ICRA estimates the revenues of integrated sugar mills to expand by 10% in FY2025, supported by an expected increase in sales volumes along with firm domestic sugar prices and higher distillery volumes after the operationalisation of new capacities. Further, the operating profit margins of the sugar mills are projected to remain comfortable in FY2025, in line with FY2024, because of firm sugar realisations and higher cane prices for SY2025. ICRA’s outlook for the sugar sector is Stable, backed by the anticipated improvement in revenues, stable profitability, and comfortable debt coverage metrics along with the Government’s policy support, including the ethanol blending programme (EBP).

Commenting on the expected domestic sugar production and prices, Girishkumar Kadam, Senior Vice President & Group Head – Corporate Ratings, ICRA, said: “ICRA projects the net sugar production to decline to 30.0 million MT in SY2025 from 32.0 million MT in SY2024 based on the expectation that higher diversion will be allowed towards ethanol production amid the high sugar stock level. Even if the diversion towards ethanol is increased to 4 million MT in SY2025, the closing sugar stock level is likely to remain moderately high. Therefore, clarity on the policy for allowing diversion beyond the cap of 1.7 million MT and the exports remain the key monitorables for the sector. Further, domestic sugar prices, which are currently in the range of Rs. 38-39/kg, are expected to remain firm till the start of the next season, thereby supporting the profitability of the mills.”

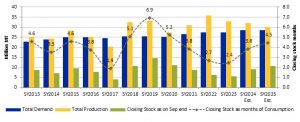

Exhibit 1: Yearly trends in sugar production, consumption and closing stock

Source: ISMA, ICRA Research; SY: Sugar year (from October 01 to September 30)

ICRA expects the closing sugar stock to be around 9.1 million MT as on September 30, 2024, appreciably higher than the sugar stock of 5.6 million MT as on September 30, 2023. This would be equivalent to 3.8 months of consumption (PY: 2.4 months). The closing stock is expected to further increase to over four months as on September 30, 2025, as per ICRA’s estimates.

Commenting on the ethanol blending and key challenges related to the segment, Kadam said: “The ethanol blending trend has remained encouraging till Ethanol Supply Year (ESY) 2024, given the higher contribution from grain-based distilleries. For ESY2025, the extent of the increase in diversion towards ethanol production over and above the cap remains critical to meet the 20% blending target set by the Government of India. The other key challenges that also need to be addressed include the availability of sufficient feedstock for grain-based distilleries and the infrastructure ramp-up required to support higher blending levels. Further, the timely launch of the E-20 (20% ethanol blended)-compliant vehicles and public adoption of the same would be key to achieving the blending targets.”

Exhibit 2: Trend in ethanol blending percentage and OMC receipt volumes (feedstock wise)

Source: till May 26, 2024; DFG: Damaged foodgrain; ESY: Ethanol supply year (From Nov 1 to Oct 31); Source: ISMA, ICRA Research