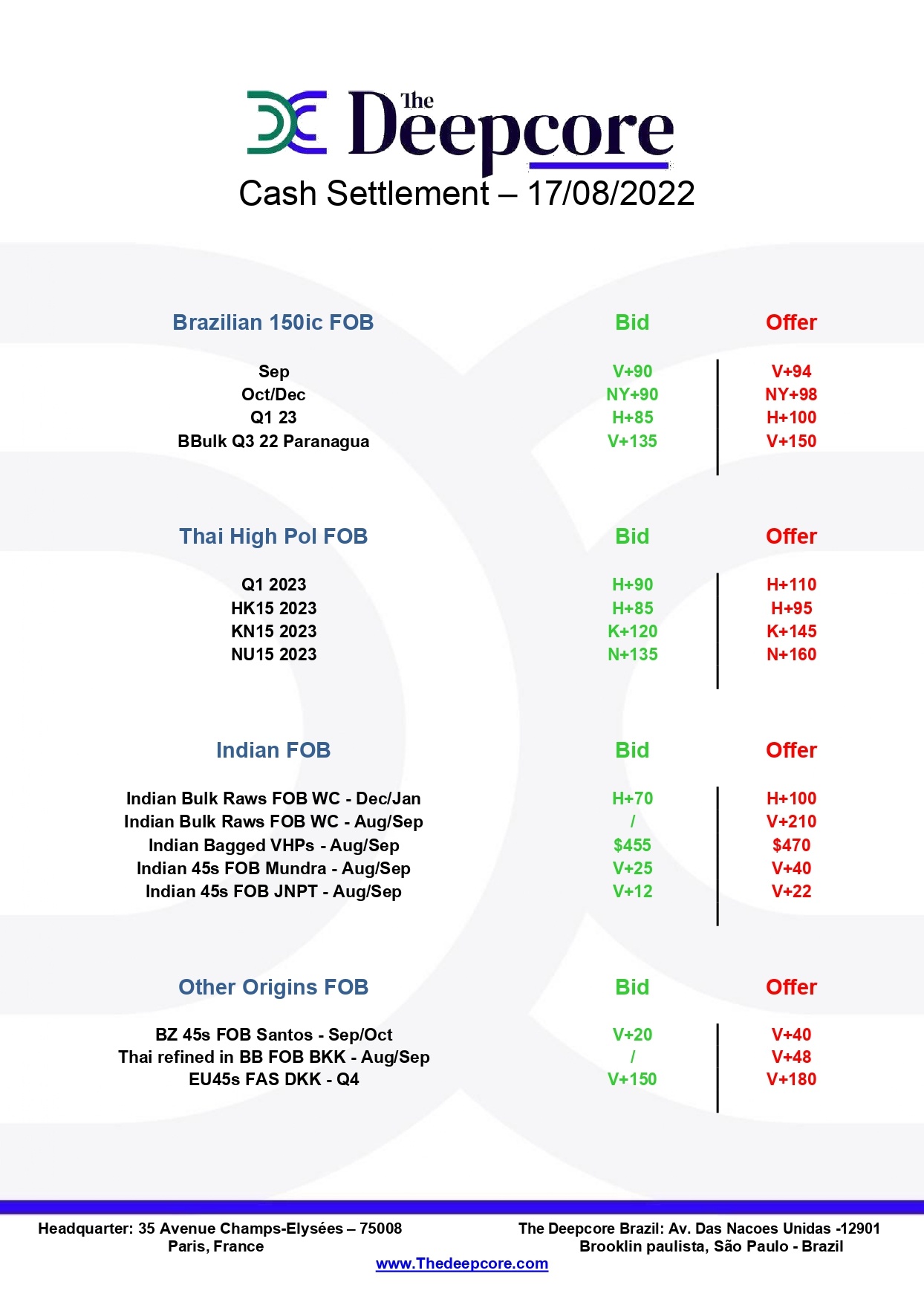

The Brazilian crystal has not been very volatile the last few sessions, resulting in unchanged premiums. The spot shipment is BID V+89/90$ and OFFER V+94/95. The Q4 also is sitting at the same range as last week with OCT-DEC BID V+90/91 OFFER high 90s. The spreads for CNF quotes for West Africa remained wide for main destinations with OFFERs from V+228/30 over NY OCT and BIDs at +215.

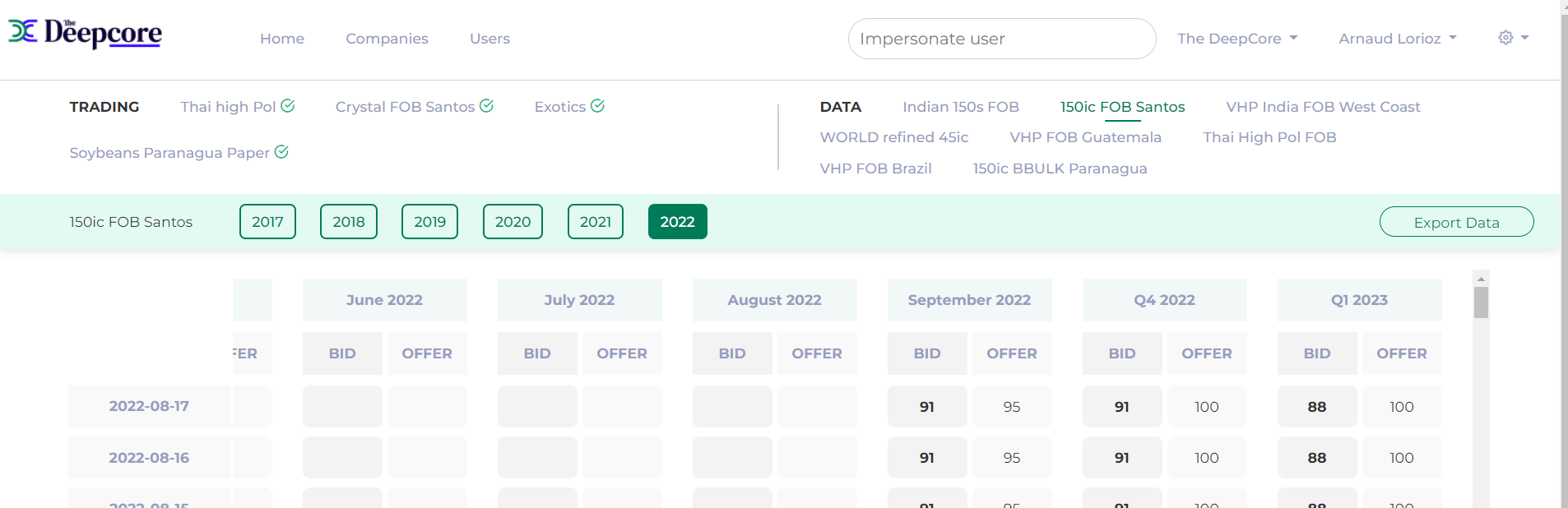

Source: 150s Santos data section on thedeepcore.com

Source: 150s Santos data section on thedeepcore.com

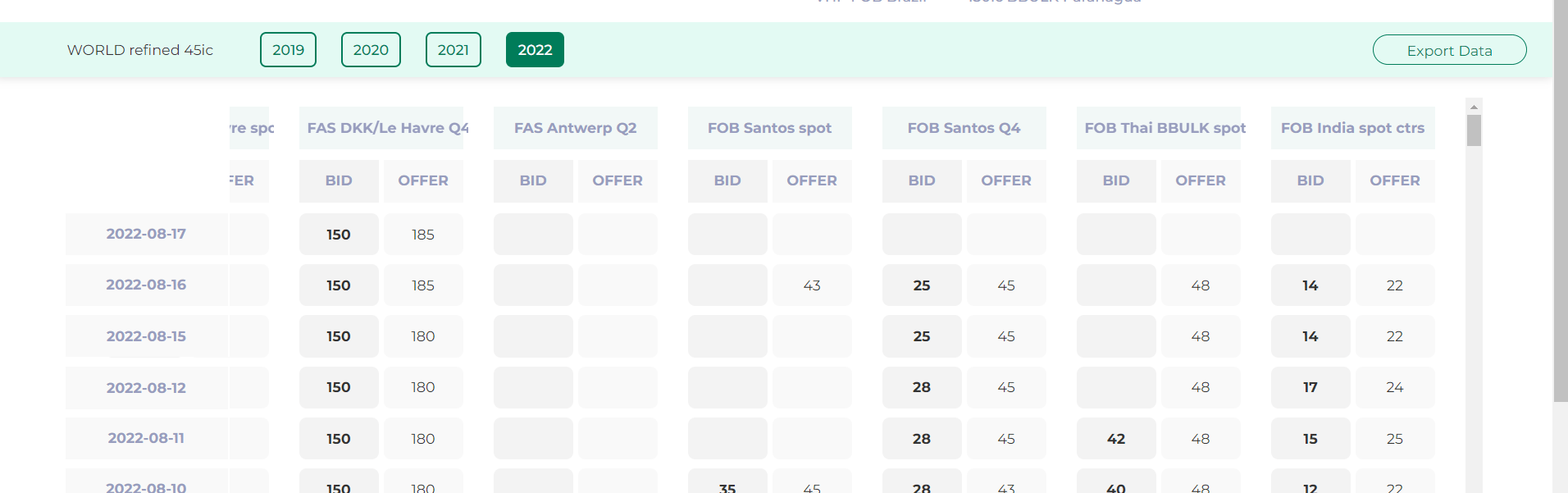

The refined FOB Santos started picking up some demand intertrade but the gap between buyers and sellers remains wide: FOB values for SEP or SEP/OCT shipments are shown in the range BID LDN V+20/25$, and the OFFER distant at LDN V+39/40, quite a gap to squeeze!

In Thai HPOL market, there was a release of B Quota under which a total of 72Kmt was awarded to two trade houses, 36Kmt each, for JULY-SEP shipment.

Intertrade activity for High Pol JUL/SEPT is BID at NY N+135 for std terms and +10 pts more for deep sea basis, and way higher, Offers at 160pts over. Most liquidity found was for Q1 and HK15 shipments. The BID level for JAN-FEB was 98 pts over NY March as opposed to 120 pts OFFER for the deep sea port (standard terms is BID 90 Vs 110 OFFER). MAR-MAY on the other hand found its bid at +85 with Offers at 105 pts over NY H23.

Indian bulk raws on the other hand, for spot shipment, are Offered around +200/210 over NY V22 with NO BIDs. More forward shipments, DEC/JAN, OFFERs in the triple digits – starting at +100 to +110 level and BIDS on the other hand, with a recent small rally on the NY, dipped a little to find a temporary spot at +60/65 but only to come back at its initial level of +70/75 over NY H22.

On the Indian whites, from West Coast, we have generic refined available at around +22 from JNPT and +40 for a more acceptable brand from Mundra. LQWs are definitely not easy to find but whatsoever is available is being OFFERED quite rich at $550/60, FOB buyers refuse on bidding against such a value but will be keen on initiating a discussion around $500-510

Source: World refined data section on thedeepcore.com

Source: World refined data section on thedeepcore.com

Thanks to our partnership with ChiniMandi, discover once per week the most accurate global values and barometer of Sugar FOB prices worldwide.

If you are interested in receiving it every day and having access to more than 5 years of prices database, please click here