Whites sugar markets are facing unprecedented situations (at least for our recent generations of traders) lately! After years of good supply where buyers were the kings, we saw a radical flip occurring the last few months. Indeed, the different main sources of supply for exports reduced drastically, or disappeared like Europa. Brazil’s new crop first started by a delay, followed by some frosts in the countries, and now a very limited flow coming out of producers, well attracted by the lucrative local markets.

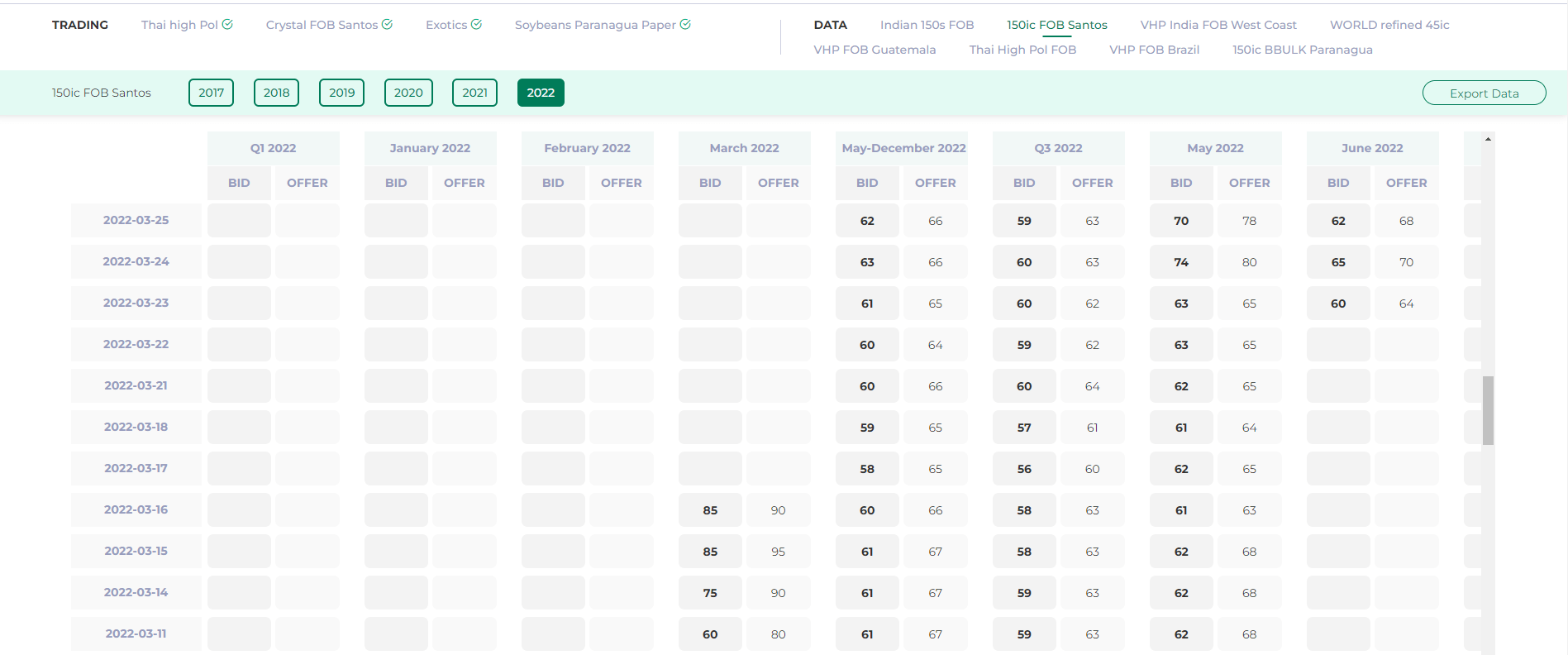

Sharing more insights on the whites’ sugar market Mr. Arnaud Lorioz, Founder & CEO of Deepcore & Mr. Ankit Kain, sugar Broker at The Deepcore, a company which provides Physical brokerage of commodities with a specialization in Sugar & Soybeans said, “We saw the premiums for crystal Brazil FOB moving up from low 60s (see below screenshot),

150ic FOB santos premium at the end of may. Source: thedeepcore.com

150ic FOB santos premium at the end of may. Source: thedeepcore.com

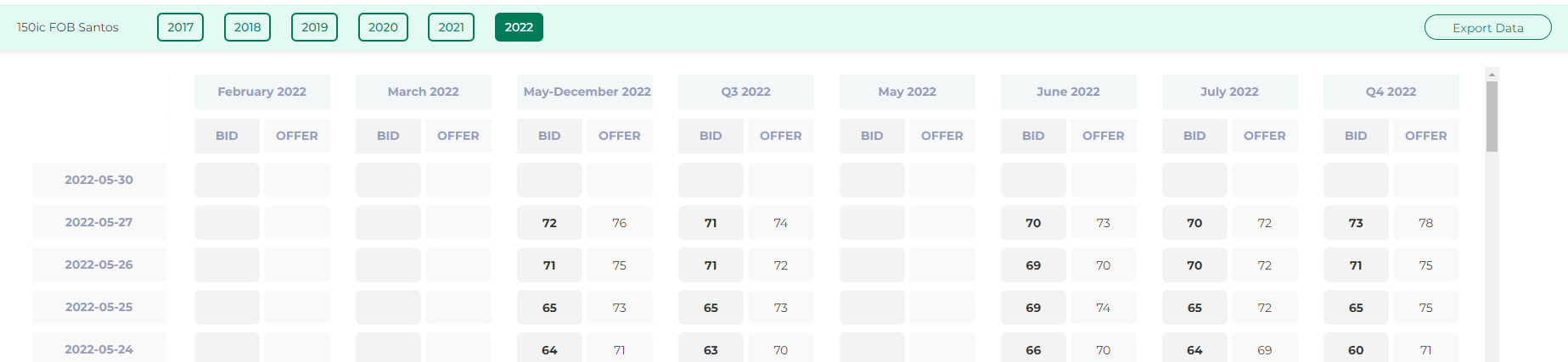

Up to 75/76 over July NY as of last Friday (see screenshot below)

150ic FOB santos premium as of last week. Source: thedeepcore.com

150ic FOB santos premium as of last week. Source: thedeepcore.com

At the same time, some of the main refiners of Mediterranean Sea stopped to export their sugar. As a systemic reaction, Indian refiners, or at least traders who hold their sugar stepped back and decided to keep their ‘sweet gold’ for them.”

“The strength of London is reflective of the good demand & supply shortages for white sugar. With almost no sugar from the west and Mediterranean regions, the Indian refined has maintained its strength in the market and is being offered, subject to ERO (export permit) approval, over a premium to London August future, around Q+10 over for spot shipments FOB West Coast India.

150s will be supply-driven from India. So far, the levels have been maintained around 474/475 level FOB JNPT for the last few weeks but this can change upon more clarity on the export permits and the remaining quantity that can find its way out of India, both will be more animated by the end of 1st week June.

Till then the market will remain slow due to this uncertainty on the Export Permits and will continue to be the case until market participants have some procedural coherence on EROs which will be applied for 1 June onwards.” Arnaud Lorioz further added.

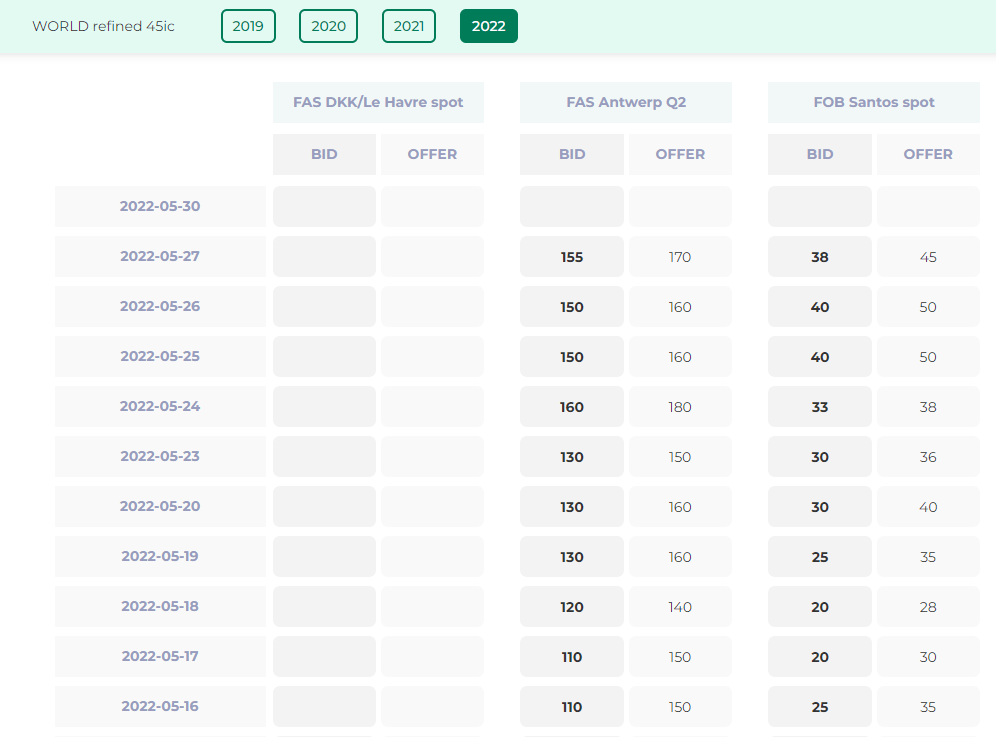

On being asked about Thailand, Mr. Ankit Kain- Sugar Broker at Deepcore said, “We saw some volume available lately, but freight rates made those well asked sugar impossible to place at destination. Frustrating, isn’t it? Back in April, the Thai 45ic FOB Bangkok was BID Ldn Q+8 and OFFER +16. Today, the spread is Q-5 Vs Q+5 , mainly due to the extra cost for freight. The Brazilian and European refined are in a completely different dimension with premiums which keeps pushing up further the supply is drying up week after week (see screenshot below)

45ic FAS Antwerp(or Le Havre) premium at the end of may. Source: thedeepcore.com

45ic FAS Antwerp(or Le Havre) premium at the end of may. Source: thedeepcore.com

The 45ic FAS Antwerp/Dunkerque/Le Havre has been trading in triple digits since more than 2 months now, and supply are extremely small. The FOB Santos refined traded at Q+40$ last week after 3 weeks of continuing rise.”

Answering on what’s next?, Ankit said,

“At The Deepcore, we don’t see any short-term reversal of the trend, but we have to admit that the recent announcement of Pakistan could change the game. Everyone will have an eye on it.

The last few weeks, we saw the London futures spread AUG/OCT pushing above the +20$ and the AUG/JULY white premium above the 140$. Why would it stop? Did we find enough sugar to satisfy demand worldwide? Will the freight be workable to bring this precious sugar sourced (if any) to the destinations asking for it? And last but not least: will the destination accept to pay up?” Kain added.

If would like to have live update of world sugar prices worldwide, get in touch with The Deepcore to access to their sugar data platform. Their data helps you to understand the outcomes of overcapacity, falling prices and authorities’ regulations on producers and refiners. By having a full access to their current and historical sugar prices, stay ahead of your competition by knowing live the most accurate prices worldwide, origin by origin, qualities by qualities.

Give your team a 360° visibility on world prices to help them in their:

◾ Analysis

◾ Fundamental research

◾ Historical data

◾ Ports and origins Arbitrage

◾ Trading decisions

About The Deepcore Data platform:

The Deepcore is the only sugar Data provider being genuinely an active player in this market. Values reported are being negotiated daily and traded. We are not just calling few people per day to ask them what they hear… We are in the market!

***Get an extended 1 month trial for your company with CHINIMANDI reference***