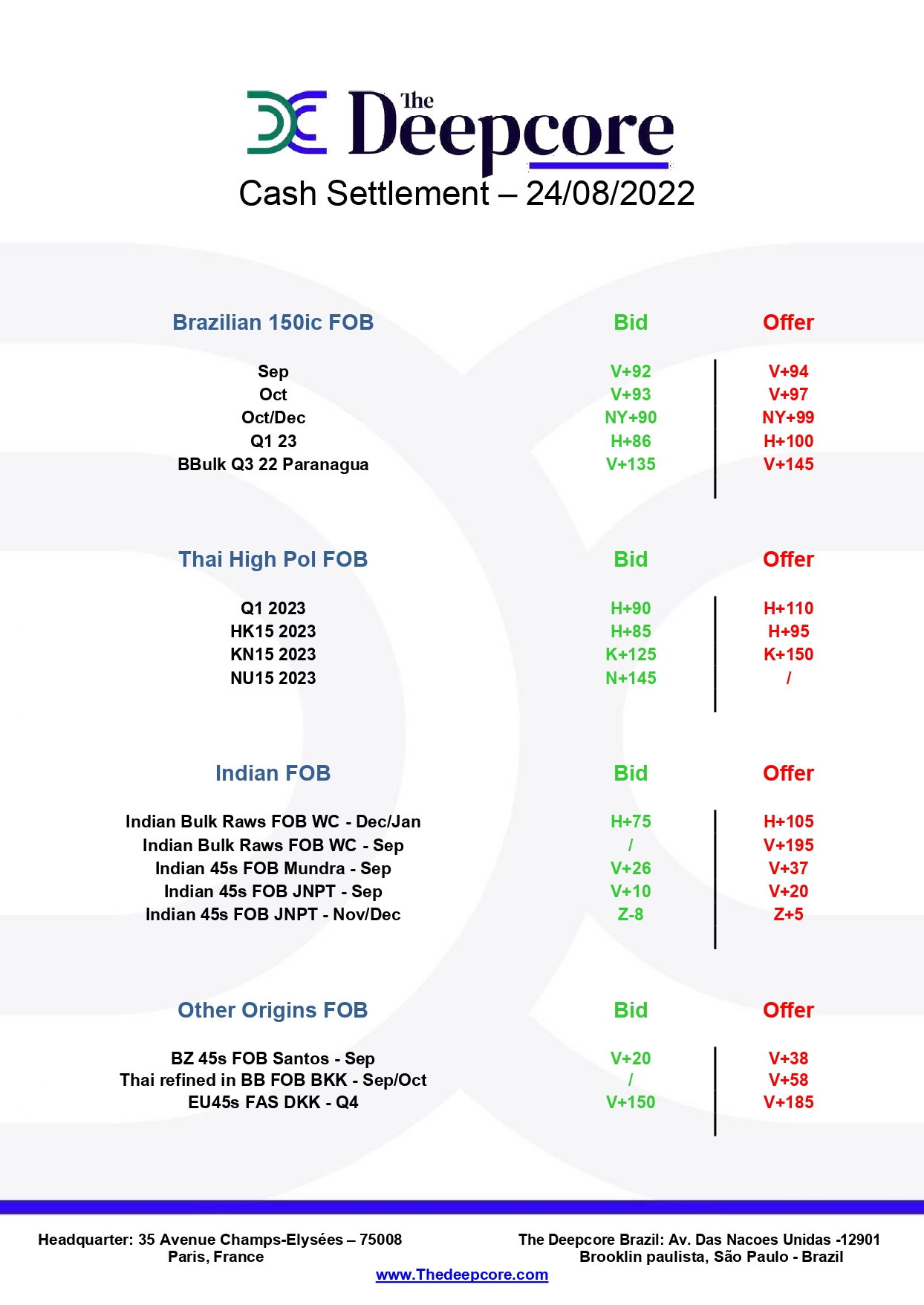

Brazilian LQWs, with Indian 150ic absent from the market, are finding new homes. And we noticed that not only in west Africa but also in East Africa. As a result, the values for the Brazilian crystals improved on both buyer and seller sides: SEPTEMBER Bids at V+92/93 Vs Offers at V+95. OCT shipments reached BID V+94 Vs Offer V+97. And, full Q4 strip on the other hand prevails at V+90 OFFER 98/99.

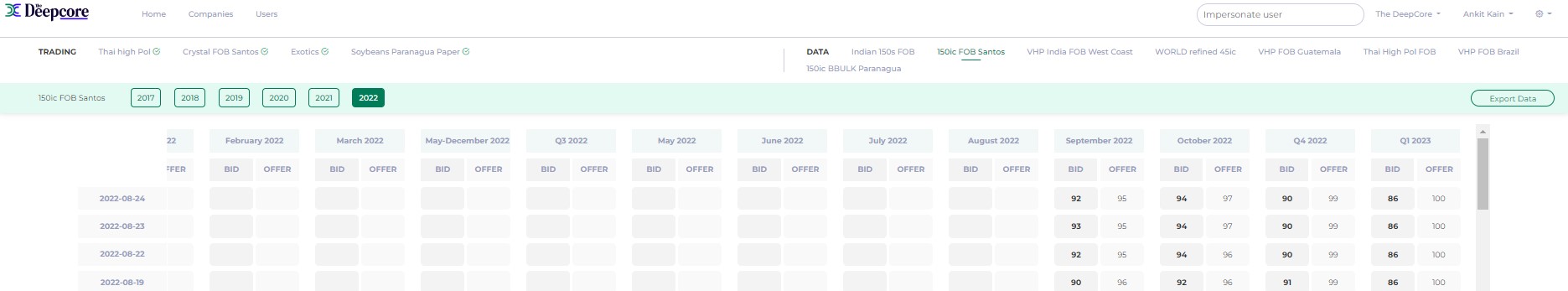

Thai High pol found most of its liquidity and action for the Q1 23 shipment for which the spread was BID 93/95 OFFER 105/07 for std terms and 8-10 pts more for deep seas ports. Furthermore, Mar-May15 for next year had its Bids in the low 80s to the mid 80s range counter to Offers around 95 for thai standard terms. May-July15 on the other hand found itself quite far apart at K+125 Vs K+150 and July-Sep15 was mostly inactive with No Offers against the bids around +140/45 std terms.

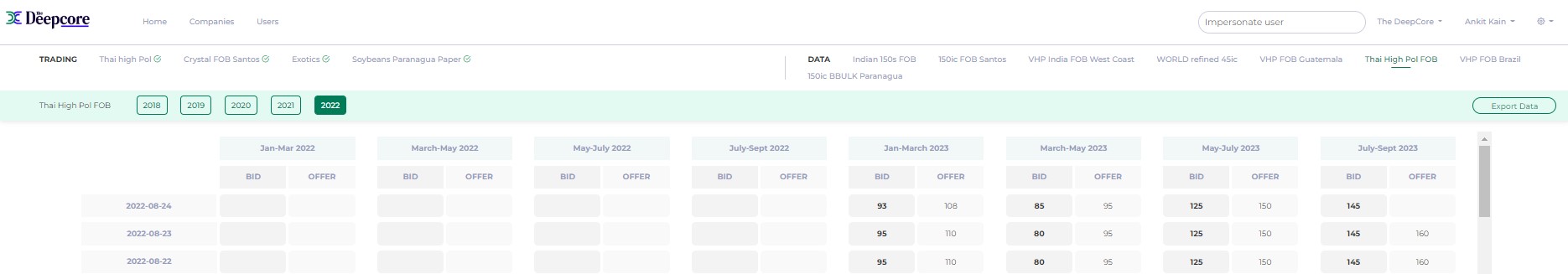

Indians bulk raws sat idle at +195/200 pts over NY OCT with no counter bid for spot and DEC, JAN shipments at NY H23+105 with a bid now at H23+75. On the whites, refined from Mundra improved to +37$ as opposed to a Bid at +26 over LDN OCT22 and coarse grain Offers around 20/21 over from FOB JNPT for the spot. We noticed a growing interest in contracting forward shipment and for NOV/DEC we have Bid Z-8 Vs Offer Z+5.

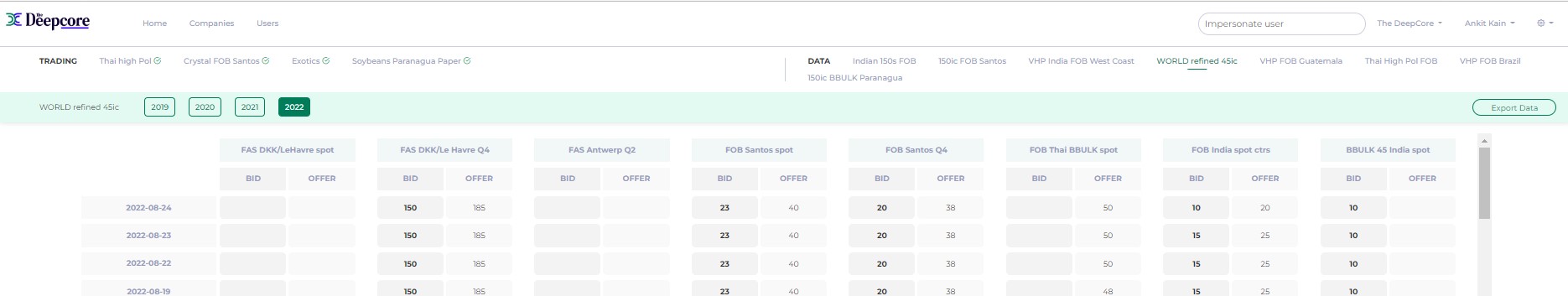

Thanks to our partnership with ChiniMandi, discover once per week the most accurate global values and barometer of Sugar FOB prices worldwide.

If you are interested in receiving it every day and having access to more than 5 years of prices database, please click here