Triveni Engineering & Industries Ltd, one of the largest integrated sugar manufacturers & engineered-to-order turbo gearbox manufacturers in the country and a leading player in water and wastewater management business, today announced its financial results for the fourth quarter and full year ended Mar 31, 2024 (Q4/FY 24). The Company has prepared the financial results based on the Indian Accounting Standards (Ind AS) and as in the past, has been publishing and analyzing results on a consolidated basis.

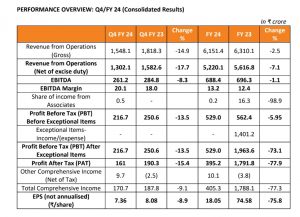

• The decline in turnover during FY 24 is mainly due to Sugar (-12%) and Water business (-30%). The turnover of Sugar Business declined due to 16% reduction in sales volumes due to lower monthly releases as determined by the Government as well as reduced exports. The turnover of the Water business declined due to slow execution of certain projects. The turnover of Alcohol business (net of Excise) and Power Transmission business, however, increased by 9% and 30%.

• Profit before share of profits of associates and Exceptional items and Tax is 3% lower at ₹ 528.8 crore. Lower segment profits of Alcohol business have been substantially off-set by improved profitability in the Engineering businesses due to improved margins.

• Despite lower sales volumes by 16%, Segment profits of Sugar business are at the same level as the previous year due to higher contribution arising from 6% increase in sugar realization prices.

• The profitability of the Alcohol business was adversely affected due to restrictions imposed by the Government on the feedstocks – sales volumes of ethanol produced from relatively high-margin molasses and FCI rice were substituted by low-margin maize operations, procured through the open market.

• The gross debt on a standalone basis as on March 31, 2024 increased to ₹ 1324.7 crore as compared to ₹ 825.0 crore as on March 31, 2023 due to higher sugar inventories held. Standalone debt at the end of the period under review, comprises term loans of ₹ 277.8 crore, almost all such loans are with interest subvention or at subsidized interest rate. On a consolidated basis, the gross debt is at ₹ 1411 crore as on March 31, 2024 as compared to ₹ 913.8 crore as on March 31, 2023. Overall average cost of funds (standalone) is at 6.5% during FY 24 as against 5.1% in the previous corresponding period. During the quarter, the Company’s long-term credit rating was upgraded to AA+ (Stable) by ICRA.

Commenting on the Company’s financial performance, Mr. Dhruv M. Sawhney, Chairman and Managing Director, Triveni Engineering & Industries Ltd, said:

“The year gone by presented several operating challenges to the Company especially in the Sugar and Alcohol businesses while our Power Transmission business delivered another year of stellar performance. It is heartening to note that the Company has reported satisfactory results despite such challenges. The Company is hopeful of an improved performance in the coming year through a combination of policy decisions, and favourable macro environment while addressing challenges with agility.

The sugarcane crush in the just concluded Sugar Season (SS) 2023-24 was 11% lower to 8.26 million tonnes, well short of our initial expectations. The major decline in crush took place in four sugar units: Deoband in Western UP and Chandanpur, Rani Nangal and Milak Narayanpur in the Central UP. The chief reasons are the climatic factors, such as, heavy rainfall and water logging in certain regions, absence of sunshine for long spell in winter and spread of red rot disease, which reduced the yields considerably, mainly in the plant cane and higher diversion to kolhus/crushers. Such trend of lower sugarcane availability was witnessed across Central & Western UP regions. The sugarcane development teams have chalked out multi-pronged strategy to contain the damage by uprooting the diseased crop to limit the spread and to carry out comprehensive varietal substitution programme to reduce the proportion of vulnerable variety Co238, especially in low-lying/ water-logging prone areas and to substitute it by other high sucrose and high yield varieties. We hope to substantially improve our crush next season.

Sugar prices have remained at healthy levels both in FY 24 and more recently. We expect these trends to continue and believe that a continually increasing portfolio of refined sugar and pharmaceutical grade sugar production, which now stands at 70% of overall sugar production, augurs well for sugar realisations for the Company. We continue to make judicious investment in our facilities to enhance crush rate, sugar quality and efficiencies.

In our Alcohol business, the Company faced several feedstock challenges during the year that led to disruption in planned production, such as abrupt stoppage of Surplus Rice by Food Corporation of India (FCI rice), restrictions with respect to usage of B-heavy molasses, introduction of Maize as feedstock, price volatility in feedstocks, etc. Accordingly, sugar operations were carried largely with C-heavy molasses as compared to B-heavy molasses in the previous year and the distillery operations were largely based on maize instead of FCI rice earlier. This has led to lower operating capacities and hence lower production and further, the margins on maize operations were relatively lower despite price corrections. We are hopeful the Government will address the feedstock and profitability challenges in FY 25 as it remains committed to Ethanol Blended Petrol (EBP) targets of 20% by 2025-26.

Our long-term strategy is to grow the Alcohol business by being an active partner in India’s EBP programme and self-reliance journey. To this end, we recently commissioned a 200 KLPD multi-feed distillery at our sugar unit at Rani Nangal which has resulted in an aggregate distillation capacity to 860 KLPD for the Company.

In our Engineering businesses, the Power Transmission business reported remarkable performance with new milestones achieved with respect to revenues, profitability and order booking in FY 24. The year also marked a period of extensive international customer outreach and continued investments in R&D and infrastructure aimed at enhancing the business’ market share to capitalize on the global opportunity landscape. Coupled with the strides made in Defence, the Power Transmission business is on a sustained growth path. In the Water business, the year went by was muted in terms of market activity and finalization of orders. We expect this to improve in the coming years and the business is well-placed in terms of bids and credentials. The long-term prospects for water and wastewater treatment solutions, both in India and in International markets, remain intact leading to a positive outlook on this business.”