Insight Focus

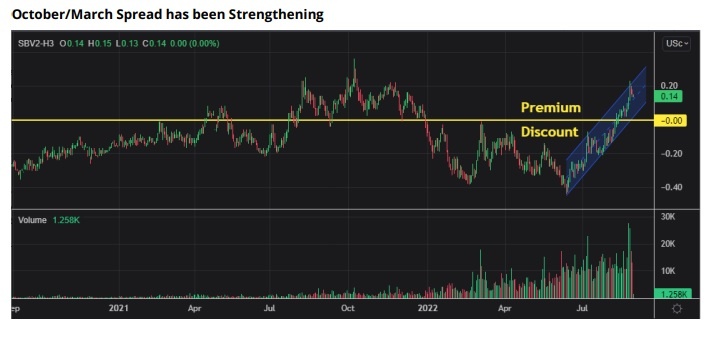

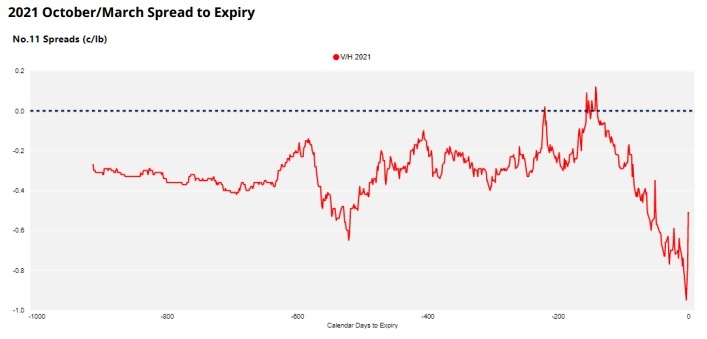

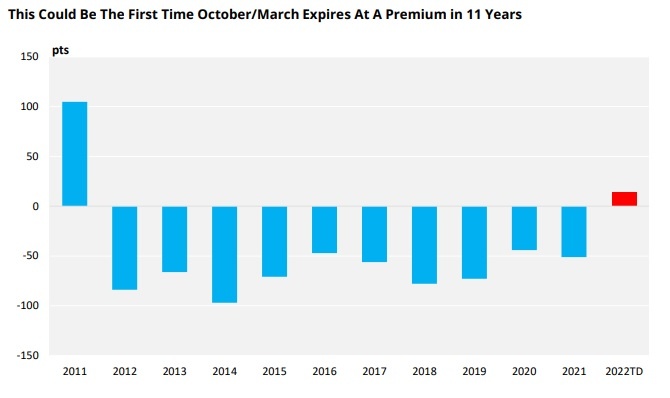

The October/March raw sugar spread is at a premium. This is unusual; it’s not expired at a premium in 11 years. The sugar market is more stressed than the flat price shows.

The raw sugar October/March spread is trading at a premium.

This is unusual; the last time the October futures expired at a premium to a March contract was 2011, when the raw sugar futures were at 26c/lb.

The Last Time October/March Expired at a Premium

Spreads: A Reminder

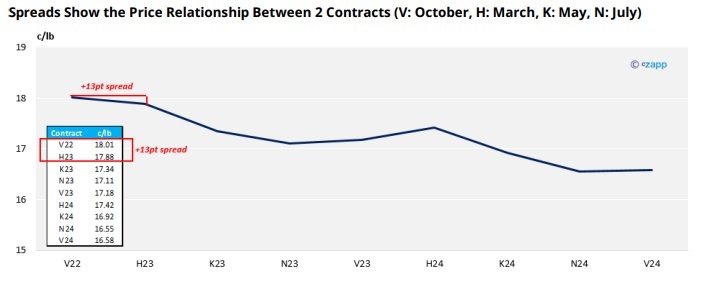

A calendar spread shows how two futures contracts with different delivery dates relate to one another. In this case we are comparing raw sugar for delivery in October 2022 with raw sugar for delivery in March 2023.

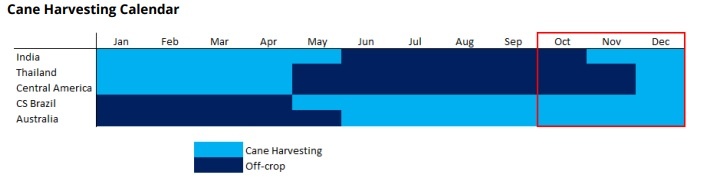

Raw sugar futures are physically settled. On expiry, traders must exchange actual raw sugar. Spreads are influenced by supply and demand for sugar through time. In other words, seasonality is important. Let’s look at the calendar.

When the October futures expires, sugar delivered must be available from 1st October to 15th December. This makes October particularly relevant for Centre-South Brazil.

Why Does Brazil Dominate the October/March Spread?

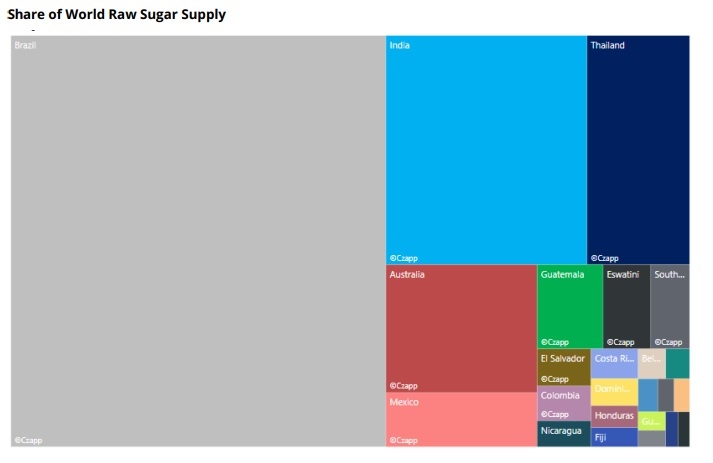

The raw sugar market is dominated by a handful of major suppliers. Centre-South Brazil is by far the world’s largest exporter of raw sugar, accounting for more supply than the rest of the world put together.

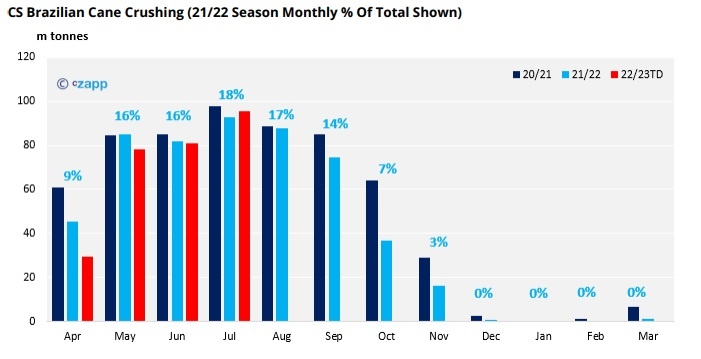

Cane harvesting in Centre-South Brazil starts in April each year and peaks in May to September.

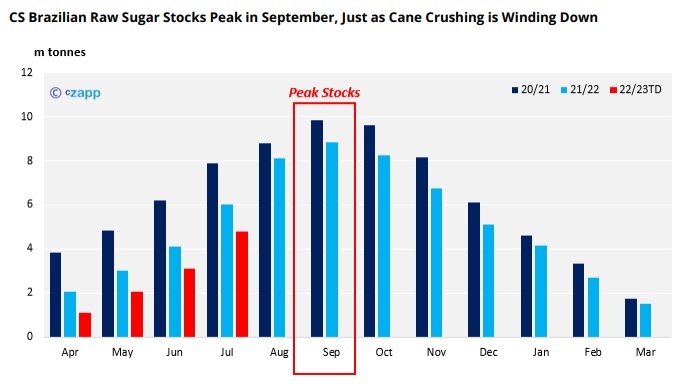

Sugar exports also increase dramatically from May each year, but the region can’t ship as quickly as it produces, so raw sugar stocks build. Raw sugar stocks peak around the end of September each year, coinciding with the October futures expiry.

Cane crushing slows and stops in the 4th quarter of each year, and sugar stocks then dwindle to minimal levels by April.

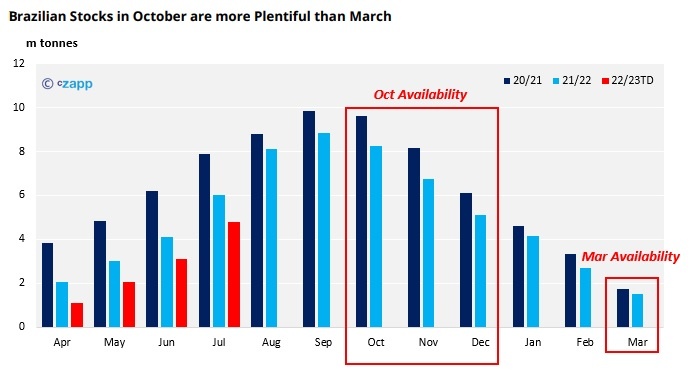

This means that Brazil has plenty of sugar available for export at the time of the October futures expiry, but very little availability by the time of the March expiry.

All other things being equal, this means that October futures should be cheaper than March futures, because sugar availability is higher in October.

Indeed, if you want to encourage traders to carry raw sugar from October into Q1, the futures market needs to cover their costs: warehousing, insurance, etc. Cost of carry from October through to March is typically 0.6-0.9c/lb depending on interest rates, FX, warehouse type, etc.

Therefore, the October/March spread often trades around this level in the run up to expiry.

What’s Happening in 2022?

This year the October-March spread is trading at a 0.13c/lb premium. October is more expensive than March! How can this be?

1) Low Sugar Stocks in Brazil

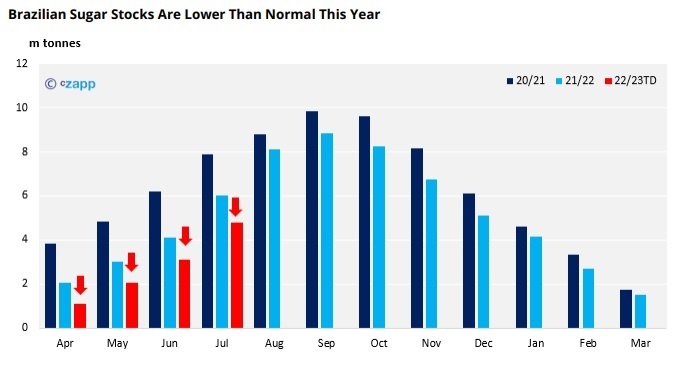

Even though CS Brazilian raw sugar stocks are peaking, they are lower this year then they have been for the last couple of years.

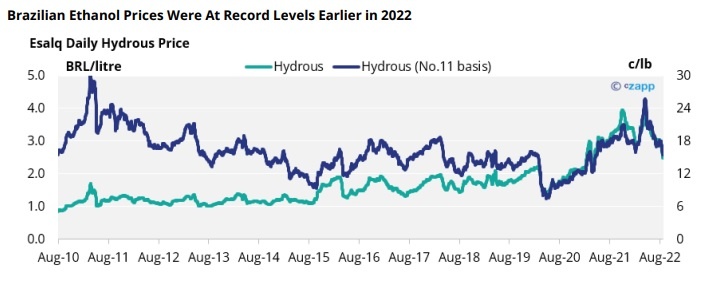

This is because cane crushing was slow to start this year, and mills concentrated early output on making ethanol not sugar.

This was no surprise; Q2 ethanol prices were huge, but it’s delayed the build of sugar stocks.

2) Congestion in Brazil

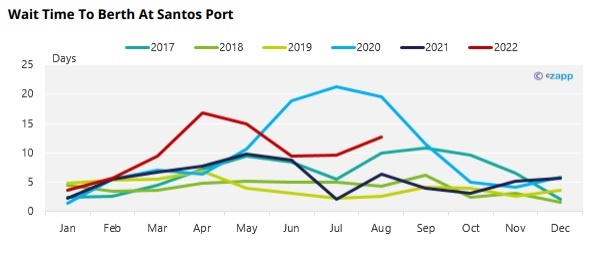

Even though sugar stocks are now building, it’s proving really difficult to get sugar out of Brazil. Drybulk vessels have consistently had to wait more than 2 weeks to berth at local ports owing to congestion.

If you need sugar NOW and want to jump the vessel queue you need to pay.

3) Other Raw Sugar Suppliers Are Struggling

In Australia the cane harvest is behind schedule following heavy rainfall at the start of cane crushing.

Australian Rainfall: A Wet 2022

In India mills would like to arrange new export contracts for Q4 but can’t because the government hasn’t outlined how export rules will work in the future.

Meanwhile Thailand and Central America are fully sold out of raw sugar until their new cane harvests start in December.

4) Global Raw Sugar Demand is Strong

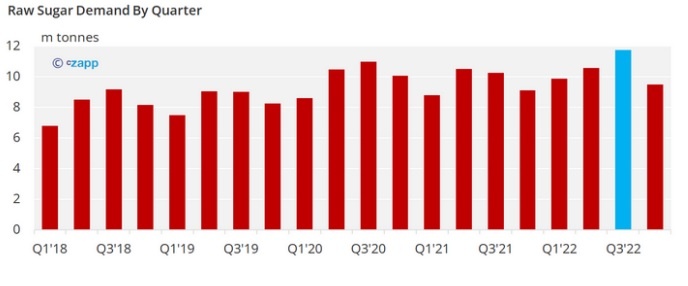

We’ve spent all this time thinking about supply; let’s look at demand, which is equally important. We’ve seen strong flows to Chinese refiners in July, high demand from the Black Sea region and also decent flows to some re-export refiners thanks to the strong refined sugar market.

Strong demand is generally positive for prices.

What Happens Next?

The next 2 weeks will bring intense volume and order flow to the spread.

Anyone not intending to deliver or receive actual raw sugar needs to exit the October’22 contract before expiry day on 30 September. Liquidity will fall dramatically after the October options expiry in the middle of September. Let’s look at some participants.

1) Speculators

Speculators are short of the raw sugar market, presumably in the October contract. These shorts will need to be bought back, either to kill the position or to roll it into March. This will add buying pressure to the October/March spread.

2) Trade Longs

Trade houses who wish to receive raw sugar from the October expiry to ship to refinery homes in Q4 will remain long. Will global raw sugar demand remain robust in Q4? That’s the bet they’re making.

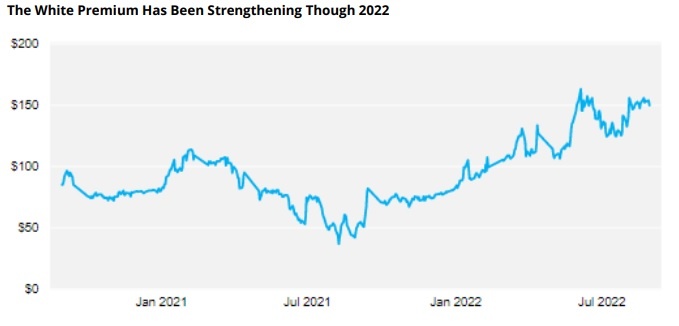

The strength in the refined sugar market versus the raw sugar market should give traders comfort (because it means refinery margins are high and they should be maximizing throughput).

Given the spread has been strengthening, trade house long positions in the October/March spread are already in the money. A further advantage for the longs is that this expiry should be relatively “clean”. The time of year means receivers will get >95% Brazilian raw sugar rather than a mix of origins.

3) Trade Shorts

Trade houses holding shorts will need to decide whether to deliver sugar into the October expiry or roll the shorts into March. To do this they need to decide whether they can perform according to No.11 contract rules on sugar they deliver. Those who can’t perform will need to buy back – either the spread directly or physical sugar which they can then deliver.

What does this all mean? Ultimately a delivery is just another transaction between buyers and sellers. You can’t always read too much into it. But the October/March usually trades at a discount unless the raw sugar market is stressed.

Even as the raw sugar flat price drifts lower, the spread is hinting all isn’t well.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.