New Delhi: The state-owned oil marketing companies (OMCs) have had a fabulous financial year 2023-24. Even as they navigated rapidly evolving geo politics and wide fluctuations in crude prices, the OMCs not only ensured fuel availability at affordable rates, with one of the lowest fuel price inflation globally in India, but they have also rewarded the shareholders’ trust by posting commendable annual results.

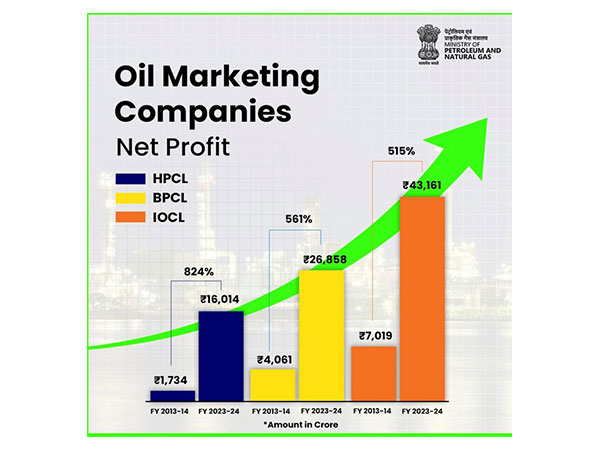

According to the Ministry of Petroleum and Natural Gas, the combined profit of OMCs for FY 2023-24 stood at Rs 86,000 crore, over 25 times higher than the extraordinarily difficult previous fiscal year.

For the full 2023-24 fiscal, HPCL reported a record net profit of Rs 16,014 crore as opposed to a loss of Rs 6,980 crore in the previous year.

The Indian Oil Corporation Limited (IOCL) also celebrated a stellar performance, achieving milestones in refinery throughput, sales volume, and net profit during FY 23-24.

BPCL’s profit after tax for FY 2023-24 surged to Rs26,673 crores, a remarkable rise of nearly 13 times from the previous fiscal year. Moreover, the company’s ambitious ‘Project Aspire’ outlines its commitment to generating substantial long-term value for shareholders, with a planned capital outlay of Rs 1.7 lakh crores over 5 years.

The Ministry of Petroleum & Natural Gas has announced that state-owned oil marketing companies (OMCs) achieved remarkable financial results for the fiscal year 2023-24, despite navigating through challenging geopolitical landscapes and volatile crude oil prices.

“The state-owned oil marketing companies (OMCs) have had a fabulous financial year 2023-24. Even as they navigated rapidly evolving geopolitics and wide fluctuations in crude prices,” said the ministry.

However, the Ministry expressed concern over some media reports that solely focused on the Q4 2024 to Q4 2023 financial comparison, painting an inaccurate and unjustified picture of the OMCs’ overall annual performance. Parameters like all-time best throughputs, excellent capex utilization, and completed projects were reportedly overlooked, leading to a biased portrayal.

The ministry states that the market response to the results has been positive, with BPCL and HPCL share prices witnessing a rise post-announcement. Experts have acknowledged the performance, with many recommending a buy, thereby bolstering confidence in the OMCs’ outlook for the current fiscal year.

(With inputs from ANI)