Main points

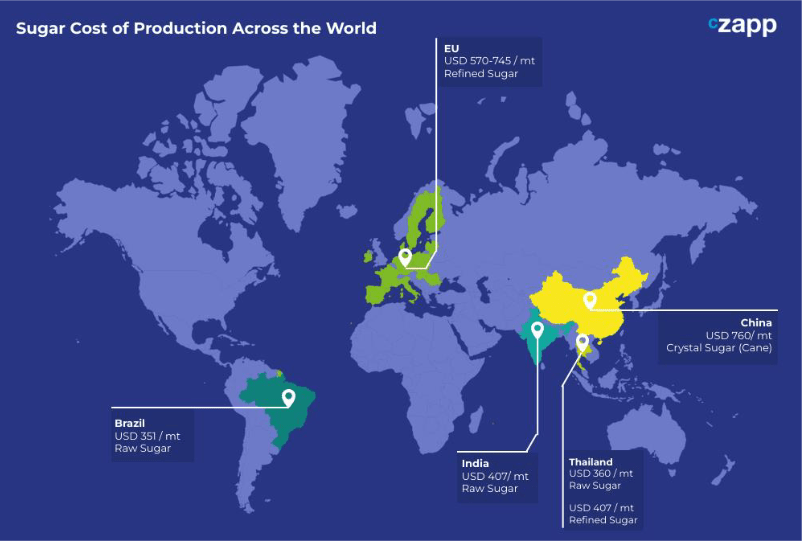

Sugar cost of production has risen in India and Europe. Meanwhile, costs have remained the same in Thailand and China, while falling in Brazil. At current sugar prices, margins are positive for sugar producers.

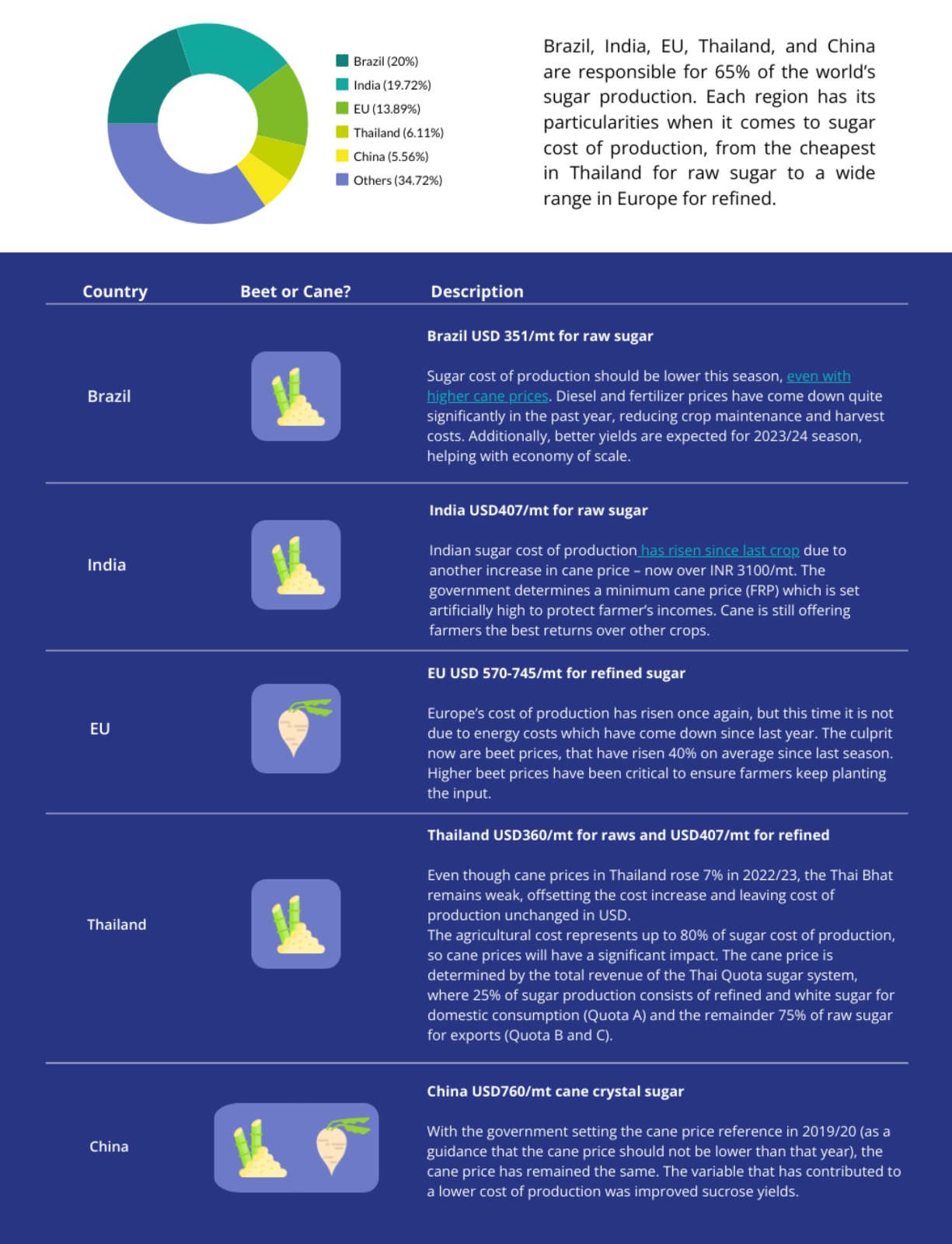

Brazil, India, EU, Thailand, and China are responsible for 65% of the world’s sugar production. Each region has its particularities when it comes to sugar cost of production, which can make it hard to compare them directly. However, Brazil is currently the cheapest producer of raw sugar.

India USD 407/mt for raw sugar

Indian sugar cost of production has risen since last crop due to another increase in cane price – now over INR 3,100/mt. The government determines a minimum cane price (FRP) which is set at a level which protects farmer’s incomes. Cane still gives farmers the best return over other crops.

EU USD 570-745/mt for refined sugar

Europe’s cost of production has risen once again, which might be surprising given that energy and fertiliser costs have fallen since 2022. However, beet prices paid to farmers have increased, in some cases by more than 40%. Higher prices have been critical to ensure farmers keep planting beet rather than switch to other crops.

Thailand USD 360/mt for raws and USD 407/mt for refined

Even though cane prices in Thailand rose 7% in 2022/23, the Thai Bhat remains weak, offsetting the cost increase and leaving cost of production unchanged in USD. The agricultural cost represents up to 80% of sugar cost of production, so cane prices have a significant impact. The cane price is determined by the total revenue of the Thai Quota sugar system, where 25% of sugar production consists of refined and white sugar for domestic consumption (Quota A) and the remainder 75% of raw sugar for exports (Quota B and C).

China USD 760/mt cane crystal sugar

With the government setting the cane price reference in 2019/20 (as a guidance that the cane price should not be lower than that year), the cane price has remained the same. The variable that has contributed to a lower cost of production was improved sucrose yields.

Brazil USD 351/mt for raw sugar

Sugar cost of production should be lower this season, even with higher cane prices. Diesel and fertilizer prices have come down quite significantly in the past year, reducing crop maintenance and harvest costs. Additionally, better yields are expected for 2023/24 season, helping with economy of scale.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.