The Indian government has set a target of 20% ethanol blending by 2025, but ethanol producers are raising concerns about several challenges that need to be addressed in order to achieve this goal smoothly.

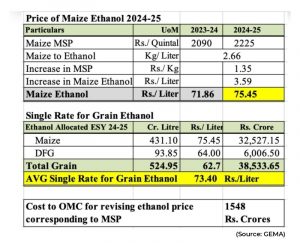

Grain-based ethanol producers in India have highlighted issues such as viable pricing for ethanol and the availability of feedstock for the Ethanol Supply Year (ESY) 2024-25 and beyond. In a recent presentation to Union Home Minister Amit Shah, the Grain Ethanol Manufacturers Association (GEMA) outlined the difficulties the industry is currently facing. GEMA proposed a single rate of Rs. 73.40 per litre for all grain-based ethanol.

In its presentation, GEMA highlighted the successes of the national biofuel policy, the operational losses experienced by producers, and proposed measures to ensure a stable and sustainable ethanol supply that aligns with the government’s blending target.

Oil Marketing Companies (OMCs) have allocated around 837 crore litres of ethanol against 970 crore litres of offers submitted by manufacturers across the country for ESY 2024-25 – Cycle 1. OMCs had invited tenders for the supply of 916 crore litres of ethanol for ESY 2024-25. The supply of grain ethanol is expected to increase to around 525 crore litres in ESY 2024-25, up from 370 crore litres in the previous ESY. Notably, 63% of this supply will come from grain, with maize contributing around 431 crore litres. According to GEMA, 11.46 million metric tonnes (MMT) of maize will be required to produce 431 crore litres of ethanol. While maize is a future crop, its current availability of 11.46 MMT is questionable.

The association detailed that losses in keeping the plant shut are higher, than in supplying ethanol at losses. If plant is kept non-operational – cost of manpower, establishment, finance & penalties of non-supply are fixed, which is approx Rs 9.50 per litre. The plant capacity reduces by 20%, in maize as compared to Damaged food grains (DFG) – this leads to higher fixed expense ratio in maize. GEMA noted that due to limited availability of DFG; industry has opted for maize, even though the losses are high – only to keep the plant running.

To address pricing pressures, GEMA has called for a single rate of Rs 73.40 per litre for all grain-based ethanol, based on a weighted average after factoring in the increase in the Minimum Support Price (MSP) of maize. The MSP for maize has risen by Rs 1.35 per kilogram to Rs 22.25, while open market sale rice is available at Rs 32 per kilogram from the Food Corporation of India (FCI).

According to GEMA, the 11.46 MMT of maize required for 431 crore liters of ethanol represents one-third of India’s maize production. An extreme shortage of maize could result in significant inflation and increased imports in other sectors.

To mitigate these challenges, GEMA suggested that a mixed grain approach would allow manufacturers to select the most viable grain for ethanol production. This strategy could also enhance accountability for feedstock in the grain ethanol industry. The association noted that a ₹40,000 crore investment by the grain ethanol sector could be saved from becoming non-performing assets.

Continue reading Chinimandi.com for more news about the Ethanol Industry.

I have a proprietary 2G Ethanol Biorefinery technology that can produce ethanol and other higher value co-products from agricultural crop residues such as bagasse (sugarcane and sweet sorghum), all plant stalks after taking out the grain such as millet, maize, rice, wheat, cotton plant, bamboo, jute, all kinds of grasses, etc, The cost of ethanol is around INR 19/liter.

I can supply 100% need of ethanol to replace the petrol import plus 15% need for blending with diesel.

I am looking for long term take-off agreement or investment to implement about 1500 2G Biorefineries across India using 60T, 120, 240 and 500 mt per day of dry lignocellulosic feedstock.

Interested parties should contact me to take the ethanol production economical, viable and sustainable for very long term with conflict of food or fuel!

Indian sugar Industry going to shut down their company,, due to continuous losses they are facing by Government pressure on sugar price since 2019, as well as Ethanol price,,, sugarcane price (MSP) are going ups, for farmers vote,, and product(Sugar, and Ethanol) price are same also for vote from its consumers,,, what a good decision,,,

Please arrange for visit such plant with successfull demonstration.

We are manufacturing worlds preferred alcohol denaturant, ie Denatonium Benzoate. Please contact us for denaturation of Ethanol with Denatonium.

NCCF SHOLUD expand further to procure CORN at MSP and provide distilleries at reasonable price

NCCF SHOULD ENCOURAGE WHITE SHORGAM FARMERS TO INCREASE AREA IN OTHER STATES FOR ETHANOL

Interested in 60 tpd plant. Pl contact and arrange for visit.

Interested in 60 tpd ethenol plant proposed by Mr Durlabh Bhanvadia . Pl arrange for discussion and visit to plant

Interested in 60 tpd ethanol plant proposed by Mr Durlabh Bhanvadia . Please arrange for discussion and visit to plant

Sir,

Will you please like to a short brief on 2 G ethanol technology in the way that how the cost of production will decrease to Rs 19 per liter

With regards

Arun Potade