Insight Focus

There is still a small production surplus expected in 2022/23. This is despite consumption increasing year-on-year. A recent crop tour in Thailand reveals worse than expected field conditions.

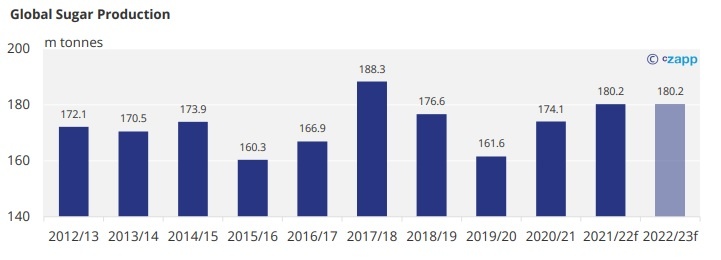

Global Production

The world will produce 180.2m tonnes of sugar in 2022/23, this is the same as in 2021/22 and the joint second largest on record. This estimate is unchanged since our forecast in the August Statshot.

Under the surface, an increase to CS Brazil’s current crop estimate to 32.5m due to lower ethanol prices causing mills to increase their blend towards sugar has offset a fall in Thailand’s expected 2022/23 crop (see more below).

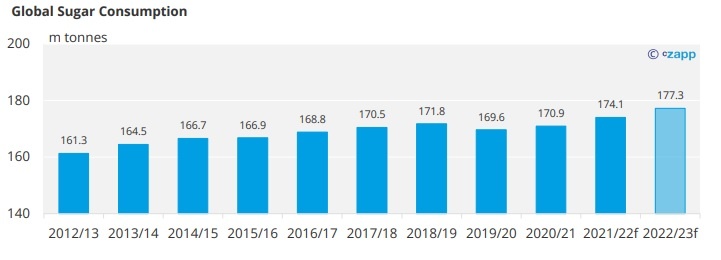

Global Consumption

In 2022/23 we will consume over 3m tonnes more sugar year-on-year than in 2021/22. This is in part due to more economies returning to pre-Covid consumption and through an increase in population.

Consumption in China will also rebound by over 500k tonnes following demand dampened by COVID lockdowns in 2021/22.

This global forecast is the same as the last update, with no revisions made.

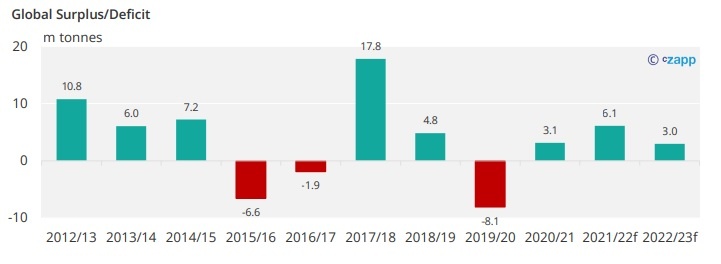

Small Production Surplus

We still expect a small surplus of 3.0m tonnes to form in 2022/23, unchanged from last month. However, with the increase to CS Brazil’s availability, and a decrease to Thailand’s, the regional picture has become tighter in SE Asia.

Growth in consumption means this is around half the size of the surplus observed in 2021/22, despite similar production.

Thailand Production Update

We think that Thailand will produce around 10.8m tonnes of sugar in the upcoming 2022/23 season, set to commence in Q4.

This represents on the year growth of 800k tonnes from 2021/22, and a second year of recovery after the heavily drought-affected 2020/21 crop year.

Until recently, we had forecast 11.3m tonnes due to increased cane acreage and good rainfall nationally, however following a recent crop tour of the lower northeast cane areas, farmers have instead reported irregular rains along with a higher level of weeds in the fields.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.