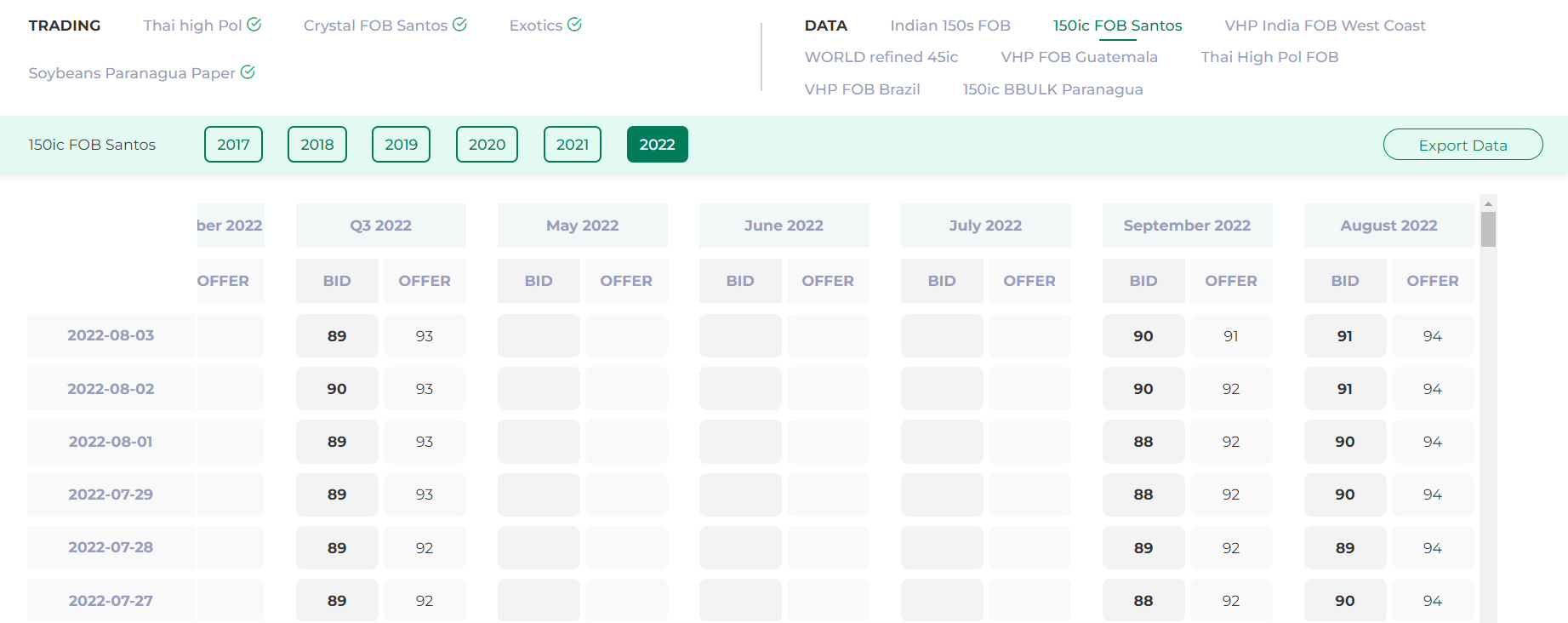

The Indian sugar Inter trade market has been mostly inactive for spot shipments due to the absence of new EROs. Except for some refined from Mundra being shown in low to mid-50s range against London No.5 Oct future. For the new season, around half a million tons of raw sugar have already been contracted by the trade houses, which have kept the inter-trade market quite active, with BID/OFFER spread as 70 Vs 100 points indicatively (96 pol basis) for DEC/JAN Vs NY11 H23 FOB West Coast India.

The Indian sugar Inter trade market has been mostly inactive for spot shipments due to the absence of new EROs. Except for some refined from Mundra being shown in low to mid-50s range against London No.5 Oct future. For the new season, around half a million tons of raw sugar have already been contracted by the trade houses, which have kept the inter-trade market quite active, with BID/OFFER spread as 70 Vs 100 points indicatively (96 pol basis) for DEC/JAN Vs NY11 H23 FOB West Coast India.

On the Brazil VHP market, values for spot shipments have been constantly increasing the last couple of months to reach the V+40s for August and the mid/high 20s for September. The more forward positions remain tight with no OFFERs in the market until December

Thai refined FOB values have maintained their ground at around +46 for generic brands and around +63/64 for premium brands, Aug-Sep or Sep-Oct shipment, in break bulk over LDN OCT22 since last week due to tight supply and good demand prospects from the destinations. The bids are shown around +40/41 over in breakbulk for the generics and $8/10 more for the premium brands.

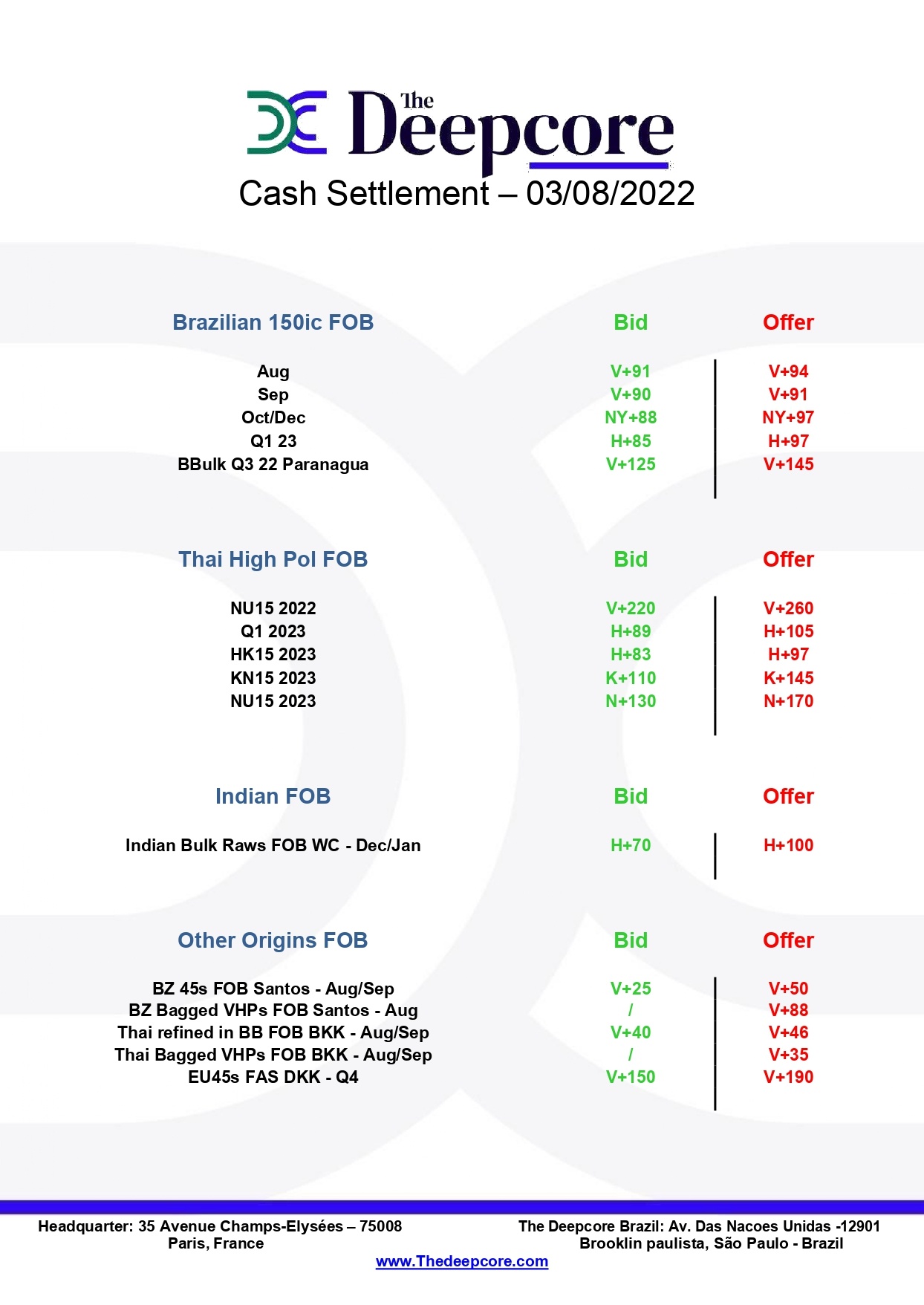

The world refined section on thedeepcore.com

The world refined section on thedeepcore.com

Thai bagged VHPs for AUG/SEP shipment Offers are LDN V+35 FOB Bangkok. On the bulk side, the thai high pol market for 2022 is now an old story as we traded the last cargos available a month ago. All the eyes are on 2023 with FEB/MARCH BID/OFFER at H+89 Vs H+100 and March/may15th at H+83 Vs H+97. The forecast on the thai crop are good, but traders are not trading it anymore… they trade the next Indian policy!

The European market keep seeing an impressive rally over the last few months with last trades for OCT/DEC shipment FAS Dunkerque/Le Havre around V+160$. Since last week, new BIDs around that level came out, but the next offers are reaching the +200$ mark. The strong heat waves affecting Europe this year are causing more and more pessimistic forecasts about the European coming crop.

On the other side of the Atlantic Ocean, the Brazilian market has been relatively steady but strong for a couple of weeks. The 150ic FOB Santos market is staying around V+90/92 for August and September shipments and a few dollars higher for October onwards.

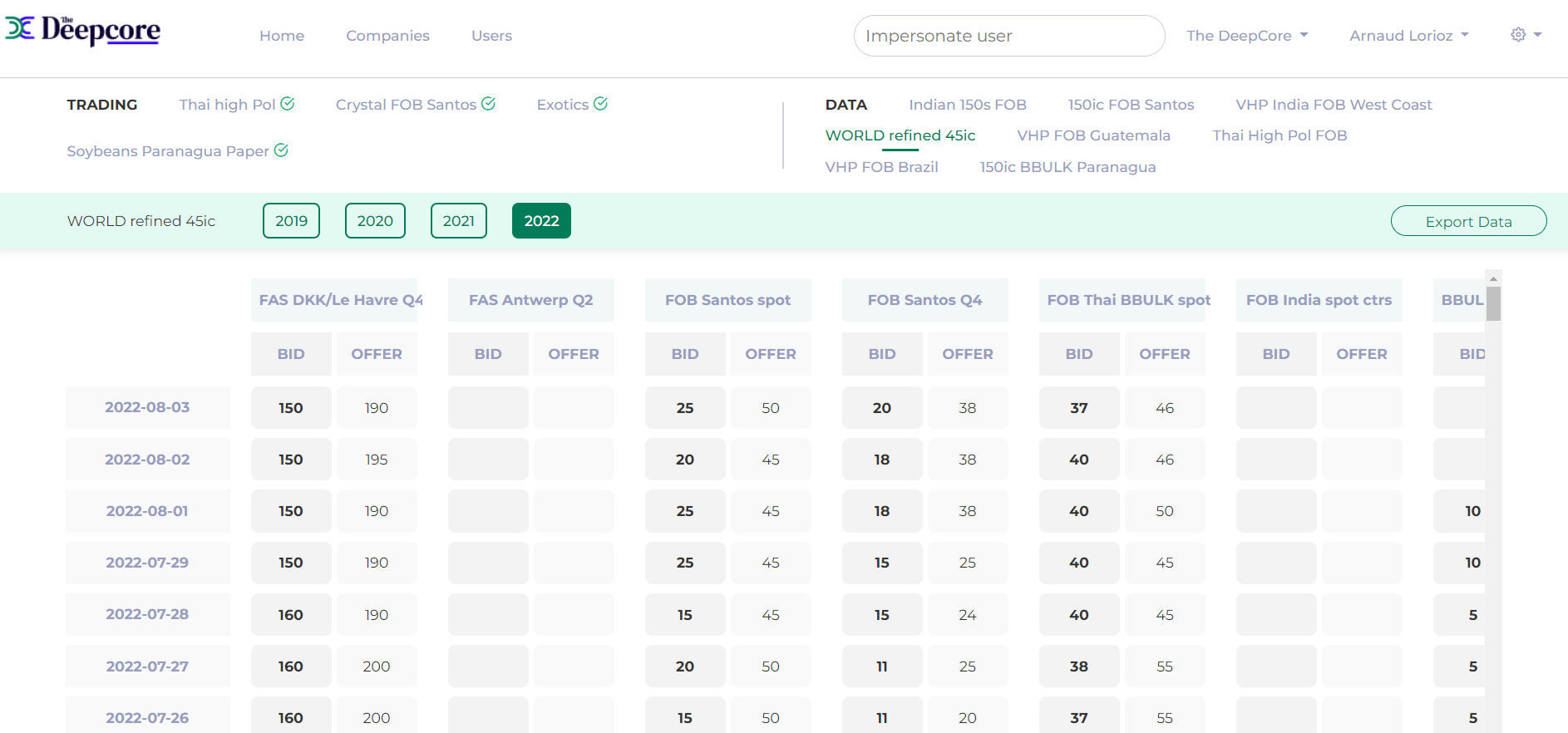

The 150ic FOB santos section on thedeepcore.com

The 150ic FOB santos section on thedeepcore.com

The Breakbulk market for crystal 150ic from paranagua has been dancing a volatile tango with the White premium, oscillating from low 120s to high 140s a few weeks ago. The refined ctrs market has been increasing from October onward, from V+20$ to V+38/40 the last few days, replicating the increase of Mediterranean refined levels, European levels… We estimate the parity for 45ic brazil FOB around V+25/30$ given the current freight.

Thanks to our partnership with ChiniMandi, discover once per week the most accurate global values and barometer of Sugar FOB prices worldwide.

If you are interested in receiving it every day and having access to more than 5 years of prices database, please click here