Insight Focus

Sugar stocks should build as 2023/24 will be the 4th production surplus in a row. Global sugar production in 2023/24 is forecast to reach 183.5m tonnes. Post-Covid global consumption is growing slightly faster than global population growth.

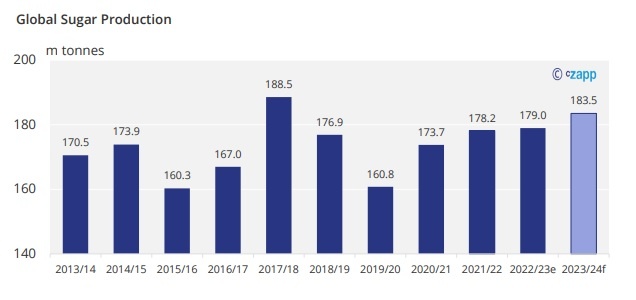

Global Sugar Production

Global Sugar Production

In 2023/24, global sugar production will be 183.5m tonnes, up 4.5m tonnes from the previous crop year and the second highest on record.

We believe this is due to increased cane availability in CS Brazil, as well as mills in CS Brazil maximizing sugar production at the expense of ethanol, as opposed to 2022/23, when mills began with an ethanol focus

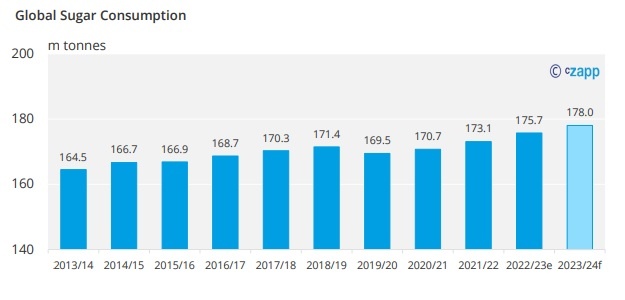

Global Sugar Consumption

Global Sugar Consumption

We forecast that in 2023/24 global sugar consumption will be around 178m tonnes.

Global sugar consumption is growing at a rate of 1.3% into 2023/24, slightly faster than population growth of 1%. The increase in consumption could be attributed to rising consumption in many developing Asian and African countries.

Moreover, we do not believe that the recession and cost-of-living pressures will have a significant impact on sugar consumption.

Moreover, we do not believe that the recession and cost-of-living pressures will have a significant impact on sugar consumption.

We made minor adjustments to our numbers in a few countries as consumption has rebounded at different rates since covid.

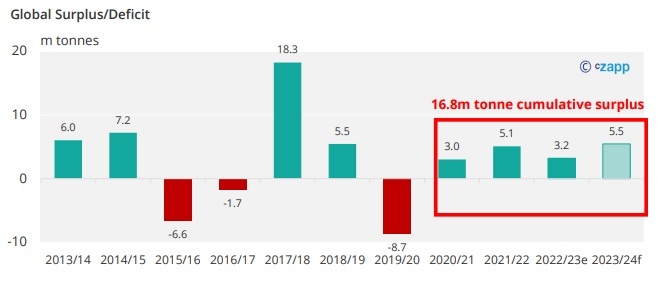

Small Production Surplus

Despite an increase in consumption from the previous season, production will still exceed consumption by 5.5m tonnes in 2023/24.

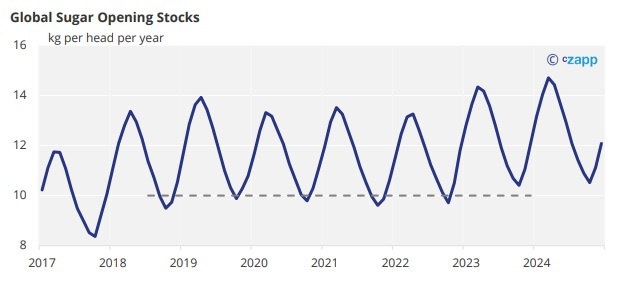

This will be the 4th production surplus in a row which means that global stocks at the low point in the cycle (per person each year) may increase from 10 Kg to 10.5Kg.

This will be the 4th production surplus in a row which means that global stocks at the low point in the cycle (per person each year) may increase from 10 Kg to 10.5Kg.

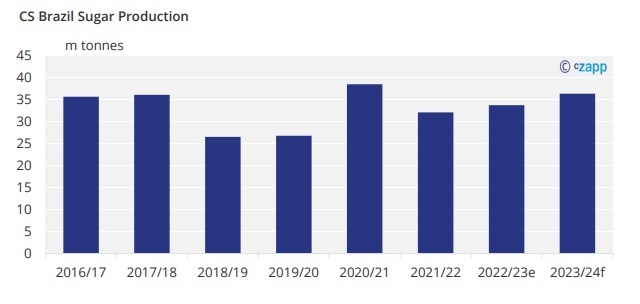

CS Brazil Production Update

CS Brazil Production Update

For the new 2023/24 season, we forecast sugar production in CS Brazil to be 36.3m tonnes, 2.6m tonnes higher than the previous season. This is because of a larger cane crop thanks to excellent weather conditions for cane growth.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.