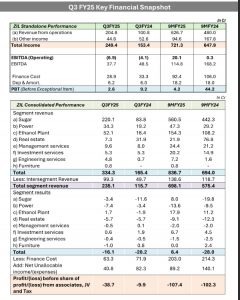

Zuari Industries Limited, the apex company of Adventz, has announced its financial results for the quarter ended 31 December 2024. The Company has demonstrated robust operational growth, particularly in its Sugar, Power C Ethanol (SPE) division and its subsidiaries. For Q3 FY25, Standalone Revenue from Operations stood at ₹204.8 Cr, reflecting a 103% growth compared to Q3 FY24. The company reported its Standalone EBITDA of ₹37.7 Cr.

On a Consolidated Basis, Revenue from Operations stood at ₹235.1 Cr for Q3 FY25, up 103% year-on-year, while EBITDA stood at ₹46.9 Cr.

The Sugar, Power C Ethanol (SPE) division delivered an exceptional performance in Q3 FY25, driven by early operational start and improved efficiency resulting in higher sugar production of 61 LQ for Q3 FY25, up 69.4% compared to 36 LQ in Q3 FY24. Sugar sales surged by 150% to 3.5 LQ, compared to 1.4 LQ in Q3 FY24. Ethanol production nearly doubled to 7,787 KL from 3,988 KL in Q3 FY24, while power exports saw an increase of 7G%, reaching 341 LU. Additionally, Sugar Recovery improved to G.86%, up from 9.74% in Q3 FY24.

Among the subsidiaries and JVs, Zuari Infraworld India Ltd (ZIIL) made notable progress, with the St. Regis Residences Project in Dubai reaching 58% project completion, well ahead of schedule. ZIIL recorded 50% bookings in Phase IV of the Plotted Development at Zuari Garden City, Mysore. Simon India Limited (SIL), the EPCM subsidiary of the Company, reported strong growth, with revenue increasing to ₹4.8 Cr in Q3 FY25, compared to ₹1.3 Cr in Q2 FY25. Our financial services businesses posted robust growth. While Zuari Finserv Limited (ZFL) recorded a 40% growth in revenue, reaching ₹15.1 Cr for 9M FY25, Zuari Insurance Brokers Limited (ZIBL) saw a 31% YoY increase in total income for 9M FY25. Our grain-based distillery project, under the bioenergy joint venture, Zuari Envien Bio-Energy Pvt Ltd (ZEBPL), achieved 58% completion.

Zuari Industries Ltd. also continued its focus on financial discipline, successfully reducing borrowing costs.

Commenting on the Results, Athar Shahab, Managing Director, Zuari Industries Ltd, said: “Zuari Industries has demonstrated resilience and operational excellence in Ǫ3 FY25, delivering significant growth across our key business verticals. Our Sugar, Power & Ethanol (SPE) division has outperformed expectations, with an earliest-ever crushing season start enabling a significantly higher production of sugar. Our sugar sales were higher by 150%, owing to higher quota allocation. The division nearly doubled the ethanol production and achieved record power exports. These achievements reflect our commitment to operational efficiency, technological upgrades, and strong farmer relationships coupled with digital transformation initiatives.

Our subsidiaries and joint ventures continue to gain momentum. Zuari Infraworld India Ltd is making steady progress in real estate development, with St. Regis Residences in Dubai now 58% complete, ahead of schedule. Simon India Limited has expanded its EPC capabilities, registering strong revenue growth. Our financial services businesses— Zuari Finserv and Zuari Insurance Brokers—have delivered solid gains, reinforcing our strategy of building a diversified and future-ready portfolio.

Our bioenergy joint venture, Zuari Envien Bio-Energy Pvt Ltd, is progressing as planned, with 58% project completion and commissioning expected by mid-2025.

On the financial front, we have successfully lowered borrowing costs through refinancing and better cash flow management. As we enter the final quarter of FY25, our focus remains on scaling our core businesses, driving efficiency, and capitalizing on emerging opportunities.”

For more details and in-depth insights, keep reading ChiniMandi, your go-to source for the latest news on the Sugar and Allied Sectors news.