For September 13, 2021

SB (Sugar nearby active contract): Last week`s close was bearish. The longer NBC-Point is 18.02, which means the long-term trend remains bullish. This is in an uptrend since April 30, 2021. A weekly close below longer NBC-Point will change the trend to neutral from bullish.

The shorter NBC-Point is 19.22, which means the short-term trend downgraded to neutral. A weekly close back above this will change the trend back to bullish.

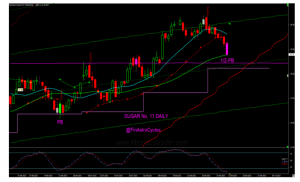

The bull-bear fight zone for the coming week is at 19.23. This is an important level for deciding who is in control for the week.

Weekly Support is 18.28-18.70. A weekly close below this range is bearish.

Weekly Resistance is 19.31-19.73. A weekly close above this range is bullish.

Cycle: This starts the 12th week of a new 20 Weeks +/- 5 weeks primary cycle off the 16.19 low of Jan 26, 2021. The last week`s report mentioned, “The half-primary cycle low is expected in the next 3-13 days. The price target for that low is 18.74-18.25. A move back above 19.88 will resume the uptrend. This cycle has made a high of 20.31 in the 8th week and failed to cross that high in the 9th week, which is a concern for bulls. A high of 20.31 will take prices to next level which is 21.50-24.00 zone. This is a wide range but will keep updating as the cycle develops. The technical indicators on daily charts are in the bearish zone”. As expected, Sugar fell and closed at the higher range of the expected price target 18.74-18.25. A half-primary cycle low is due anytime by September 17, if it is already not in. It has closed at an important cycle deciding moving average line, which is 18.80. The technical indicators are in the oversold zone on the daily chart.

A close below 18.80 and bounced back again above that green line mentioned, in the chart, will confirm that low is in and prices will rally again. There are multiple supports at 18.45-18.34-18.25 (look in the chart).

Click below to read the previous episode

Sugar Time Cycles – Weekly : Sept, 6 2021

Legal Disclaimer: Trading in futures/options of any asset class carries a high level of risk, where traders can lose much more than the capital infused. Past performance is no indication or guarantee of future performance. The support and resistance may represent favourable risk/reward places to buy/sell depending on the broader trend. These comments and trade recommendations are primarily for the traders/investors of futures contracts. They are provided mainly with “speculators” in mind. By its very nature, speculation means “willing to take risk of loss”. “Speculators” must be willing to accept the fact that they are going to have several losses, many more than say, “investors.” That is why they are “speculators.”

Speculators are typically right about 50% of the time, +/- 10%. The way speculators become profitable is not so much by a high percentage of winning trades, but by controlling the amount of loss on any given trade, so the average trade on winners is considerably more than the average trade on losing trades. These comments can be of value to both speculators and investors. Those who take these trades need to be willing to adjust stop-losses, and even the trade itself, as the week unfolds, and dependent upon technical factors that will arise with each day’s trading. There is no guarantee as to

future accuracy or profitability.

Each trader and reader trades at his or her own risk, and neither the author nor publisher assumes any responsibility whatsoever for anyone’s financial or commodity market decisions.

The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.chinimandi.com