sugar futures contact, but no margin against the back of the futures curve. However, the benchmark Brazilian SELIC interest rate is nearly 14% today; there’s no incentive for local or international investors.

Likewise in Thailand, where approximate cost of raw sugar production is 17c/lb.

Perhaps the only major sugar-growing region which is seeing growth is India. The government here has given incentives to expand distillation capacity to use sugar cane to make ethanol, not sugar. Meanwhile, any further sugar which the Indian industry does make as a by-product requires >17c/lb to be supplied to the world market based on last season’s export rules. Again, the back of the futures curve is too low to allow this to happen.

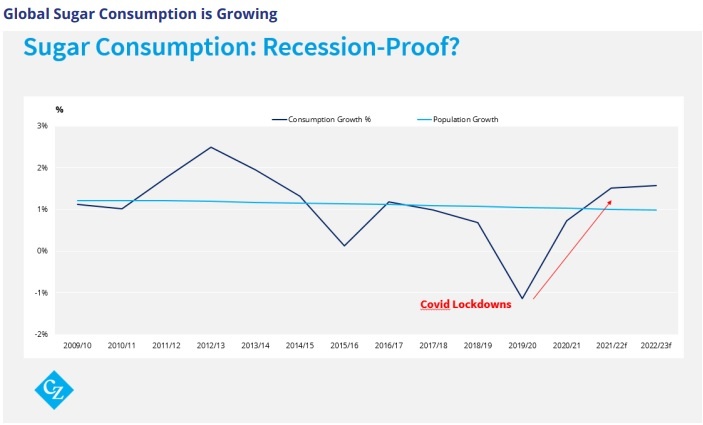

For much of the past decade, sugar consumption globally has grown in line with population, at around 1% a year.

COVID lockdowns affected out of home sugar consumption, but as the world has largely moved beyond the pandemic we have seen sugar consumption rebound to normal levels once more.

It’s also possible that sugar is recession-proof. It’s a cheap luxury that tastes nice to eat. It’s also useful. It caramelises, adds bulk, retains moisture and acts as a preservative. It’s therefore hard to reformulate foods away from sugar, while consumers are more likely to cut back on big-ticket items like meat or dairy than cheaper carbohydrates.

Finally, global sugar consumption has caught up with the last decade’s production, exceeding 175m tonnes for the first time in 2022/23.

As consumption grows in the future, we will need new investment in sugar production, something which is unlikely to happen at current prices.

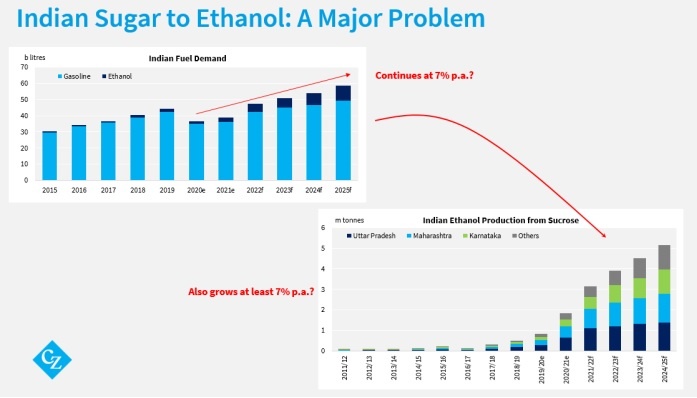

Perhaps the biggest problem for the sugar market in the next 5 years will be India’s move to a 20% blend of ethanol in gasoline. Pre-COVID, Indian gasoline demand was growing at around 7% a year. If this continues in the future, India will need ever-increasing amounts of ethanol to sustain the E20 blend.

Where will all this ethanol come from? The original government plans envisaged around 50% coming from grains distillation and 50% from cane distillation by 2025. But India has largely exported its excess grains stocks following Russia’s invasion of Ukraine. This means India will divert an increasing amount of cane juice and molasses to making ethanol, not sugar.

Can India’s cane acreage grow fast enough to keep pace with road fuel demand? What happens when there’s bad weather and a poor cane season? In the past two seasons then world sugar market has traded to 21c/lb even with India exporting 8-10m tonnes of sugar a year. The sugar market isn’t prepared for the season when India has to import sugar or ethanol or both.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.