Insight Focus

Activity in China is often cited as a key indicator of global economic health. But why exactly is China so important to the global economy, and to food systems?The massive urban population promotes high consumption, but the tide could be turning.

China is a key driver of consumption growth due to its population demographics and growing middle class. But now, researchers believe the population could be contracting. What does this mean for global food supply and demand?

Population Grew Through Late 20th Century

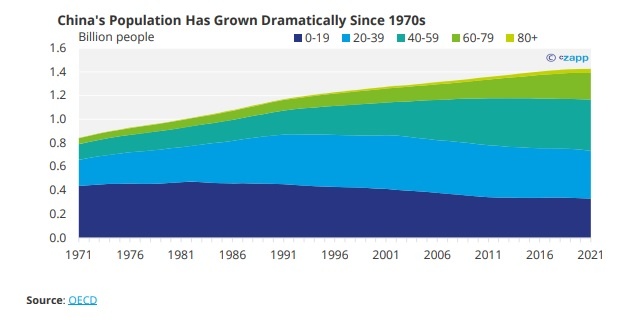

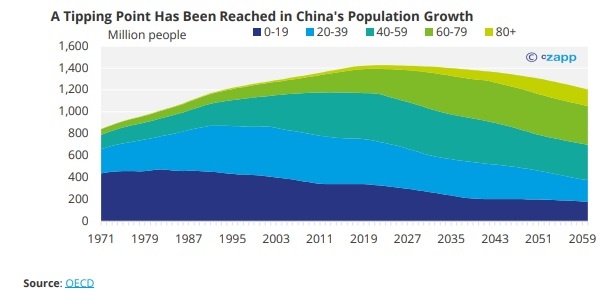

One reason why China is so important to global supply chains is its huge population. More than 1.4 billion people now live across its 3.7 million square mile land mass. And its population has only grown since the late 1960s.

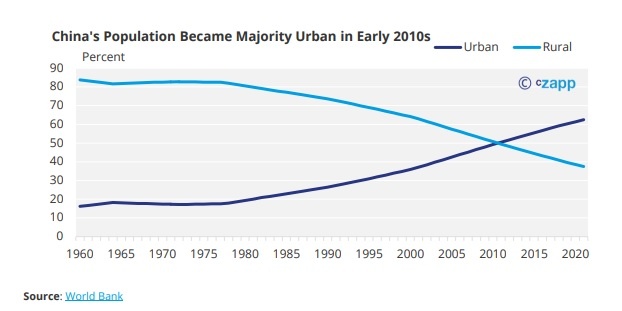

A large, expanding population of course means higher demand for products and services. The fact that the population has become more urban has also driven consumption.

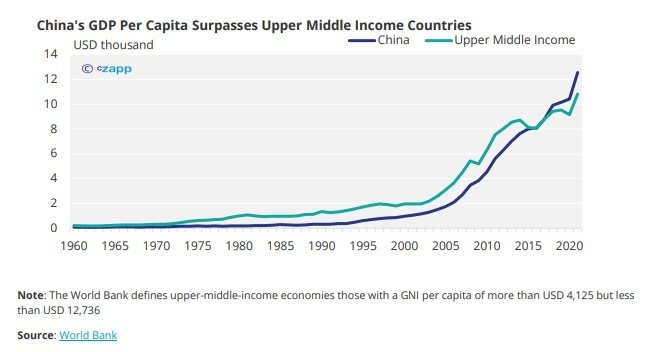

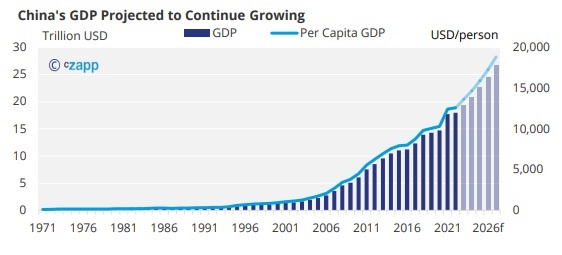

The spending power of the Chinese population has also steadily increased – correlating with higher consumption of goods.

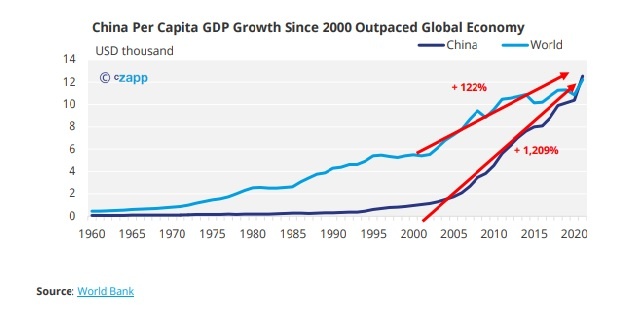

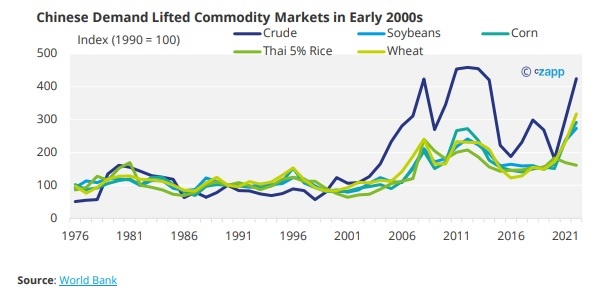

In fact, in the early 2000s, the Chinese economy began to grow significantly as industrial production ramped up.

In fact, China was almost single-handedly responsible for a huge commodities boom in the early 2000s as its economy expanded and demand rose.

How Does China Feed 1.4 Billion People?

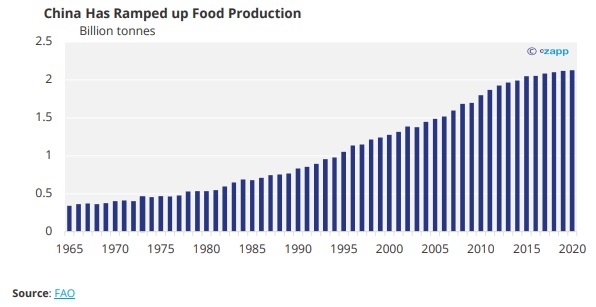

China’s large population presents some issues for the country’s government in that it is difficult to produce enough food domestically to feed so many people. China has made a concerted effort in recent years to increase domestic food production.

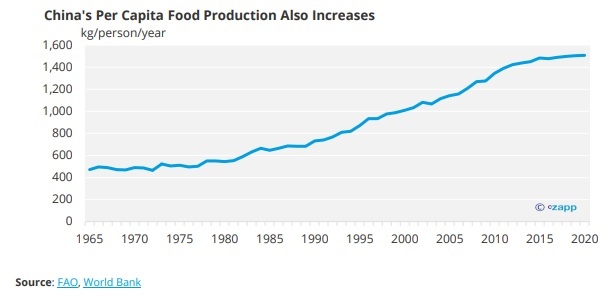

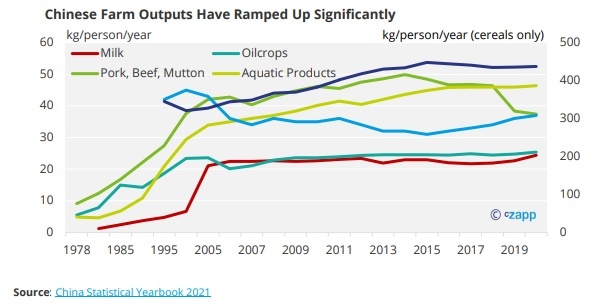

Production has risen to such an extent that per capita production is also on the rise, despite population gains.

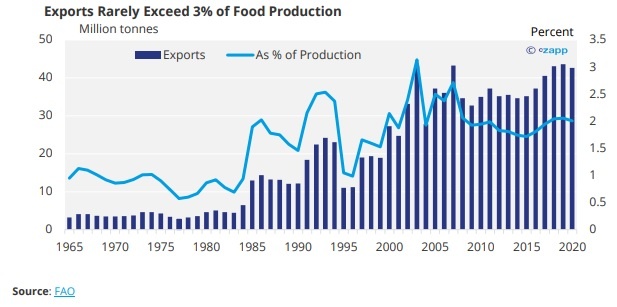

China also exports very little of its food products. Although they have grown over the years, they still represent just a small chunk of overall production.

China’s primary food policy is to increase domestic production and become largely self-sufficient. This lofty goal was laid out in the 2008 National Food Security Mid- and Long-Term Planning Outline. The government has promoted research and development, production subsidies and waste reduction to strengthen its food supply.

In the 2022-31 Agricultural Report, the government said that domestic food production is growing at a faster rate than consumption. For meat products, poultry and dairy it said imports have declined, but consumption has continued to rise.

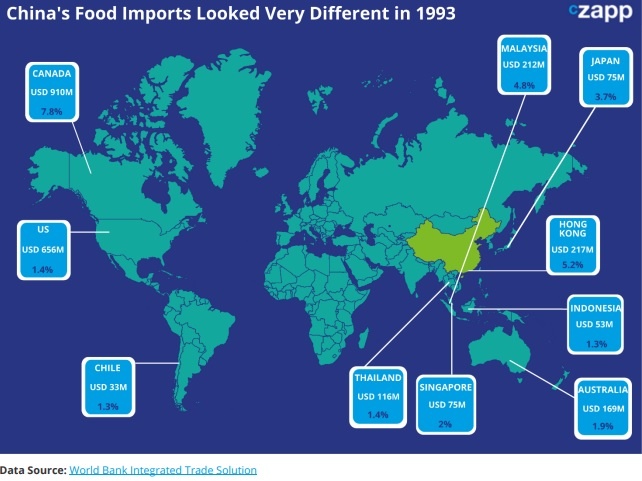

This has changed a great deal in the past 35 years due to sociodemographic factors such as higher purchasing power and more varied diets.

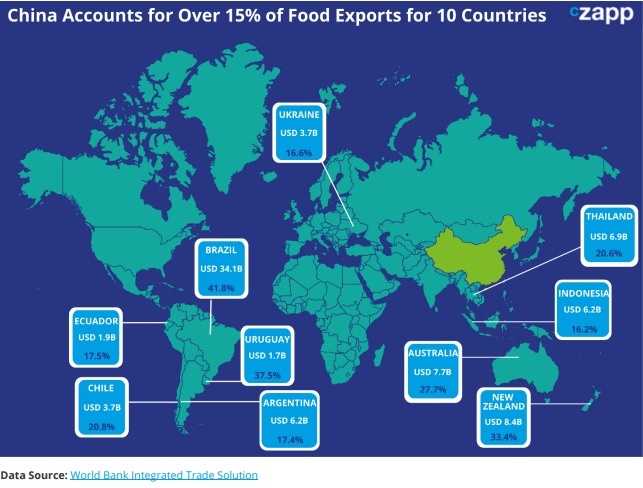

But if the population begins to shrink, as researchers now believe to be happening, this has huge implications for food exporters.

Notably, there are large drops in the 20-39 age bracket – or those born between approximately 1982 and 2001.

Much of this can probably be attributed to the country’s One Child Policy, which was in place from 1980 to 2015 and mandated that families could have just one child each. Now though, younger generations are choosing not to have children, which is set to further reduce the younger population as the older generations expand.

And as we have explored in our sugar consumption case studies, there is a peak per-person consumption limit. This means that, ultimately, if population declines, food demand is likely to follow. The Chinese government expects sugar consumption to increase very slowly in the years to 2031, at an average growth rate of 0.4% per year.

Too Early to Panic

If we take into account only the country’s domestic agriculture push and the projected population contraction, a corresponding drop in import demand should be expected in the next 35 years.

However, there are other factors at play. Both China’s GDP and per capita GDP are projected to continue growing. This equates to more spending power and therefore higher consumption.

Note: Lighter shade indicates projection

Source: IMF, World Bank

For the moment, it seems that growing GDP can offset population contraction, leading to an increase in demand.

There is also the question of nutrition. While Chinese production volumes have ramped up, a varied diet is still needed, which requires imports, particularly sugar, soybeans, meat and dairy products. Very few, if any, countries in the world are self-sufficient in producing all food groups.

Will E10 Mandate Impact Imports?

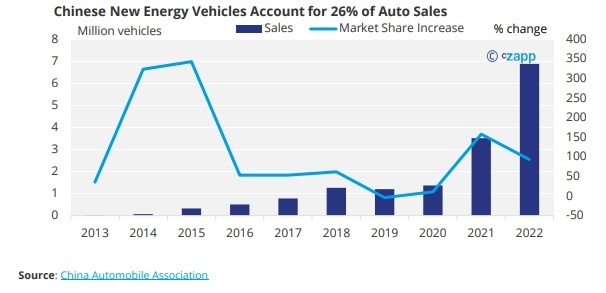

Another question for importers surrounds the E10 mandate, which was rolled out in 2016 as part of the 13th Five-Year Plan for biomass energy development. While biomass power generation is relatively mature today, the development of liquid fuel has stagnated, and biogas and biomass solid fuels are at the early development stages.

The government had initially planned to promote ethanol production in major grain growing areas but headwinds in the past few years have led to the depletion of large volumes of corn stocks. This means the E10 project has stalled since 2020. Now, the Chinese renewable energy mix mainly consists of solar, wind and hydro power. Biomass accounts for just 3.4%.

Of course, this could mean there is greater scope for growth of the industry. But for the moment at least, the country seems to be focusing more on electric vehicles rather than ethanol fuel.

Concluding Thoughts

Concluding Thoughts

- China is a vital link in the global food supply chain.

- Not only does it account for huge demand, but it produces over 2 billion tonnes of food.

- However, there is a danger that world markets are too reliant on China.

- Recent evidence suggests that population growth has reached a peak.

- This of course has huge implications for food consumption.

- But changing food habits in China will probably have much more impact than population growth going forward.

- China’s demand dynamics are complex but it will likely continue to be one of the most important markets in the world for F&B companies.

For more articles, insight and price information on all things related related to food and beverages visit Czapp.